Written by Clive Maund

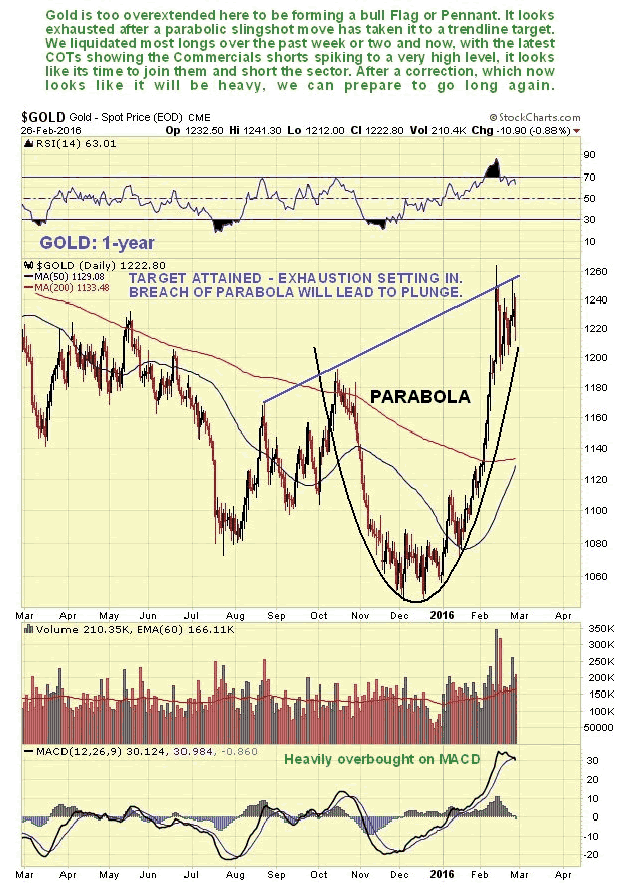

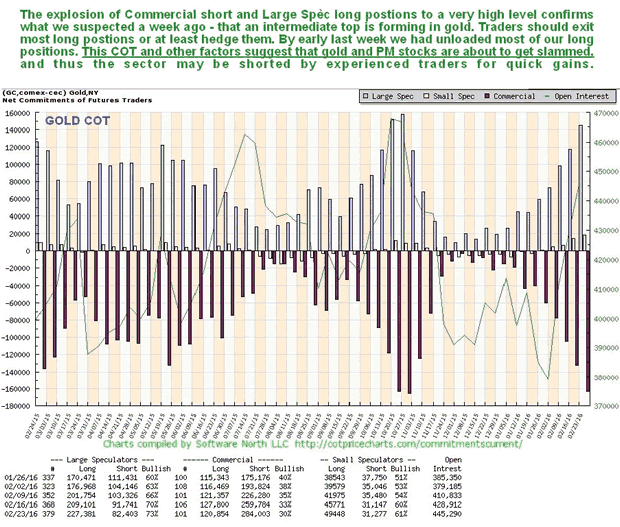

An intermediate top is forming in gold and silver, confirmed by the latest COT data, indicating that a severe drop is imminent. In addition, the latest 1-year chart for gold shows gold having become heavily overbought after after a parabolic slingshot move. Breakdown from the parabola will likely lead to a dramatic plunge. This article addresses these factors complete with enlightening charts. Read on.

Gold

The latest 1-year chart for gold is – or should be – alarming for those still long the sector. It shows gold having hit a target after a parabolic slingshot move that resulted in it becoming heavily overbought. Now it is vulnerable to a reaction which the latest COTs suggest will be heavy. Breakdown from the parabola will likely lead to a dramatic plunge.

The gold COT chart below…shows that Commercial short and Large Spec long positions exploded higher last week, the culmination of a multi-week exponential ramp. As the Commercials are collectively always right and the Large Specs wrong, this means trouble. This is characteristic of an important top, and gold is now expected to plunge, probably immediately.

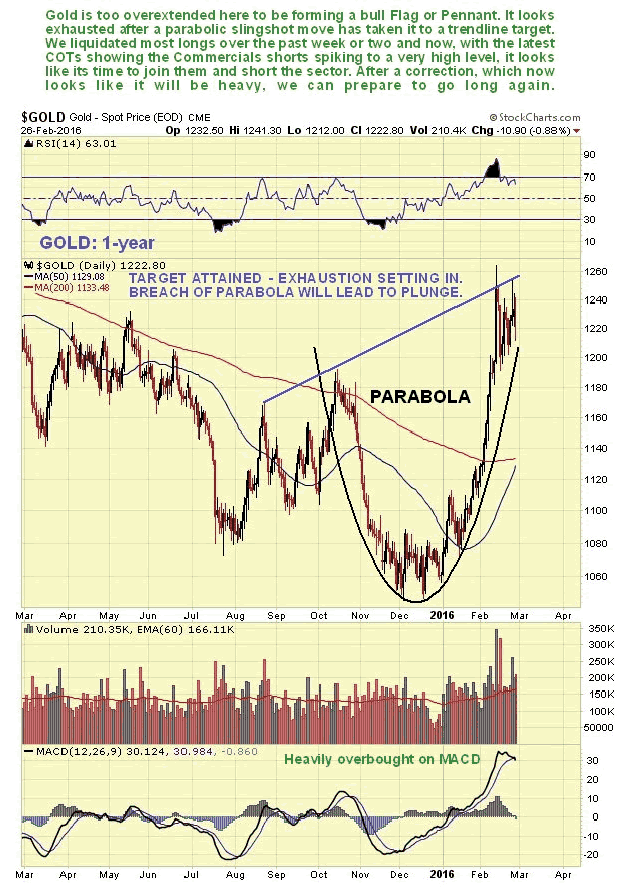

The long-term 6-year chart below provides additional clues regarding why gold‘s sharp advance halted when it did – it has arrived at the upper boundary of the broad downtrend channel shown.

Silver

Turning to silver, the picture is considerably weaker, and is in fact dismal, although longer-term this should not be a cause for depression, as silver is normally weak compared to gold at this stage of the cycle.

On silver’s 1-year chart below we can see that the recent rally was weak compared to the rally in gold – it did not even manage to rise much above its 200-day moving average, which did not turn up, and it failed to break out of the downtrend channel shown. Now it is breaking lower again, and latest COTs, which we will come to in a moment suggest that the reaction now starting will be severe, and take it to the lower boundary of the channel as a minimum downside objective.

Leave A Comment