Gold prices fell $4.48 an ounce on Wednesday, ending an eight-day streak of gains, as a rebound in the dollar and the market’s inability to penetrate the $1321 level prompted investors to book profits from a recent rally to a 16-week high. Strong gains in equities also sapped demand for the metal. European and Asian stock markets were mostly higher and U.S. stock indexes hit new record highs. In economic news, the Institute for Supply Management reported that its index of manufacturing activity climbed to 59.7 from 58.2 a month earlier. The minutes from the U.S. Federal Reserve’s December meeting showed that policymakers are still seeking a gradual rise in interest rates.

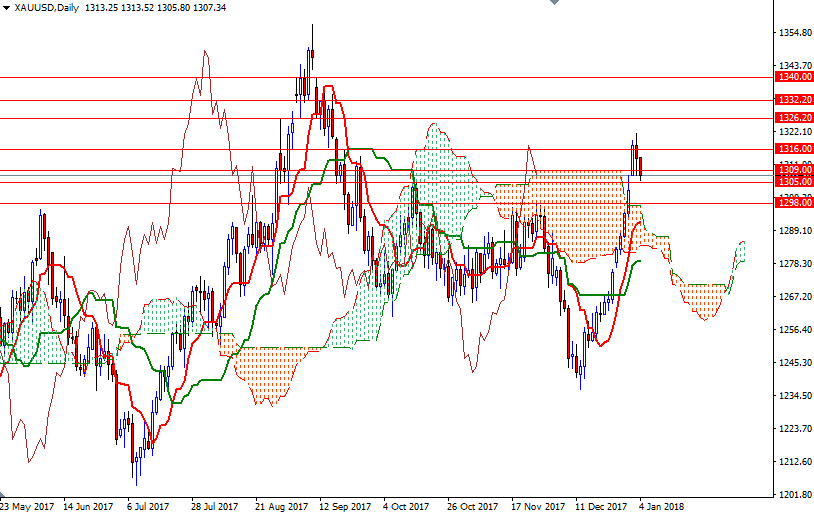

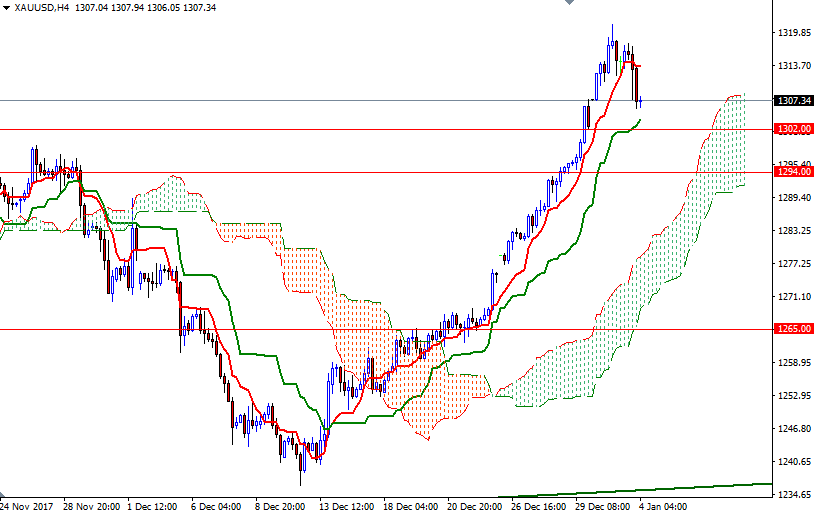

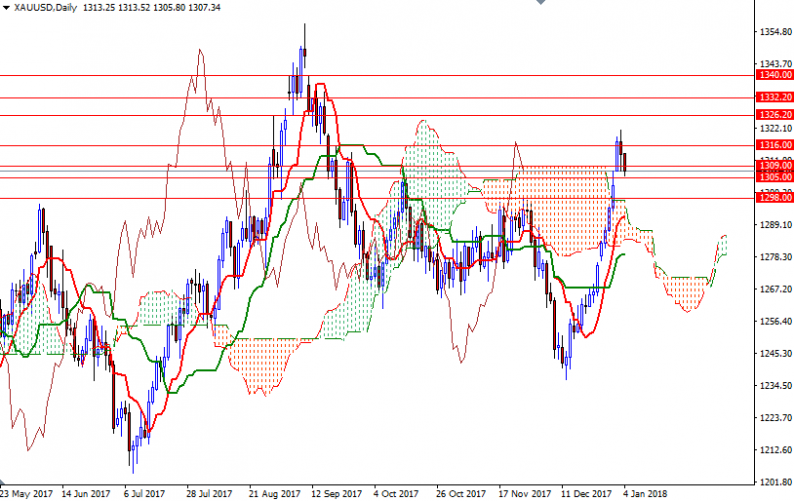

XAU/USD returned to the Ichimoku clouds on the H1 chart as expected after the market failed to stay above the 1316 level. The shorter-term charts are slightly bearish, but there is a strategic support at 1305, the confluence of a horizontal support and the bottom of the hourly cloud. If this support remains intact, we may revisit 1309 and 1313/2. The bulls have to lift prices above 1313/2 to challenge the resistance in 1317/6.

On the other hand, if the aforementioned support at 1305 is broken, then the next stop will be 1302. A break below 1302 indicates that the bears will be targeting 1298 next. The bears have to produce a daily close below 1298 to gather momentum for 1294/2.

Leave A Comment