Gold rose for a third straight session on Wednesday as the dollar weakened after the Federal Reserve left monetary policy unchanged and signaled that it will be cautious about future rate hikes. In a statement after its two-day meeting, the Federal Open Market Committee said “The committee is closely monitoring global economic and financial developments and is assessing their implications for the labor market and inflation.”

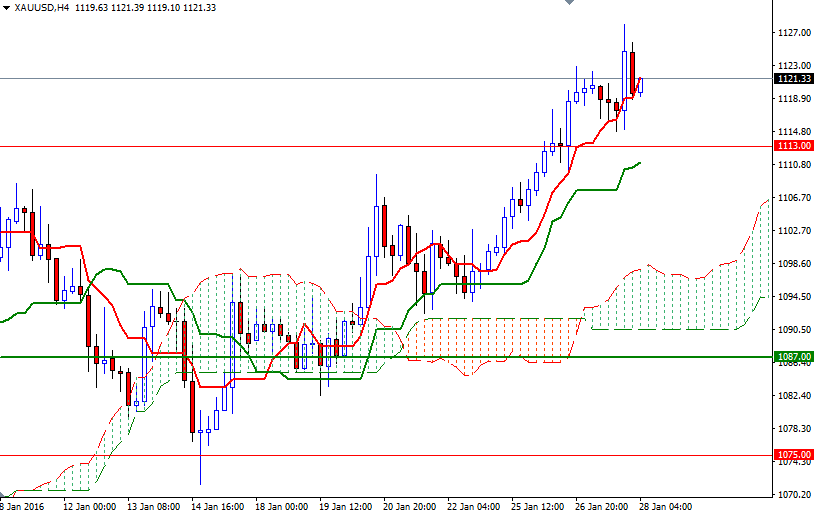

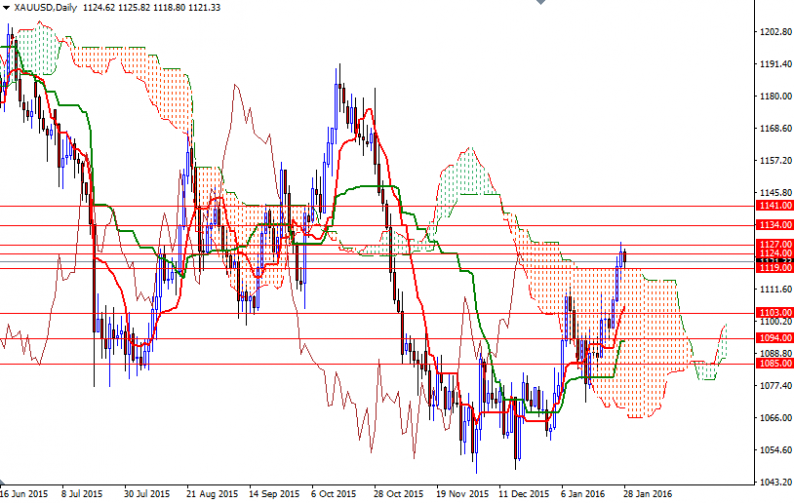

From a technical perspective, there are two things that I pay attention at the moment. First of all, the market is trading above the Ichimoku clouds on the daily and 4-hour time frames, plus the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) lines are positively aligned on both time frames. Secondly, despite the short-term positive outlook, the weekly chart is still bearish.

Today the bulls are trying to hold prices above the 1119 level which happens to be the top of the daily cloud but as I pointed out yesterday, they have to push through the 1127/4 resistance so that they can gain enough traction to reach the 1141 level. On its way up, expect to see some resistance at 1134. If the 1127/4 region continues to cap prices and we slip below the 1119/8 area, it is likely that the pair will revisit the 1115/3 support. A break below the 1113 level could see a fall to 1109.

Leave A Comment