Gold prices ended Monday’s session up 0.95%, or $10.53, to settle at $1128.26 an ounce as disappointing U.S. economic data pressured the dollar. The greenback weakened after the Institute for Supply Management said economic activity in the manufacturing sector contracted in January for the fourth consecutive month. Comments by Federal Reserve Vice Chairman Stanley Fischer also helped provide a lift to gold. Fischer said “Further declines in oil prices and increases in the foreign exchange value of the dollar suggested that inflation would likely remain low for somewhat longer than had been previously expected before moving back to 2 percent.”

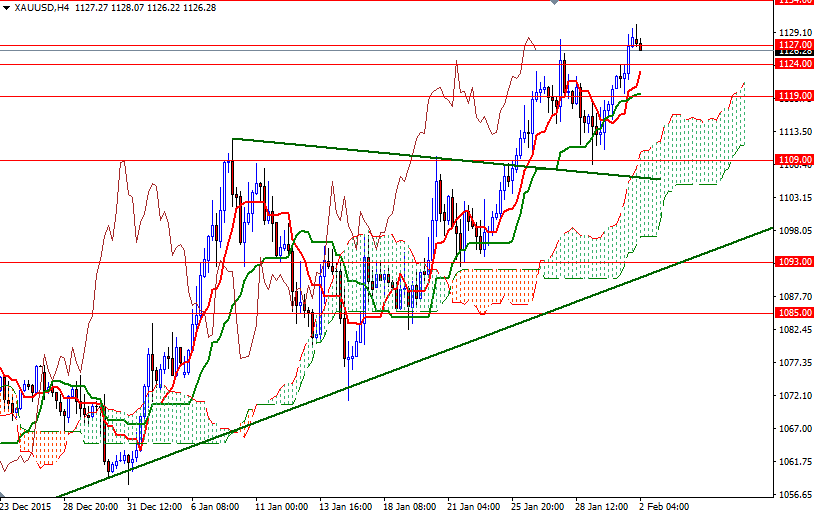

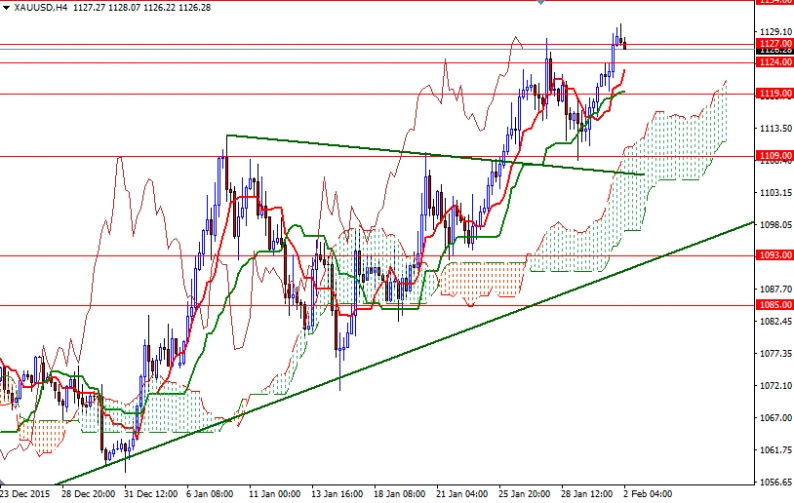

The XAU/USD pair traded as high as $1130.37 earlier in the Asian session but found some resistance and started to retreat. It looks as if the market is heading back to the $1124 level. The hourly Kijun-sen (twenty six-period moving average, green line) and the top of the Ichimoku cloud on the 30-minute chart converge in the same area so it should provide some support.

If the fall doesn’t halt in that region, then the market will have a tendency to retest the supports at 1122 and 1119. The bears will have to drag prices below 1119 if they intend to put extra pressure on the market and march towards the 1113 level. On the other hand, if the bulls manage to defend their camp at around 1124 and prices anchor somewhere above 1127, I think the market will be targeting the next barrier at 1134. Closing beyond 1134 would indicate that the market is getting ready to challenge the resistance at 1141.

Leave A Comment