It’s not easy to build wealth in any asset class. It’s even more difficult to retain it.

On that golden note…

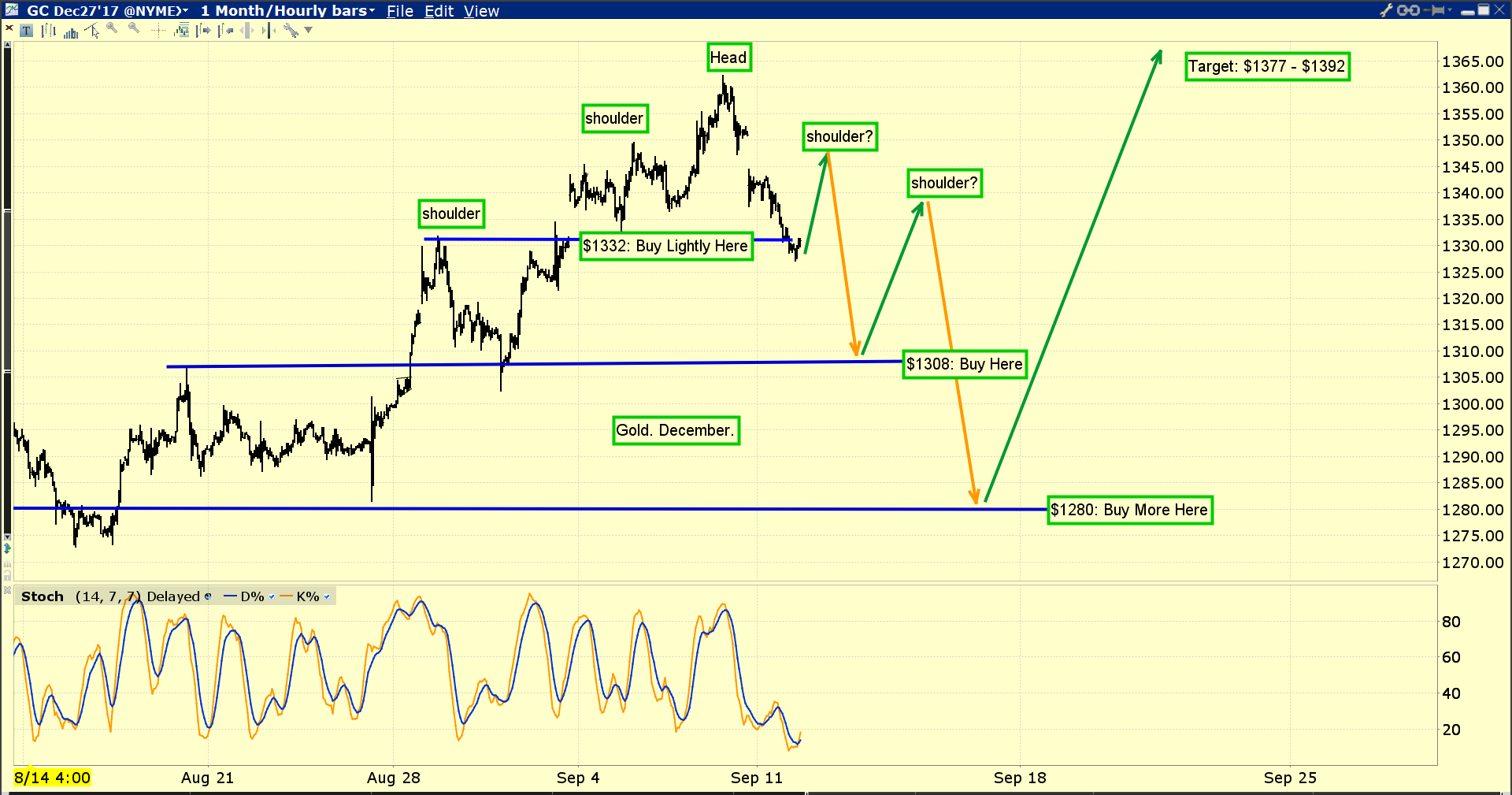

Double-click to enlarge this short term gold chart.

Over the past week or two, my wealth building mantra has been, “Book profit now”. From a technical standpoint, the world’s mightiest metal has begun to show signs of “head and shouldering”.

Head and shoulders top patterns are negative for the price, and it’s normal for them to appear when gold reaches strong resistance.

Strong resistance is not created out of thin air. It’s created by major fundamental events.

To view the ramifications of one of those events.

Double-click to enlarge.

In November of 2016, many gold market players were buying gold aggressively as it became obvious that gold enthusiast Donald Trump had won the US election.

The gold price spiked higher as Trump won, and then imploded when the Indian government’s shocking demonetization announcement ruined the party. Conspiracy buffs will find it very suspicious that the Indian demonetization announcement seemed to happen just minutes after Trump had won.

Regardless, the Trump victory became bitter-sweet for Western gold bugs as they watched the gold price crash.

From a technical perspective, the tremendous volume that occurred on demonetization night has turned the $1350 price zone into powerful resistance.

The good news is that compared to the violence of the November sell-off, the current decline is very mild. I’m a light buyer now, and a much bigger buyer at $1308 and $1280, basis December futures.

It’s important that investors wait for emotional discomfort before rebuying with size. The bottom line is that to build gold market wealth that is sustained, significant patience is required.

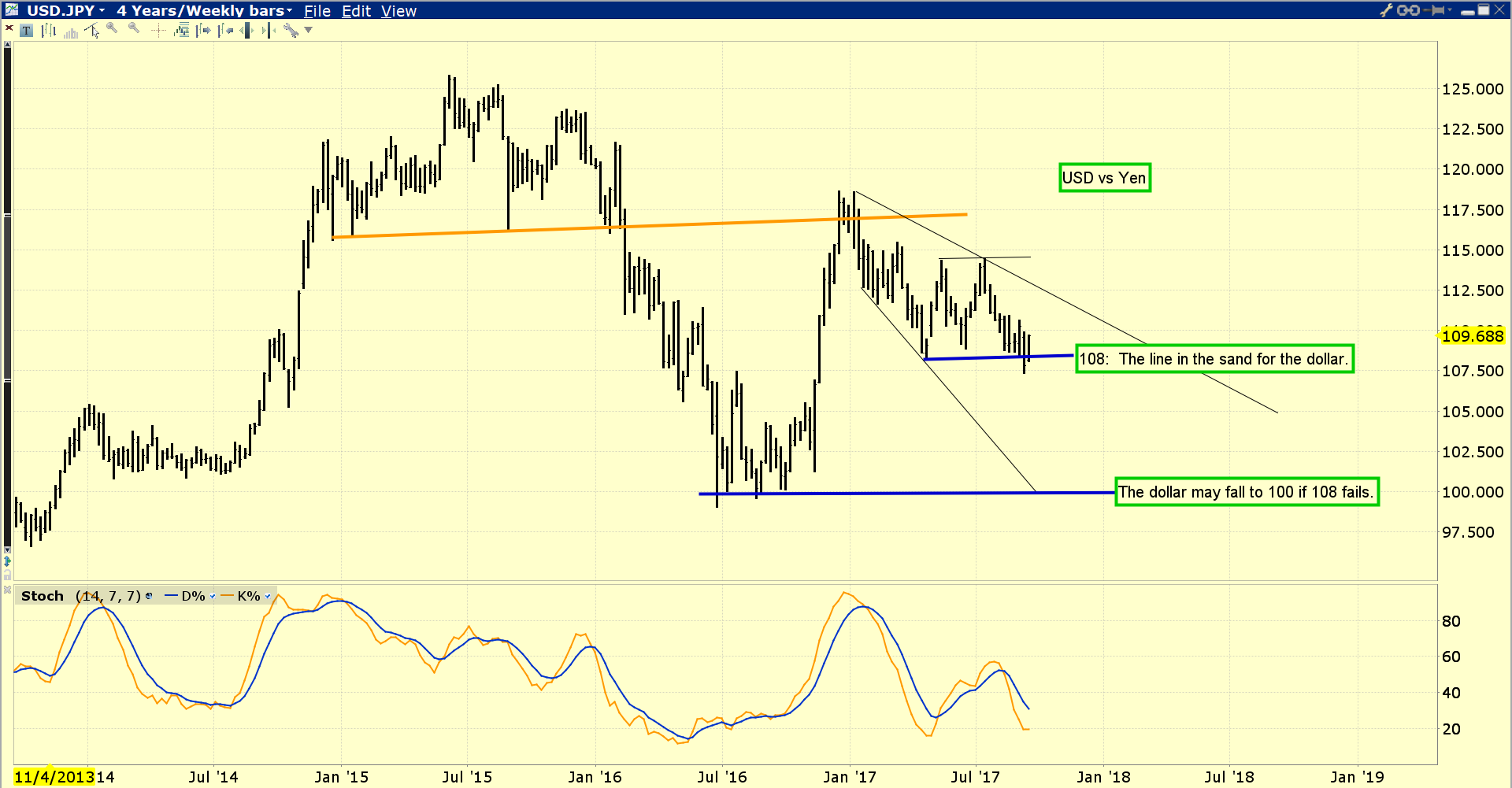

Double-click to enlarge this dollar versus yen chart.

Leave A Comment