“Gold Miners are a leveraged play on Gold”

“Gold Miners are a good hedge against the S&P 500”

There are few sectors in the market that generate as much attention, emotion, and misinformation as the Gold Miners. You’ll often hear some version of the two quotes above, stated as fact.

Let’s evaluate the data to determine their accuracy…

1) Leveraged Play on Gold?

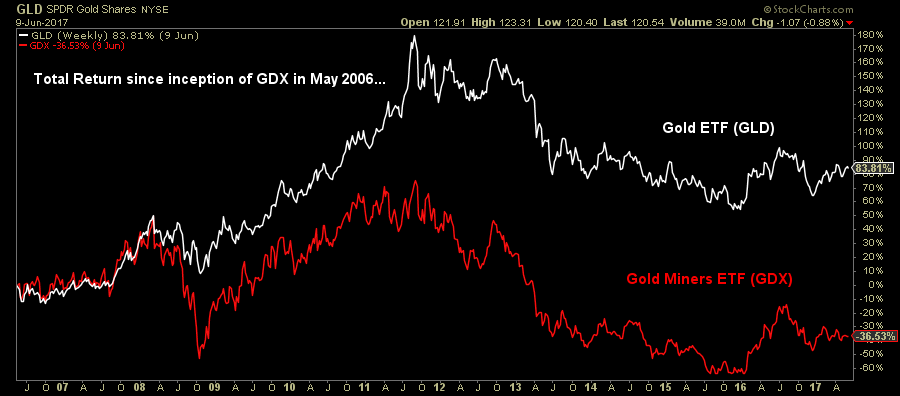

The Gold Miner ETF (GDX) launched in May 2006. Since its inception the Gold ETF (GLD) has advanced over 84%. If you assumed that Gold Mining stocks would be up some multiple of this amount, you would be mistaken. Gold Miners have actually declined over 36% during the same period.

How is that possible?

For starters, there is no formula that states that the Miners have to return x% of Gold. They are not commodities but stocks, and as such their returns are dictated by dividends, earnings growth and multiple expansion/contraction. While these factors are undoubtedly influenced by the price of Gold, they are not ruled by the price of Gold. As we have seen since 2006, the price of Gold can go up and if the Mining companies are poorly managed and multiples contract, their stocks can certainly go down.

That’s not to say the two securities aren’t related. They are. With a monthly correlation of 0.83 between GLD and GDX, they often move in the same direction. And that’s not to say that the Miners don’t often behave as leveraged Gold. With an Upside Capture versus Gold of 172% (when gold is up, Miners are up an average of 1.72 times that amount) and a Downside Capture of 164% (when gold is down, Miners are down an average of 1.64 times that amount), they often do.

But often is not the same as always, and correlation is not the same thing as performance.

After trading largely in line with Gold from mid-2006 through mid-2008, the gap between Gold and the Miners widened significantly in the back half of 2008 when the Miners went into free fall. For the full 2008 year, Gold finished up 5% versus a 26% decline for the Miners.

Leave A Comment