Last week, gold failed to effectively breach the $1,300 level. What does it mean for the gold market?

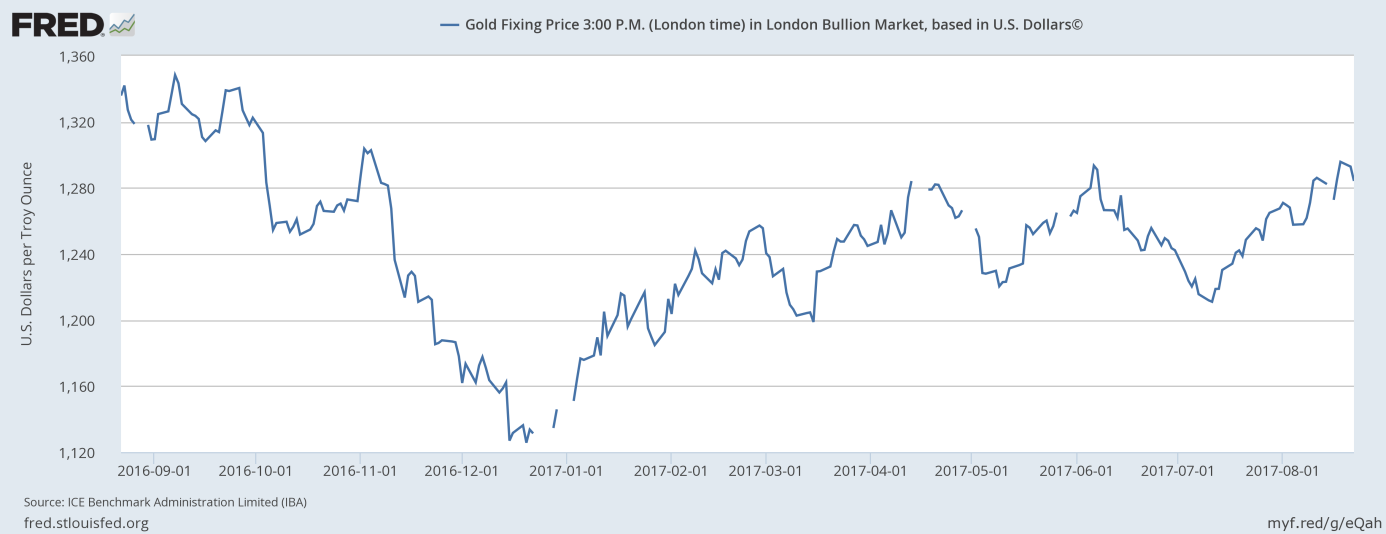

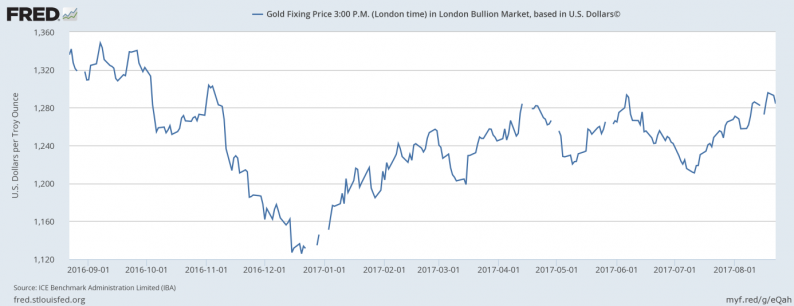

On Friday, gold hit intraday $1,306 at Comex, a level not reached since the Election Day. However, the rally turned out to be unsustainable, as the rebound in the U.S. dollar exerted downward pressure on the yellow metal. The breakout above psychological level of $1,300 would have been very important move, given that gold has been traded within the narrow trading range $1,200-$1,300 for six months, as one can see in the chart below.

Chart 1: Gold prices over the last twelve months.

The failure to do that is, thus, bearish and may signal the potential for reversal. We have already discussed this session in great detail in our Gold & Silver Trading Alerts, and in today’s analysis we will disclose some of our thoughts.

We are not saying that gold will not break this level eventually, but it would need a strong catalyst to do it in a sustainable manner or the precious metals market would have need to be after its final (!) bottom. Gold recently rallied on nuclear tensions regarding North Korea and yet – it still didn’t manage to hold above $1,300. This tells us something.

Namely, unless something important happens and changes market sentiment – for example, the stock market crashes, or the Fed postpones the next interest rate hike and the normalization of its balance sheets or an important technical or cyclical development takes place – gold should be trading sideways in the short term (this seems to have been the case for the past few days). We live in the goldilocks economy, which is neither too hot, nor too cold – and it turns out to be neither bullish nor bearish for the gold market – at least based on the last several months of gold’s performance.

The Jackson Hole Symposium might provide the needed impetus. Investors impatiently await this conference, so any unexpected remarks may shake the markets. When expectations are high, it’s easy to be disappointed. If the Fed turns out to be more dovish than expected (or the ECB more hawkish than forecasted), gold prices will probably jump above $1,300 (but would such a rally be sustainable is a different matter). However, we believe that the opposite scenario is actually at least just as likely. The Fed may wait for the next hike until December, but it might announce the start of unwinding of its balance sheet earlier, which would tighten the monetary policy as well.

Leave A Comment