Gold prices settled at $1302.40 an ounce on Friday, rising 1.85% during the week and 13.1% over the year. The general strength in world equity markets and the Federal Reserve’s rate hikes were negatives for the safe-haven gold market. However, weakness in the U.S. dollar lent support to the precious metal. Gold is usually inversely correlated with the main reserve currency and correlated with the second reserve currency which is the Euro at the moment. Also keep in mind that when the bull market runs in stock markets start to fizzle (at some point it certainly will), money flows out of stocks will benefit gold.

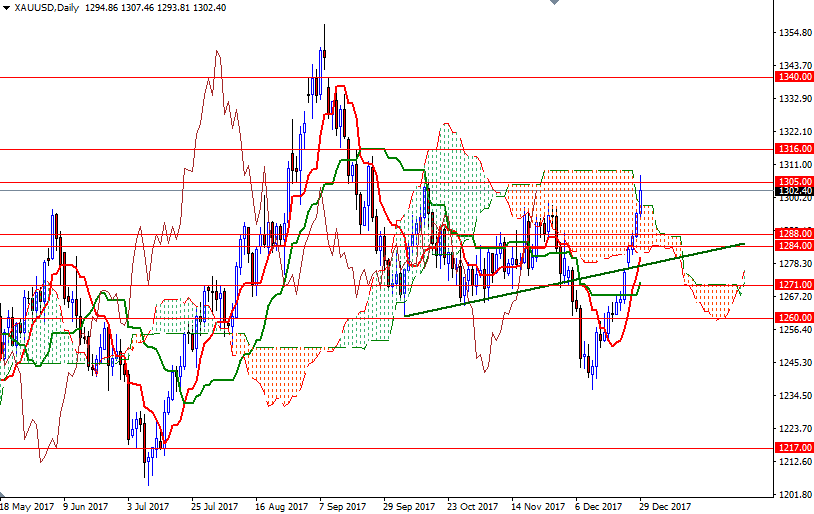

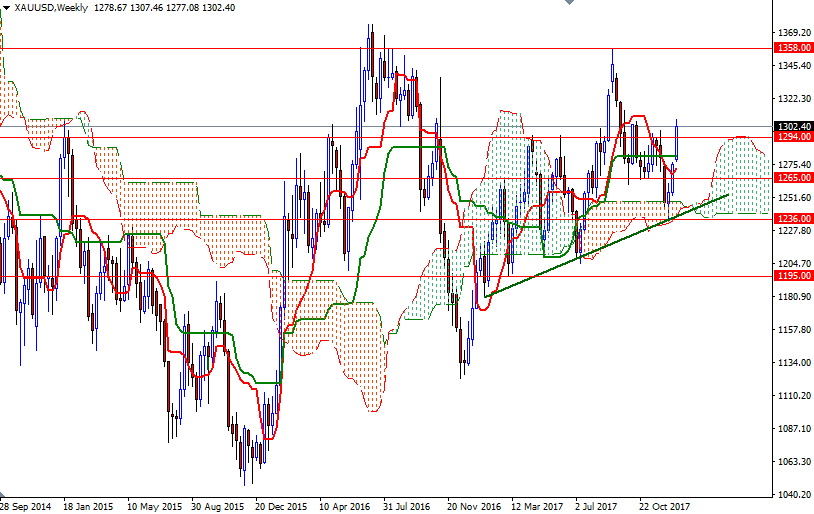

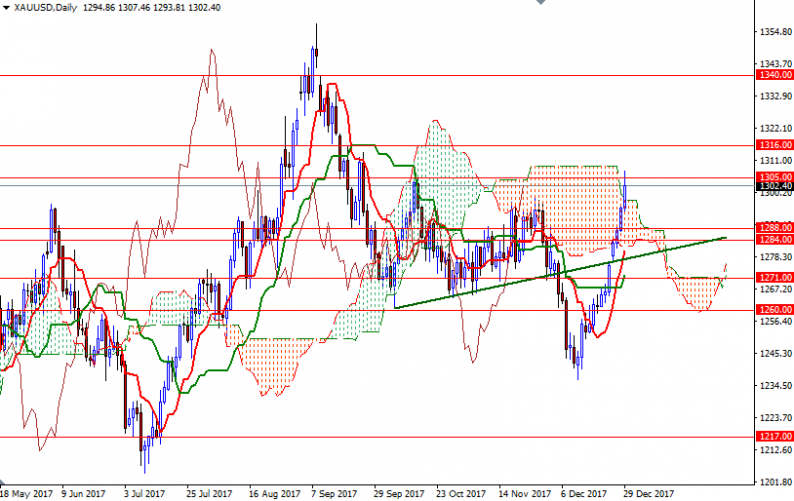

From a chart perspective, trading above the weekly Ichimoku clouds suggests that XAU/USD is likely to continue to benefit from the bullish long-term outlook. The weekly Chikou-span (closing price plotted 26 periods behind, brown line) which is above both prices and the weekly cloud also supports this theory. Despite this bullish outlook, note that prices are moving inside the monthly cloud so it will not be a smooth ride.

The bulls will have to push and hold prices above 1316 to challenge the subsequent targets 1325 and 1340. Beyond 1340, the 1358/3 area stands out as an obvious resistance. If the market passes through this barrier, look for further upside with 1365 and 1375 as the next targets. A break through there brings in 1391/88. To the downside, keep an eye on the 1288/4 area. If this support is broken, the market will be aiming for 1276/1. The bears have to overcome the strategic support at 1265-1259.20 so that they can set sail for 1250/45. The bottom of the weekly cloud sits around 1236. Closing below there on a weekly basis would open up the risk of a fall to 1200-1195. Once below 1195, the bears will be targeting 1179/0.

Leave A Comment