A Surprise Move on Friday

Shortly after we posted our most recent comment on gold sentiment on Thursday evening after the NY market close, the precious metals once again tanked overnight in Asian trading. To our surprise, the move was reversed rather spectacularly later at the COMEX, with gold producing a bullish engulfing candle on the day. This is a tentatively positive development. Below is a 30 minute chart showing the most active December futures contract over the past week:

30 minute chart of December gold

However, from a technical perspective, further developments must be awaited, specifically, there needs to be follow-through that confirms what is currently only a smallish break above resistance. Preferably we would like to see a weekly close that at a reasonable distance from the resistance line so as to indicate it will once again serve as support. Note in this context that a previous attempt to overcome lateral resistance at $1240 quickly failed in the low 1250s, shortly after the 50- day ma was touched. Overcoming this moving average is probably an additional condition that needs to be fulfilled to confirm a trend change.

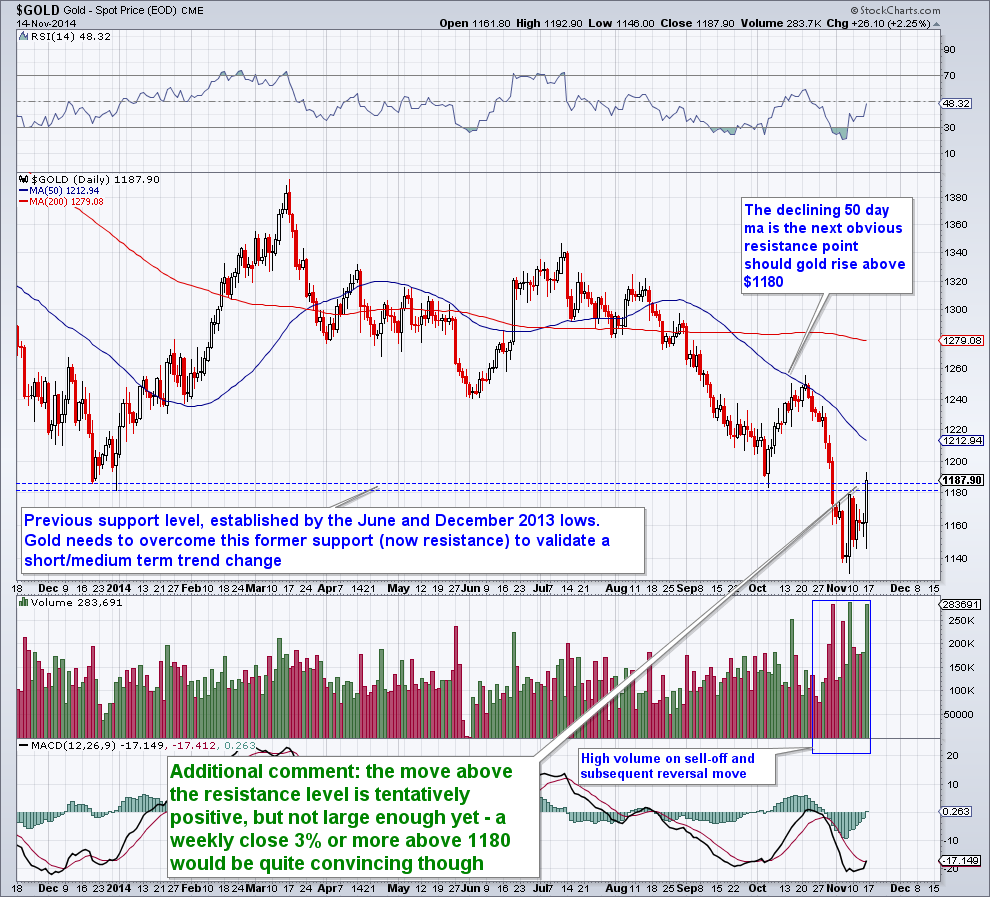

We have left our previous annotations on the daily chart in blue, and have added a new comment in green script:

Gold recrosses the former support level it previously violated

On the positive side, if the break back above this support/resistance line actually holds, it would represent a bullish development for the short to medium term, as in that event, we would have a failed breakdown on our hands.

Conclusion:

Gold has taken a positive initial step, but a little bit more evidence is required from a technical perspective to confirm that a durable trend reversal is in place.

Charts by: BarCharts, StockCharts

Leave A Comment