A Brief Update on Positioning and Sentiment in Gold

Even while gold’s fundamental price according to Keith Weiner’s calculations (in which he compares spot to futures prices) stands some $140 above the current market price (as of the end of last week), futures market speculators have turned more bearish on gold than at any time in the past 13 years.

Photo credit: Lisi Niesner / Bloomberg News

When there is great unanimity among traders about a market’s direction, they are very often going to be proved wrong – at least in the short to medium term (i.e., over time periods lasting from weeks to months). The caveat is that even more pronounced positioning extremes have occurred in a few short time periods during the 1980s and the 1990s, and there is obviously no law that says this cannot happen again.

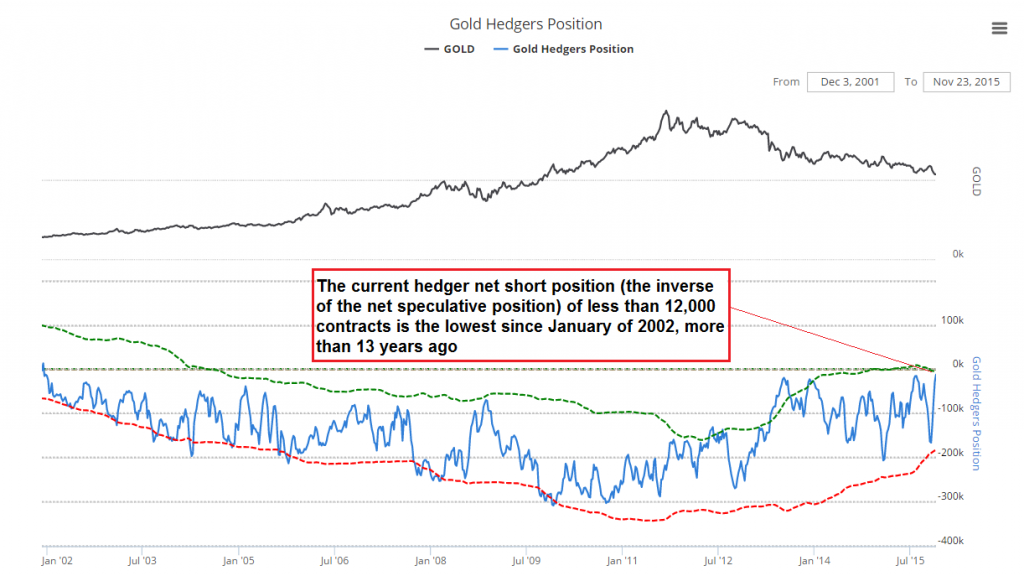

Last week, the smallest net speculative long position since January of 2002 was reported (this chart shows the net hedger position, which is the inverse of the net speculative position) – click to enlarge.

However, it is still quite noteworthy that speculators as a group are more bearish on gold today than they were at the lows of its 20 year long secular bear market in 1999-2000. This definitely means one thing: once a rally does get underway, there is going to be a lot of fuel to support it as this extreme in pessimism unwinds. Gold stocks meanwhile continue to diverge positively from gold and silver, just as they have exhibited persistent negative divergences near the 2011 – 2012 highs.

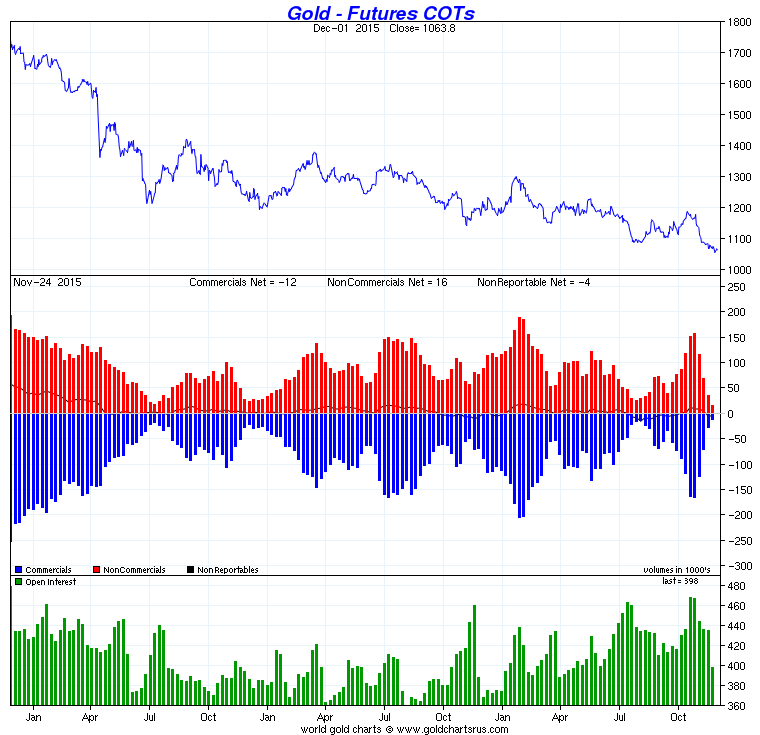

Here are a few more charts illustrating the current situation; first different ways of charting the net positions of speculators and hedgers:

Net speculator and hedger positions, as well as open interest in bar chart form – click to enlarge.

The next chart shows the very same thing, but trader positions are further dehomogenized, with small and large speculators as well as hedgers shown separately in a line chart. Open interest is charted as a line as well. Open interest in COMEX gold futures is actually historically quite large at the moment.

Leave A Comment