GOLD TALKING POINTS

Gold slips to a fresh weekly-low ($1190) as the ISM Manufacturing survey unexpectedly climbs to 58.5 in August to mark the highest reading since 2004, and recent price action raises the risk for a further decline in the precious metal as it snaps the range-bound price action from the previous week.

GOLD PRICE FORECAST: DOWNSIDE TARGETS BACK ON RADAR AS RANGE SNAPS

The rebound from the 2018-low ($1160) unravels as the uptick in business sentiment sparks a bullish reaction in the U.S. dollar, and the inverse relationship between gold and the greenback may continue to materialize over the near-term as the data prints coming out of the economy encourage the Federal Reserve to further normalize monetary policy.

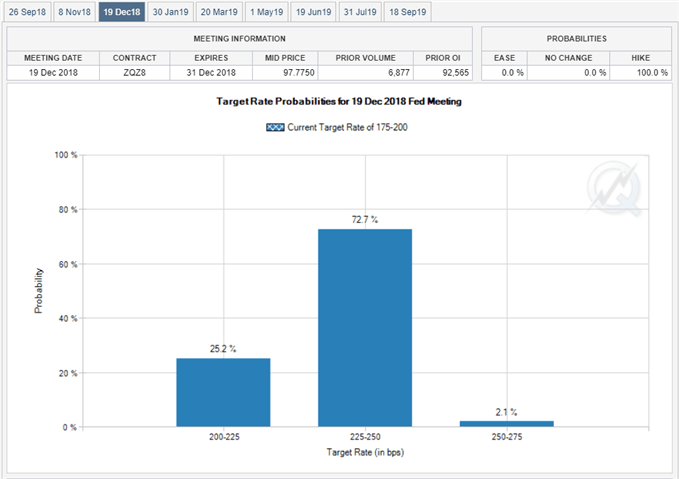

Keep in mind, Fed Fund futures still show market participants gearing up for a rate-hike in September and December even though Chairman Jerome Powell strikes a less-hawkish outlook for monetary policy, and the central bank may continue to prepare U.S. households and businesses for higher borrowing-costs as ‘inflation is near our 2 percent objective, and most people who want a job are finding one’.

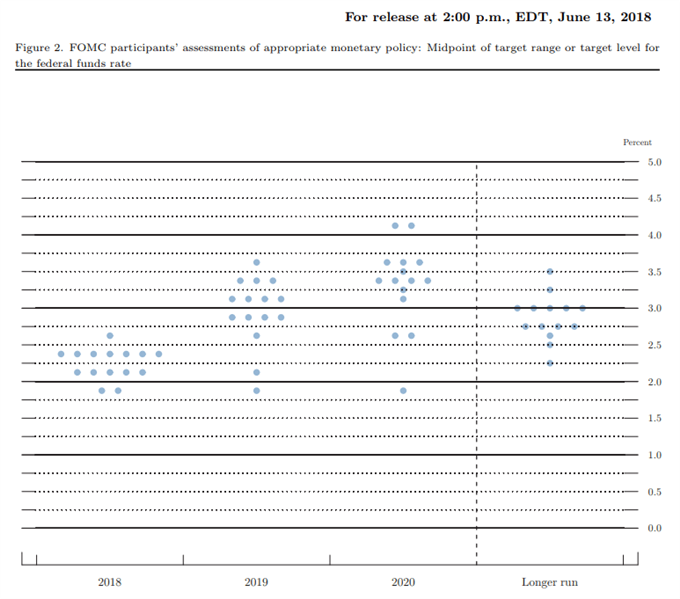

However, the updated Summary of Economic Projections (SEP) may influence the near-term outlook for gold and the greenback as the central bank looks to adjust the forward-guidance for monetary policy and ongoing projections for a neutral Fed Funds rate of 2.75% to 3.00% may produce headwinds for the dollar as it saps bets for an extended hiking-cycle.

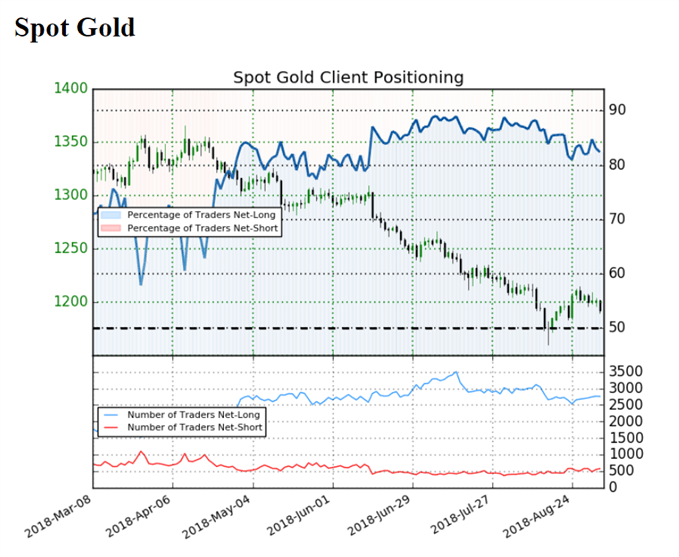

Until then, the broader outlook for gold remains tilted to the downside especially as the IG Client Sentiment Report continues to show retail sentiment near extremes, with 82.4% of traders still net-long bullion as the ratio of traders long to short sits at 4.68 to 1. The number of traders net-long is 0.3% higher than yesterday and 0.2% lower from last week, while the number of traders net-short is 2.6% higher than yesterday and 11.3% higher from last week.

Leave A Comment