Gold prices have struggled to make much of recent US Dollar losses. The flagship anti-fiat asset might have been expected to soar as cooling Fed rate hike bets punish the greenback but has turned in a reserved response instead. A lull in top-tier news flow over the coming 24 hours suggests this is unlikely to change for now but major on-coming event risk means that a breakout may well be in the cards this week.

Meanwhile, crude oil prices continue to push higher amid speculation that an OPEC meeting in Vienna this week will produce an extension of a cartel-led production cut scheme due to expire in March. Stage-setting commentary from key officials leading into the sit-down – particularly from critical non-OPEC producers, such as Russia – may drive price action in the interim.

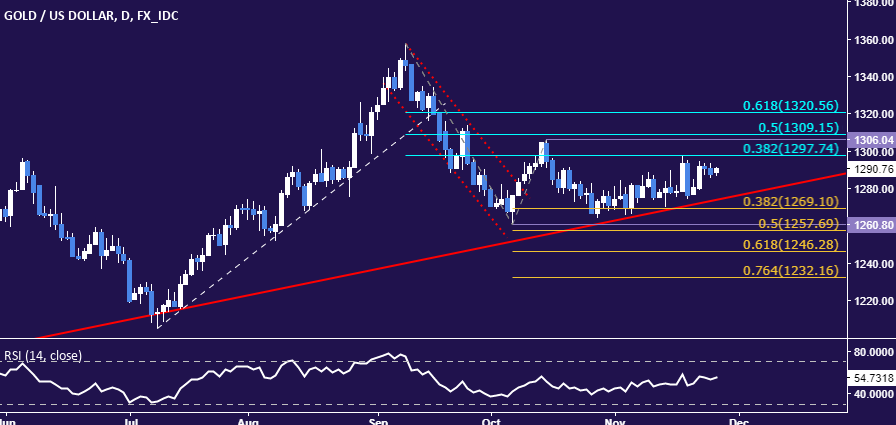

GOLD TECHNICAL ANALYSIS – Gold prices are still confined to a choppy range below the 38.2% Fibonacci retracement at 1297.74. A daily close above this barrier initially exposes the 1306.04-9.15 area (October 16 high, 50% level). Alternatively, a turn below the 38.2% Fib expansion at 1269.10 opens the door for a test of the 1257.69-60.80 region (October 6 low, 50% expansion).

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices are taking aim at resistance marked by the 38.2% Fibonacci expansion at 59.52, with a break above that on a daily closing basis exposing the 50% level at 60.98. Alternatively, a reversal back below the 23.6% Fib at 57.72 targets the 56.61-82 area (resistance-turned-support, 14.6% expansion).

Leave A Comment