Gold prices rose for a third day in a row but remain coiled within the recent trading range as stock markets regained strength from an upturn in crude oil. In the latest economic data, durable goods orders data came in stronger than expected but that didn’t have a long lasting impact on the greenback. Attention now turns to the second estimate of fourth-quarter U.S. gross domestic product figures due later today.

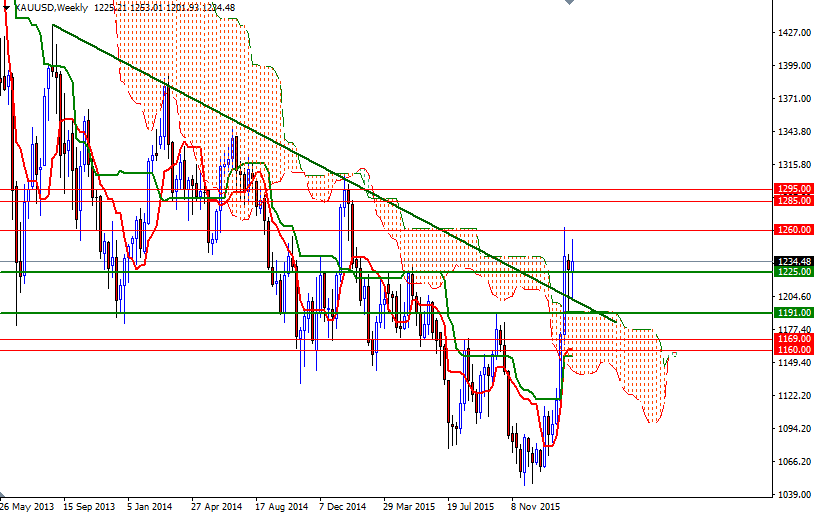

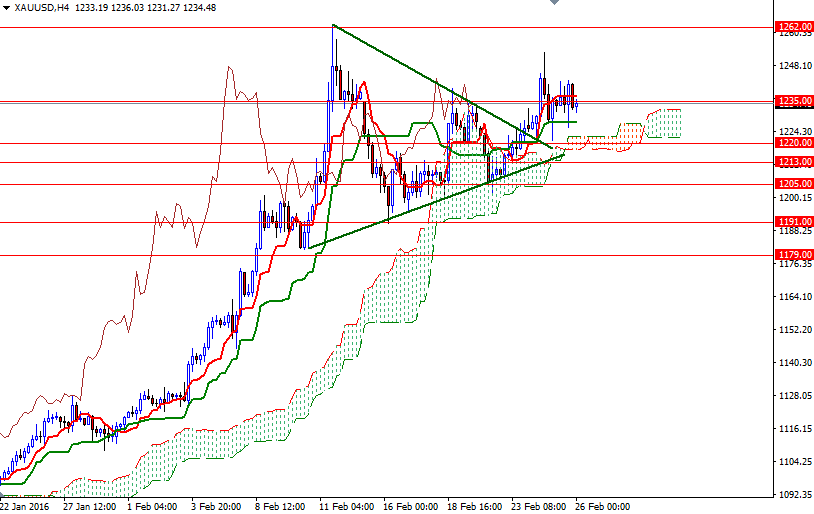

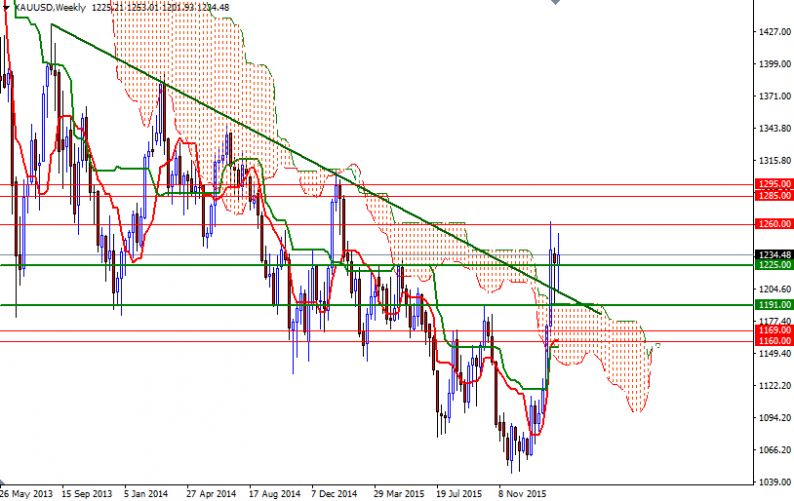

The XAU/USD pair traded as high as $1240.26 an ounce during Asian morning hours before easing slightly to $1234.48 an ounce. The weekly, daily and 4-hourly charts are bullish at the moment, with the market trading above the Ichimoku clouds. Additionally, we have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines. The general outlook suggests that the downside will be limited unless prices make a sustained break below the 1120 support – where the short-term bullish trend line and 4-hourly clouds converge.

From an intra-day perspective, the key levels to watch will be 1245 and 1227. It is quite possible that the pair will gain some traction if it can push through resistance at 1245. In that is the case, I think the 1250 resistance will be tested. As I pointed out it my previous analysis, there is good resistance between the 1250 and 1262 levels. Once the bulls clears 1262 on a daily basis, XAU/USD may proceed to 1285. However, if the bears take the reins and prices drop below 1220, we could revisit 1213 afterwards. Shattering this support would make me think that the market will test the 1205/1 zone.

Leave A Comment