Daily Forex Market Preview, 05/02/2016

The markets were unrelenting yesterday as EUR/USD posted new monthly highs including Gold while USD/JPY continued to fall back to below the 117 handle. The January payrolls report from the US is due today which is likely to be key to either further weaken or help the US Dollar recoup its losses. Meanwhile, Gold and EUR/USD remain poised for further gains while GBP/USD is likely to see some downside if prices close below yesterday’s low of 1.453

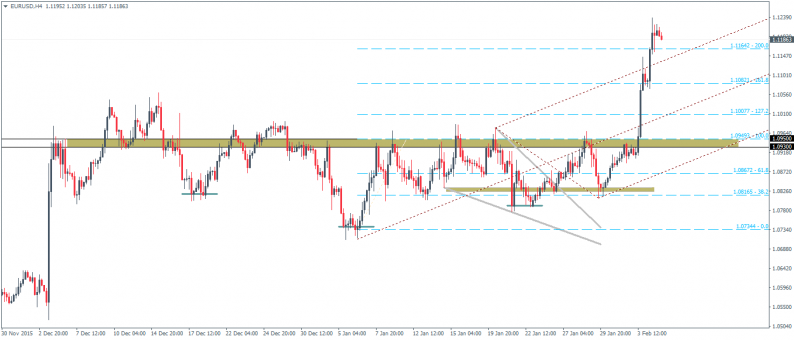

EURUSD Daily Analysis

EUR/USD (1.11): EUR/USD closed near the main resistance between 1.13 – 1.12 on the daily chart while also forming a bearish divergence to the Stochastics. A decline is likely to be limited to 1.105 – 1.095 region, which would mark a retest of the inverse head and shoulders neckline resistance. Establishing support here could signal a further move to the upside as long as the previous low near 1.0816 is not breached.

USD/JPY Daily Analysis

USD/JPY (116.74): The Dollar remains weak against the Yen as price action broke below 117.25 – 117 level of support. The next leg lower could see a test to 116 low, previously tested briefly around 20th January. The bias remains to the downside, with any pullbacks limited to 118.395 – 119 level in the near term. Only a convincing close above 119 could see the potential for a move to the upside. For the moment, there is a small dynamic support being formed at the current levels near 117, which should see USD/JPY attempt to gain back to 119.

GBP/USD Daily Analysis

GBP/USD (1.45): After posting strong gains earlier this week, GBP/USD closed with a doji candlestick pattern on the daily chart yesterday. The doji close comes near the main resistance level of 1.474 – 1.4635 and the recent high is marked by a hidden bearish divergence to the Stochastics. A move to the downside is therefore likely with 1.443 – 1.437 coming in as the main support to the downside. As long as prices hold above this support, GBP/USD remains biased to the upside, but a risk of breaking this support could see price action easily decline lower to 1.42

Leave A Comment