Gold prices moved lower on Wednesday as the greenback clawed back some of its recent losses. “Economic activity increased in each of the twelve Federal Reserve Districts between mid-February and the end of March, with the pace of expansion equally split between modest and moderate… Employment expanded across the nation and increases ranged from modest to moderate during this period,” the Federal Reserve said in its Beige Book report.

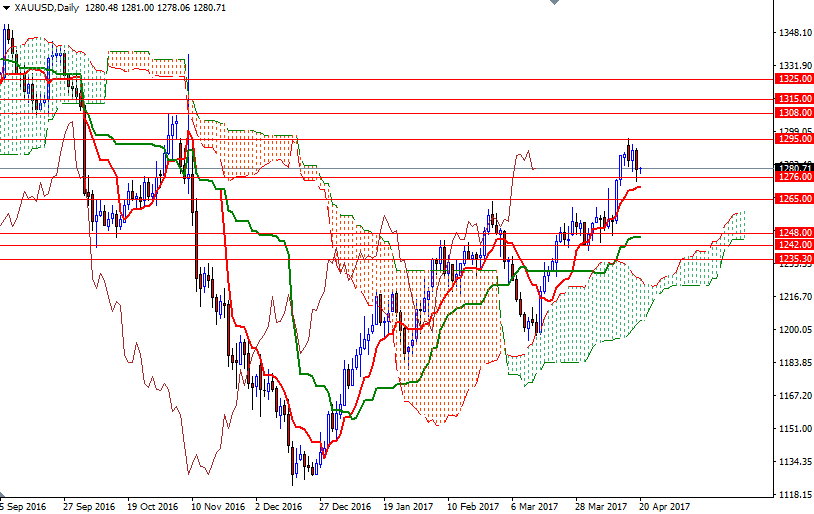

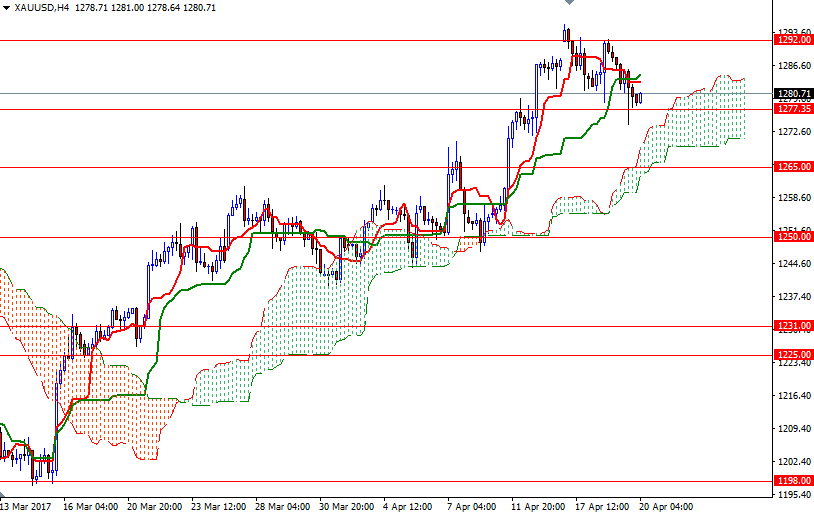

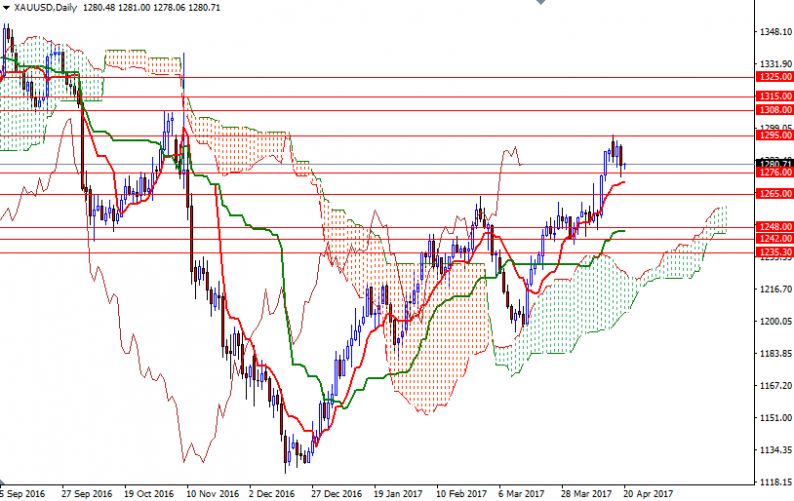

The medium-term outlook remains positive, with the market trading above the Ichimoku clouds on both the daily and 4-hourly charts, however, the short-term charts imply that the bulls may be losing momentum. The market challenged the 1295 level earlier in the week but failed to break through. Consequently, XAU/USD returned to the 1277.35-1276 area. Prices are currently hovering right above this area.

If prices fall through, then the market will probably head towards the cloud on the H4 chart. In that case, 1272 and 1269 will probably be the next stops. The bears have to drag prices below 1269 in order to set sail for the 1265 level. The bulls will need to take out the resistance at 1283.40, which happens to be the top of the cloud on M30 chart, if they intend to march towards the 1289/7 zone. Beyond there, the 1295/2 zone stands out as an obvious key resistance. A daily close above 1295 paves the way for a test of the 1308/4 zone.

Leave A Comment