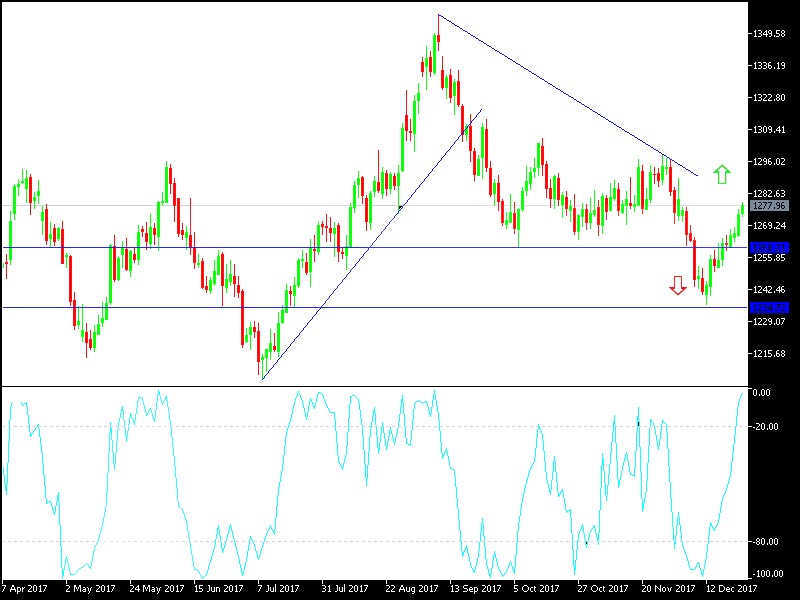

If gold manages to test the resistance at 1283 an ounce, the highest level for the precious metal in 3 weeks, it would be a good chance for it to move towards the psychologically important peak at 1300. Gold took advantage of the US index, which measures the greenback’s strength against a basket of 6 currencies, retreating towards 93.20, and the drop of the US stock market, to achieve gains. Gold is moving within upward channel as shown on the daily chart, but within tight ranges, even with the strong pressures on the dollar after the passage of the US tax cut bill. It seems that the increased move towards crypto-currencies after the recent record gains, especially the for the Bitcoin, contributed to reduced interest in buying gold, as the recent gains were lower than usual in light of a lower dollar.

Technically: Gold prices will have a strong bullish move today if the prices moved towards the resistance level at 1285, the psychological peak at 1300. The nearest support levels for gold are currently at 1271, 1265 and 1253. We still prefer buying the gold from every bearish level. In light of market closure due to holidays this week and early next week for Christmas and New Year’s, traders need to be alert of price gaps due to markets coming back in interrupted form sometimes, and it is better to avoid trading until the markets are fully back to normal.

On the economic data front today: Gold will have full focus on the dollar’s level and the reaction to the US consumer confident and pending houses sales. Gold will also monitor updates regarding renewed geopolitical fears regarding North Korea, Brexit, and Trump’s economic policy.

Leave A Comment