Greetings from the beautifully bucolic Swiss canton of Fribourg where, like Gold, the cows barely budge toward otherwise producing their gruyérienne delights.

Indeed Gold these many months has taken on the daily life of a cow: both awake with the dawn, spend most of the grazing day chewing upon their respective regurgitated cud (which in the case of Gold are its traders), and then retire into the dusk pretty much in the same unbudged state as they were the day before. Oh, the cow may give a few daily gallons of milk along the way, as might Gold take a few points during its day…at the end of which neither has really made any hay.

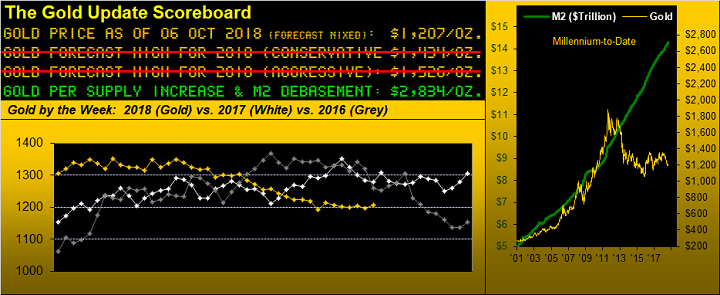

Ever since Gold fell from the grace of the 1300s back on June 14, price’s median daily net change (regardless of direction) has been but a wee 5.5 points. Moreover, since August 29 (27 trading sessions ago), Gold has had but two days of net double-digit change. That’s all, including closing out this past week with a three-point gain on Friday to settle at 1207 ..in the midst of which the S&P 500 suffered its worst two-day loss since April 9. How oblivious as a safe haven has become our Golden bovine.

Nonetheless, with time being at a premium for producing this week’s missive, let’s quickly riffle through our salient charts, starting with the track of Gold’s daily closing price since its highest some seven years back. And look at just how scrunched price has become in the rightmost part of the chart, so much so that one might have to call for a defibrillator to keep Gold going:

Of course in the midst of this, the venerable weekly Barron’s just ran a piece suggesting Gold has put in its low (with but three months to go) for this year, citing global central banks stepping up their purchasing of the yellow metal (deftly so as to not materially push price higher) given their usual laundry list of financial uncertainties. That from the “Buying Without Budging Dept.” albeit such push is purportedly some of the “strongest” buying in three years.

Leave A Comment