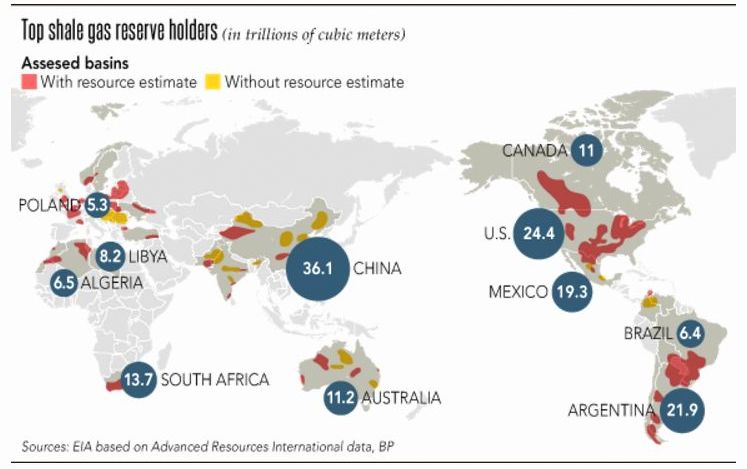

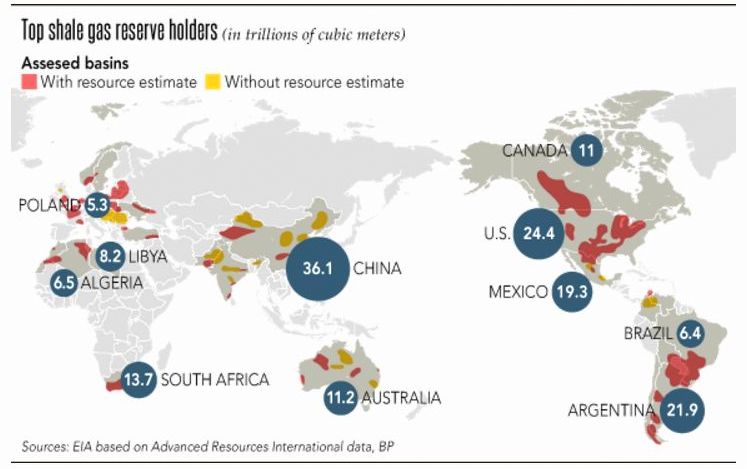

Water, water not a drop to drink. While that may not precisely sum up China’s dilemma, it is clear that the country with the world’s largest shale gas reserves, and urgent need to extract it, will have problems achieving its ambitious long-term goals. The newly-finalized Five Year Plan calls for an enormous increases in natural gas output in China. The carbon emission reduction agreement signed by President Obama and Chinese leader Xi Jinping also requires China to diversify away from coal. Shale gas is the obvious replacement.

As of now, virtually all that gas remains trapped in the ground. The two companies given the plum rights to develop the gas, China’s oil giants Sinopec (SHI) and PetroChina (PTR), may not have the technical competence to fully develop the resource. The companies that have the skills, mainly a group of small entrepreneurial US drillers, has so far shown zero inclination to either come to China or come to the aid of the two SOE giants by providing equipment and know-how.

To attract them to China will likely require a significant shift in the way China’s energy resources are owned and allocated. It will mean creating terms in China every bit as favorable, if not more so, than skilled shale gas drilling companies enjoy in the US and elsewhere.

This is why for China’s senior leaders and economic planners, this map is as much a curse as blessing. Knowing that vast quantities of much-needed clean energy is in the ground but not having the domestic infrastructure and technology to get it to market efficiently is about as tough and frustrating as any economic problem China now confronts.

The Chinese policy goal and the on-and-in-the-ground situation in China are on opposite sides of the spectrum. China has said it must quickly increase the share of natural gas as part of total energy consumption to around 8% by the end of 2015 and 10% by 2020 to alleviate high pollution resulting from the country’s heavy coal use. The original target announced with great fanfare was for shale gas production to increase almost 200-fold between 2012 and the end of the decade. But, this goal was quietly slashed by 30% last year. More slashes may be on the way.

Leave A Comment