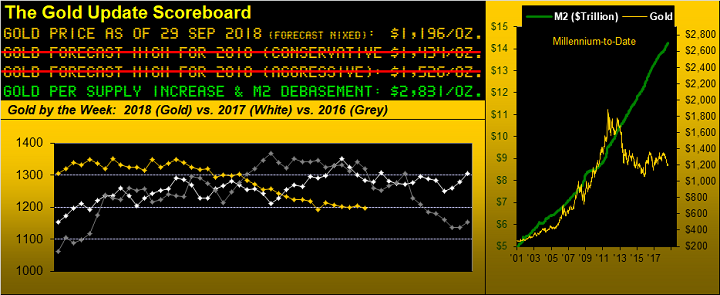

If only Gold were to return to the once-efficient nature of increasing its market value astride the non-stop growth in the stateside money supply (M2) — such debasement in tow with skyrocketing debt and derivatives — we’d have the whole package … or at least a present Gold price per the above Scoreboard in excess of 2800 rather than seeing the past week settle at 1196. For through the eyes of Swiss cheese, Gold’s present-day valuation is riddled with holes.

In any case, the unavoidable annoyance of the market’s never being wrong, the ninth trading month of 2018 has come to an end such that it is time to bring up the usual cavalcade of colorful — albeit factually dour — Gold & Co. graphics.

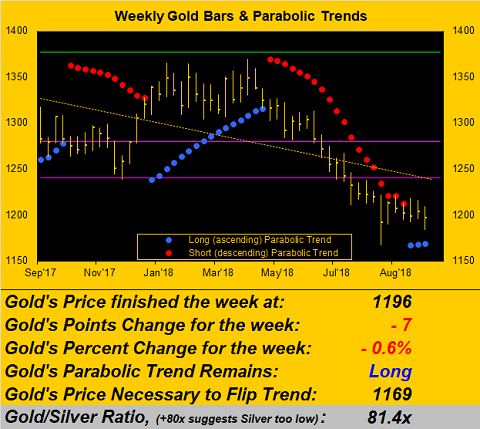

Let’s begin with Gold’s weekly bars from a year ago-to-date … and frustrating indeed remains their state. With but 27 points separating present price (1196) from the trip price (1169) to send the parabolic trend back to Short with essentially no price gain from the Long side, it’s a somewhat precarious picture. Given Gold’s “expected weekly trading range” is 25 points, it’s not that long a row to hoe to flip the show to Short:

Further from the year ago-to-date perspective, Gold is -7%. But in comparison to the data from the “Live by the Volatility, Die by the Volatility Dept.”, it’s but a third of the damage being suffered by precious metal equities, to wit Newmont Mining (NEM), Goldcorp (GG), Franco-Nevada (FNV), and the VanEck Vectors Gold Miners exchange-traded fund (GDX), all being -20%, dare we further mention the Global X Silver Miners exchange-traded fund (SIL) which is -27%. Fairly messy this view, rather akin to adding to one’s slice of Swiss cheese a spread of mustard, only to then find it having dripped through onto one’s pants:

Speaking of Swiss as we turn to the BEGOS Market Standings year-to-date, we see the mighty Franc off the least (-0.7%) of the losers. In fact, the table’s order of the markets is the same as it was at the end of August, with only Oil, the S&P 500 and the Dollar Index (which while not a BEGOS Market we include in this stack) are in the black to this point. So-called “Dollar Strength” being Gold’s bane remains the rationale being bandied about, whether from the FinMedia or some billionaire chit-chat we took in a few evenings ago in dear old Monaco.

Leave A Comment