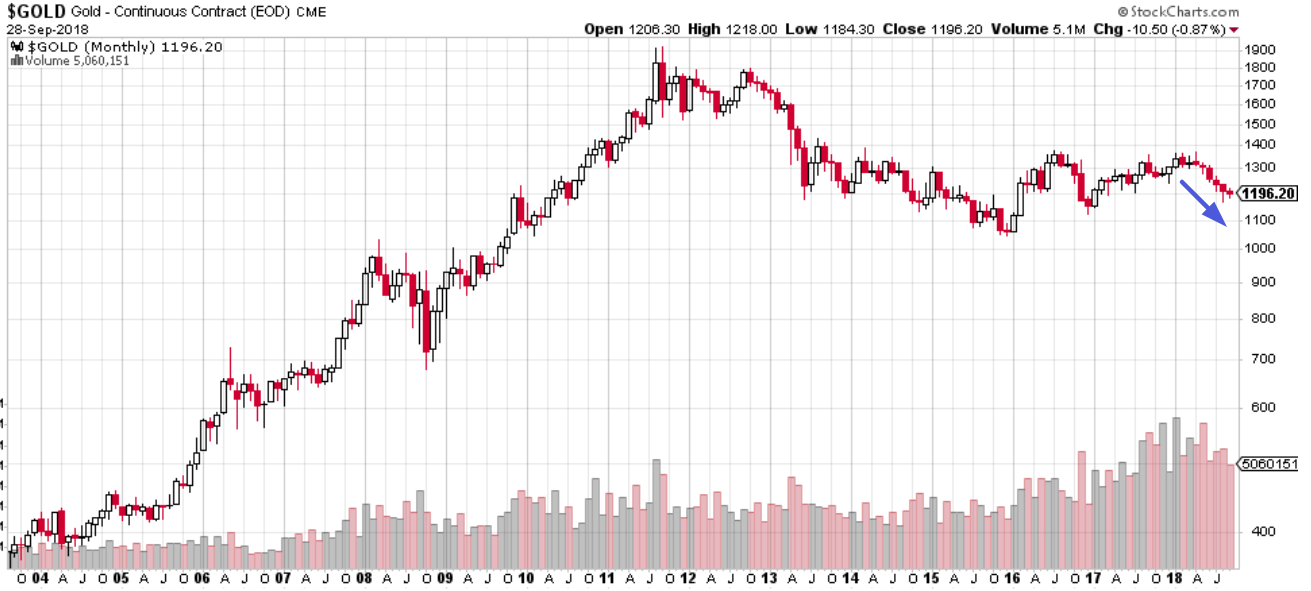

Gold and silver have been exceptionally weak this year. Gold is now down 6 months in a row.

From a short term perspective, this is about as bad as it gets for gold (historically).

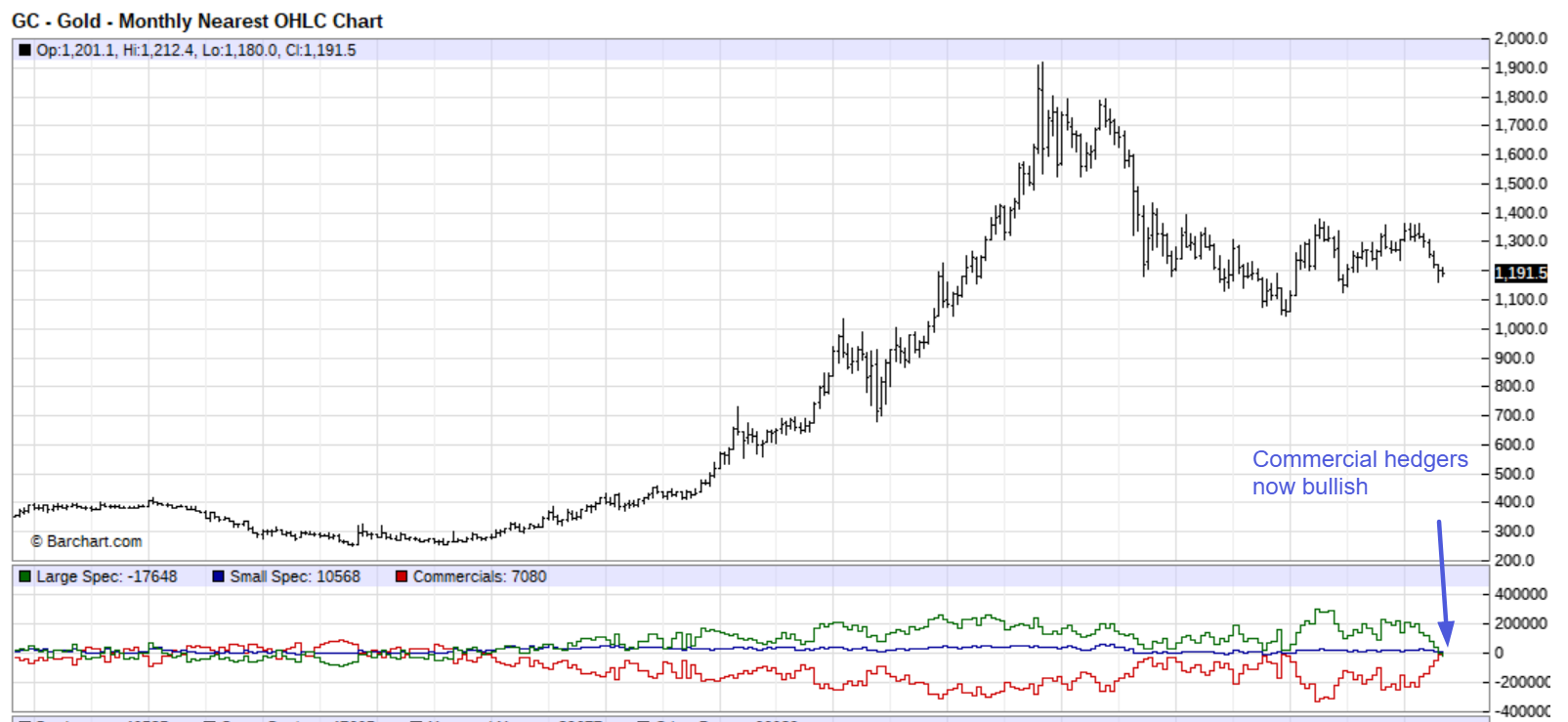

But here’s a very important point that I want to illustrate. Commercial hedgers are now long gold for the first time since 2000. (Gold began a massive bull market after 2000).

Some people see this as a long term bullish sign for gold. I don’t. Commercial hedgers were consistently long gold during the 1990’s while gold swung sideways in a big range. Gold and silver are increasingly showing signs that are characteristic of these long sideways consolidation patterns.

Conclusion

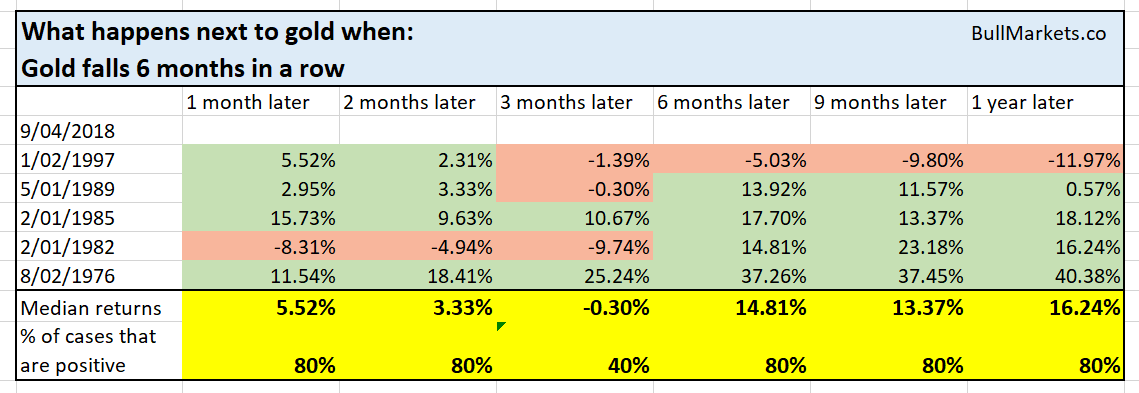

Here’s another interesting point. Look at the dates from this study. While the U.S. economy was typically in the late-stages of its economic expansion cycle, inflation didn’t go up significantly over the next year.

Click here for more market studies.

Leave A Comment