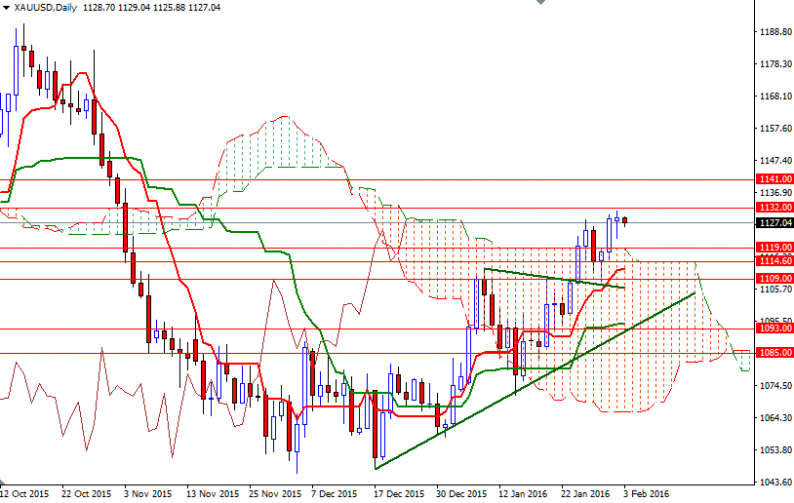

Gold prices rose slightly on Tuesday closed the day at $1128.78 an ounce. Although the precious metal’s safe-haven appeal intact as equities and oil prices continued their slide, the market remained in a relatively tight range. The pattern on the daily chart suggests that gold prices will tend toward consolidation as markets await key U.S. data. Today sees the release of ADP employment report and ISM non-manufacturing PMI data but of course the highlight of the week will come on Friday when the Labor Department releases its employment report for January.

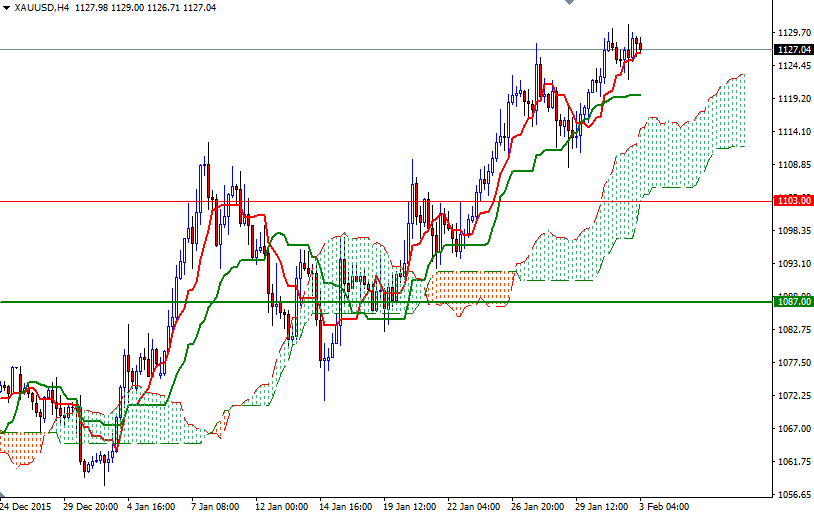

The XAU/USD pair is sailing above the Ichimoku clouds on the daily and 4-hour time frames, plus the Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines are positively aligned on both charts, suggesting that the medium-term outlook is bullish. Apparently the bulls don’t want to lose their strategic camp in the 1121/19 region because that would give the bears an advantage they need to drag prices to 1114.60 and then 1111.28-1109. Similarly, the bears increase pressure when the market approaches the 1132/1 area.

If the XAU/USD pair drops below the 1109 support, then the market will have a tendency to fall further towards the ascending trend-line. In that case, the 1103 level could be the next stop. The upward potential is likely to be limited by the resistance in the 1132/1 zone, so we need to climb above there in order to march towards 1141. If the bulls gain more traction and successfully break through, then we are likely to proceed to 1146.

Leave A Comment