The disruption of the physical retail market by online retailers has been one of the main stories on Wall Street since the beginning of the dot-com boom nearly two decades ago. And as the closure of brick and mortar stores has accelerated over the past year or so speculation about what the future holds for traditional retailers has reached fever pitch.

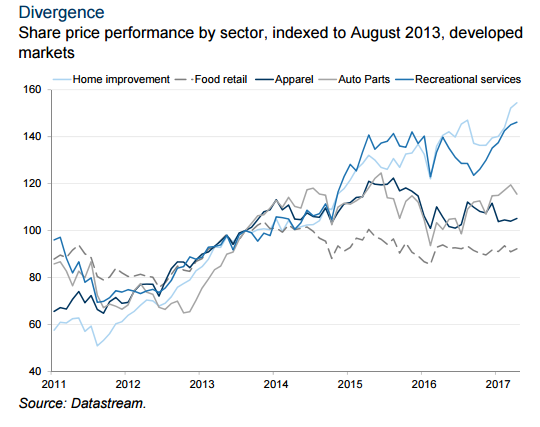

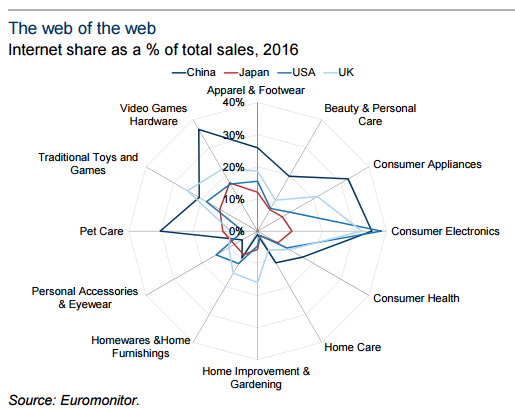

However, according to research from Goldman Sachs, there are pockets of the retail industry that remain attractive for retail investors. Specifically, the lead story in the bank’s April 12 bi-monthly “Fortnightly Thoughts” research booklet, takes a look at the performance of those sectors, which haven’t been affected by e-commerce. Companies exposed to consumer spending categories with relatively low e-commerce penetration (home improvement, education, and auto parts) have outperformed those that are more easily brought online over the past five years.The reasons why these sectors have not faced as much pressure are varied but can be broadly broken down into four categories, offline value-add, demand preferences, distribution complexity, and regulation.

These Sectors Won’t Be Able To Resist Online Disruption For Long

Two key examples of sectors that have been able to hold out against online giants thanks to specific in-person requirements are high-end jewelry and education. Both of these services can be provided online. Indeed there are some online-only education courses, and high-end jewelry retailers offer online personalization. But for the really bespoke products such as one-off engagement rings or engineering/science/medical higher education courses, there really is no online replacement.

But for how much longer will this continue to be the case? Goldman argues it won’t long before all the remaining online purchase barriers are broken down as web giants such as Amazon and JD.com continue to grow rapidly:

“These giants could add new product lines to their existing portfolios at (almost) zero marginal cost and thereby improve their asset turn, skewing the economics for existing competitors. In other words, entry into niche product segments like textbooks, pet food, camping equipment or LED bulbs does not necessarily require the likes of Amazon and Alibaba to invest in new logistics infrastructure and it may not necessarily grow their addressable markets meaningfully. But it can prove hugely disruptive to producers of niche goods or specialist retailers.”

Leave A Comment