Today’s post is an important one. I might have put Grandma in the trunk, but the coming struggle between generations is no laughing matter. It very well might end up being the defining theme for financial markets in coming decades.

I came to this conclusion after sitting down to write about Central Banks’ inability to create inflation (so far). But first, to understand where we are headed, we need to know where we have been.

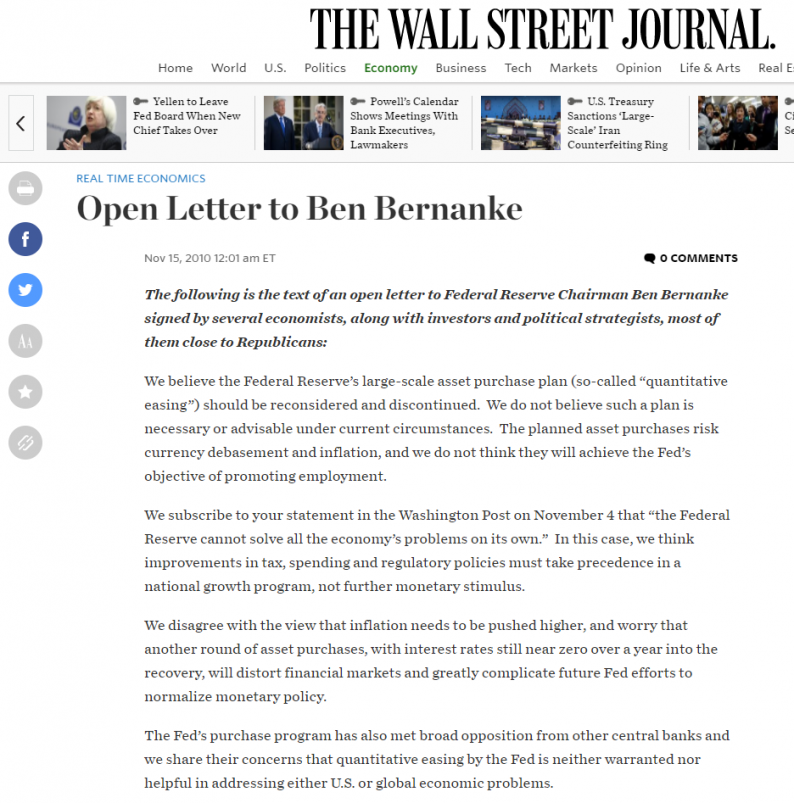

Think back to Bernanke’s second round of quantitative easing. At the time, many smart people thought it would create run-a-way inflation. Some more prominent market figures were so concerned, they wrote an open letter to Ben:

And this was signed by some heavy hitters. Cliff Asness from AQR, Jim Chanos from Kynikos, Niall Ferguson from Harvard, James Grant from Grant’s Interest Rate Observer, Seth Klarman from Baupost, Paul Singer from Elliott and John Taylor from Stanford, just to name a few. These are serious folk who do not idly throw around open letters to the Federal Reserve Chairman. It’s one thing when Peter Schiff screams about the coming inflationary crisis, but it’s a completely different animal when this list of individuals takes the time, and the risk to their reputations, to write an open letter. No, they did this because they were convinced currency debasement and inflation would be the result.

Well, we should get them some napkins to clean the egg off their faces. Let’s have a look at how their prediction panned out.

Contrary to all their dire warnings, the US dollar did not collapse. In fact, apart from a six month period after their warning, when investors were still heeding the elites’ advice, the US dollar did the exact opposite and instead soared higher. Ooops. And neither did inflation explode upwards. Double ooops.

And let’s make no mistake. It wasn’t just these few that felt this way. It was a widely held consensus view. And as much as I like to think of myself as a contrarian, I swallowed the theme hook, line and sinker. Yup, if they had wanted the MacroTourist’s John Hancock on the open letter, I would have gladly supplied it.

What went wrong?

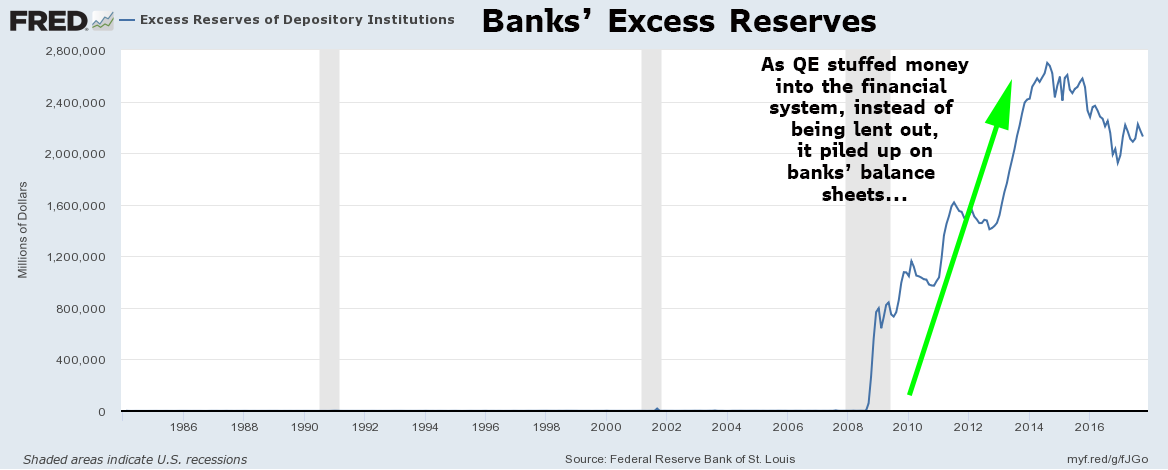

Why didn’t all that quantitative easing cause the inflation so many were so worried about? Assuming Milton Friedman’s famous equation MV = PQ (where M is money supply, V is velocity and P is Price and Q is Quantity) holds true, the dramatic increasing of M (money supply) should have created a corresponding increase in P (Price).

The mistake was that (most) everyone assumed the velocity of money was much more stable than occurred in reality. Money was shoved into the financial system, and instead of being taken up and lent, it sat inert on banks’ balance sheets.

So instead of the MV=PQ equation balancing from an increase in the M with a big increase in P, instead V just collapsed.

There were few market forecasters who thought the massive quantitative easing programs would simply result in higher financial asset prices, with desperately little inflation, rock bottom rates and lacklustre growth. Yet that’s exactly what we got.

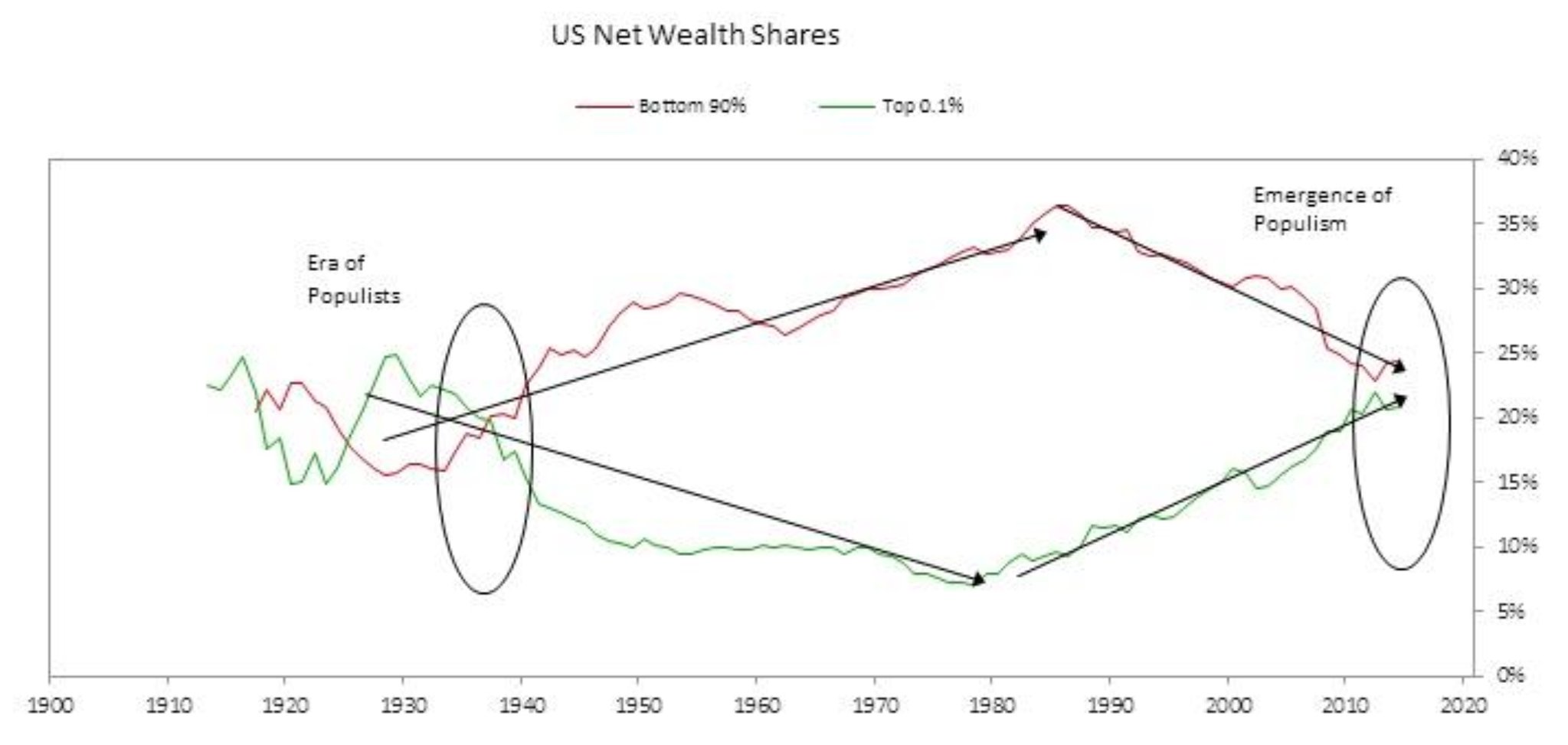

Instead of the Central Bank liquidity going into the real economy, it has fueled a desperate yield chasing, risk extending food fight. In the process, it has exacerbated the growing inequality problem within developed economies’ societies. After all, who owns the majority of financial assets? It’s certainly not the middle and lower class.

We have all seen the various charts that show the increasing inequality, but this one stood out to me.

The rich keep getting richer, while the poor keep getting poorer.

I don’t want this to become a political piece. I am not here to get on my soap box. As traders, we don’t care what should be, but need to be laser focused on what is. And the reality is that this growing inequality affects markets. To ignore it, or get into an argument about proper government policies is imprudent and unproductive. It is what it is.

Central Banks’ reaction to the 2008 Great Financial Crisis worsened this situation, and we need to understand how this might change in the future.

The rise of populism

Regardless of what you think of Trump, there can be no denying that he was elected on a rising populist wave. Too many regular working Americans have been left behind, and they elected Donald on hopes for some real change. Ironically, they elected Obama on a similar frustration, but unfortunately, he was not able to affect the change they hoped.

And just like how Obama was a disappointment, Trump will be an even more bitter pill for the average working class person to swallow.

Trump might mouth words about fighting for the little guy, but he has proven time and time again, he is nothing more than a shill for the big business interests that have encumbered previous administrations.

Trickle down economics is no way to run an economy suffering from a balance sheet recession. Do you really think giving the rich a tax break will cause them to spend? Not a chance. All it will do will raise financial prices even further into the stratosphere.

Now don’t bother arguing with me about the morality of who deserves the tax break. I don’t care. All we care about is what this means for the markets.

Leave A Comment