An interesting thing happened on the way to World Domination, uhh, I mean “Stability” – the data quit cooperating with the Federal Reserve’s carefully devised planned.

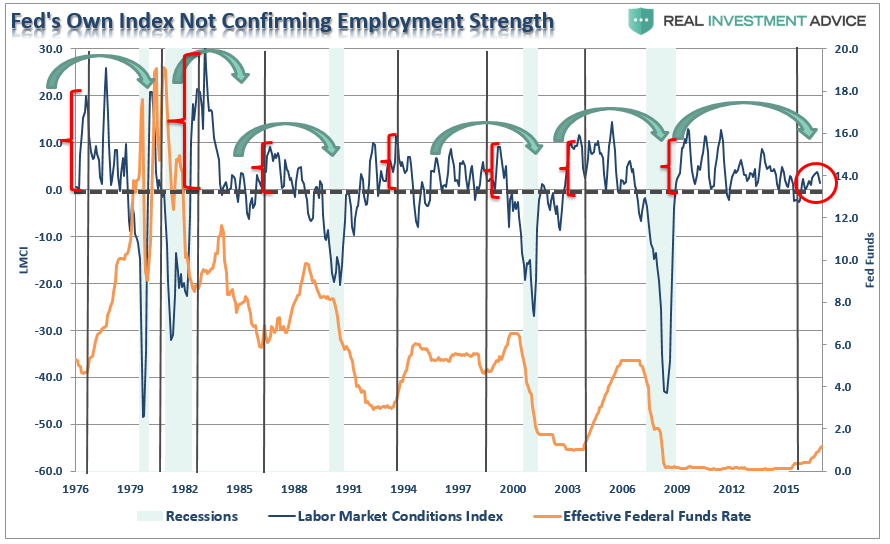

Just recently the Federal Reserve quit updating their carefully constructed “Labor Market Conditions Index” which failed to support their ongoing claims of improving employment conditions. The chart below is the last iteration before it was discontinued which showed a clear deterioration in underlying strength.

But to add insult to injury, inflationary pressures have not resurfaced as anticipated despite years of ultra-low interest rates and a flood of liquidity into the financial system. This has now led the Fed to start considering whether their cornerstone inflation model still works. As Bloomberg noted recently:

“Federal Reserve officials are looking under the hood of their most basic inflation models and starting to ask if something is wrong.

Minutes from the July 25-26 Federal Open Market Committee meeting showed a revealing debate over why the economy isn’t producing more inflation in a time of easy financial conditions, tight labor markets and solid economic growth.

The central bank has missed its 2 percent price goal for most of the past five years. Still, a majority of FOMC participants favor further rate increases. The July minutes showed an intensifying debate over whether that is the right policy response.”

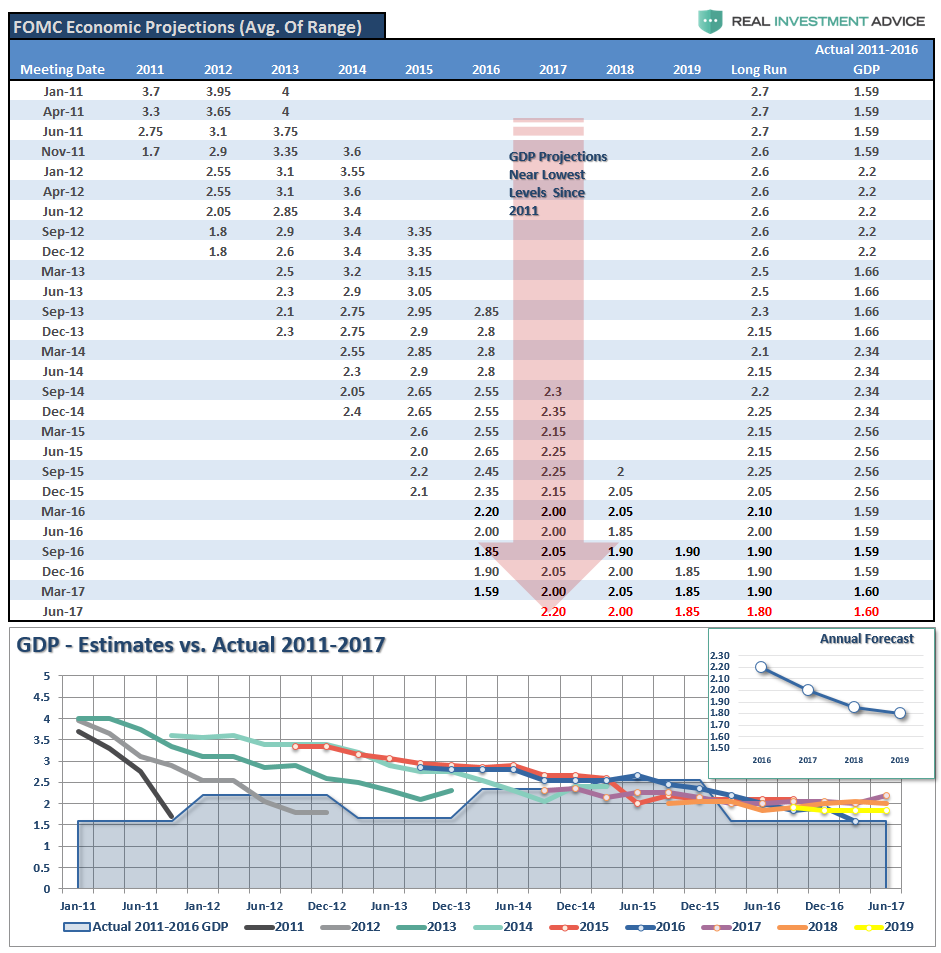

Of course, nowhere is the Fed’s inability to forecast efficiently than in their own published forecast they began producing in 2011 to be more “transparent” with the financial markets. The results have been spectacularly disastrous.

However, despite the clear evidence that economic growth is hardly running at levels that would be considered “strong” by any measure, the Fed has decided the best path forward to continue “tightening” monetary policy. This is ironic considering the ENTIRE PURPOSE of TIGHTENING monetary policy is to SLOW economic growth to keep inflationary pressures at bay.

Leave A Comment