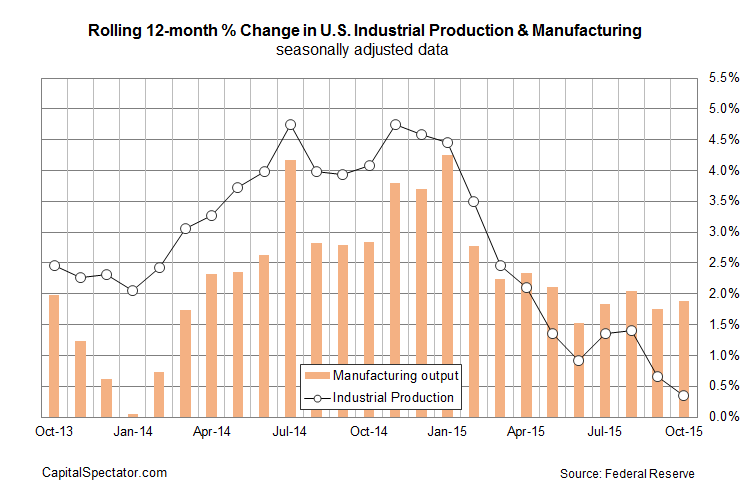

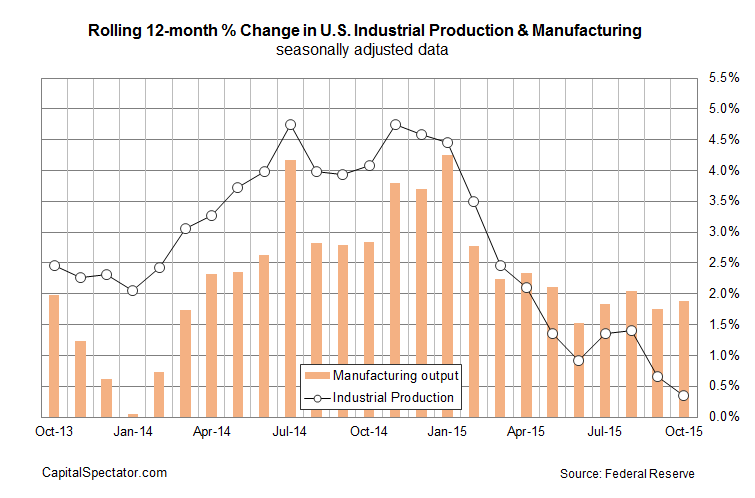

Industrial output continued to contract last month, according to this morning’s report from the Federal Reserve. US production slipped 0.2% in October, dashing expectations for a mild gain via two surveys of economists. The decline leaves the year-over-year trend higher by only 0.3%–the weakest advance in nearly six years.

The bearish trend in industrial output is a weight on the economy but it’s not yet translating into a clear signal of heightened recession risk for the US. The odds are still low that an NBER-defined recession has started for the US, as detailed in the Nov. 15 issue of the US Business Cycle Risk Report.

It’s worth pointing out that while headline industrial activity weakened last month, the manufacturing component strengthened, posting a 0.4% rise in October—the first increase in three months. The firmer data in manufacturing juiced the annual pace a bit, lifting manufacturing output by 1.9% in October vs. the year-earlier level, which is slightly above September’s 1.7% gain.

“It was a warm month nationally,” Brett Ryan, a US economist at Deutsche Bank Securities tells Bloomberg. “There wasn’t as much need to heat homes and that weighs on utility output,” which was a factor in pushing the headline industrial data lower while manufacturing activity perked up.

Nonetheless, the outlook for manufacturing remains mixed at best. Yesterday’s November update of the Empire State Manufacturing Survey was surprisingly weak in the New York Fed region, suggesting that a sustained turnaround for the sector may not be imminent. The virtually flat reading of the ISM Manufacturing Index for October echoes that view.

On the other hand, Markit’s purchasing managers’ index (PMI) for manufacturing supports today’s upbeat manufacturing numbers from the Fed. In contrast with the gloomy data from other sources, the headline PMI reading increased to a six-month high last month. Chris Williamson, chief economist at Markit, earlier this month said:

Leave A Comment