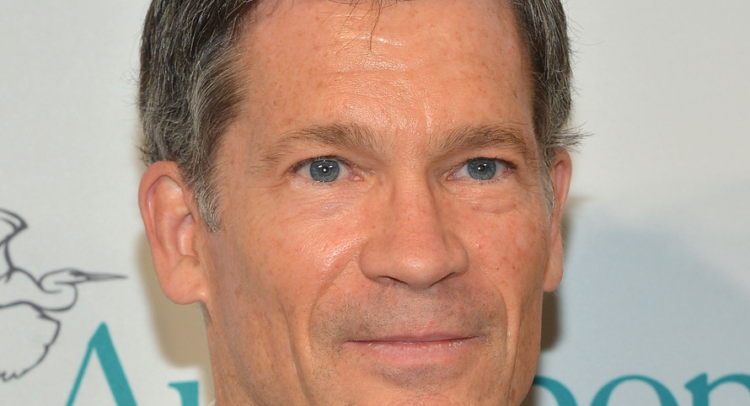

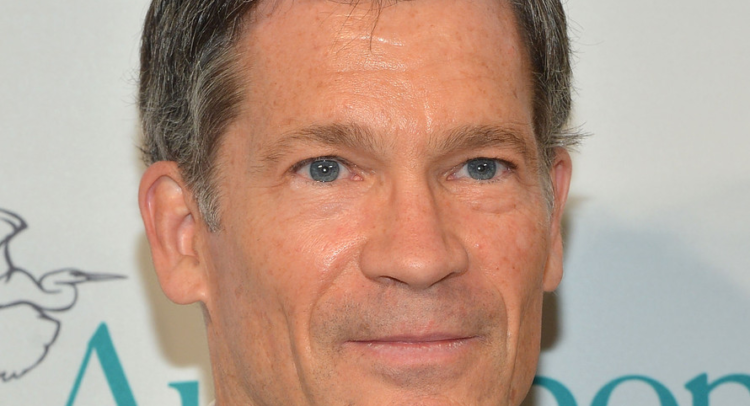

One of the world’s most powerful hedge fund managers, Louis Moore Bacon of the $3.71 billion Moore Capital Management fund, has finally decided to initiate a position in major stocks Apple Inc. (Nasdaq:AAPL) and Amazon.com, Inc. (Nasdaq:AMZN) as well as new tech stock Snap Inc (Nasdaq:SNAP). Despite Bacon’s love of secrecy -he is well known to be one of the Street’s most private billionaires- investors are still keen to track the fund’s movements in the hope of replicating its successful returns.

Moore himself made most of his money from trading- placing him as one of Forbes 400 wealthiest people on the 2017 list. Bacon’s most notable trades relate to his impressive ability of accurately predicting world events. He famously worked with George Soros on finding ways to dump the pound before the 1992 currency crisis and correctly anticipated the 1987 stock market crash. Now he donates his money to American campaigns (Republicans and Democrats) and various environmental charities including the Moore Charity Foundation.

His interest in investing began at an early age- while still studying he met trader Walter N. Frank who encouraged him to start his own trading career. Moore subsequently received an MBA from the prestigious Columbia Business School, and then quickly shot up the trading ranks of Shearman Lehman Brothers to become senior vice president. His success propelled him to launch his own fund, Moore Capital, in 1989- which returned an incredible 85% in its first trading year. As Bacon once famously said, Moore Capital will deal in “anything that trades”. However the fund fared less well during 2000, apparently returning just 2% after he thought that inflation would increase due to the strong US economy.

Bacon has also been the subject of some less-than positive press attention. In 2010, Business Insider reported that the body of his house manager Dan Tuckfield was found in Bacon’s hot tub in the Bahamas. The police concluded that Tuckfield died of natural causes. Currently Bacon is embroiled in a bitter dispute on the island with retail tycoon Peter Nygard that has involved over 16 legal actions and, according to Vanity Fair “allegations of activities that include vandalism, bribery, insider trading, arson, murder, destruction of the fragile seabed, and having a close association with the Ku Klux Klan.”

Leave A Comment