Looking at the most recent CFTC Commitment of Traders report, BofA makes two notable observations ahead of what may be a volatile week between the Fed’s 25bps rate hike announcement on Wednesday, just hours after the Dutch General Election, and on the same day as the US debt ceiling expiration hits.

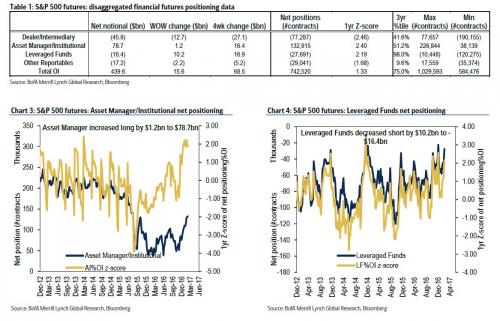

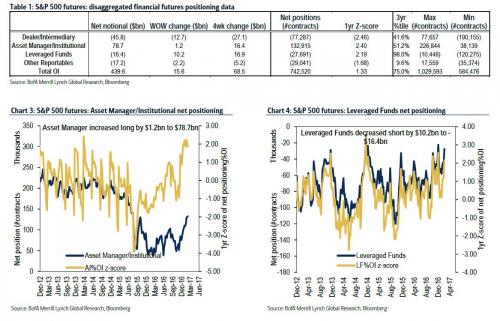

The first is that HFs short covered the most S&P 500 futures contracts in a week since the US election. Specifically, asset managers increased S&P 500 longs by $1.2bn to $78.7bn; bringing the net position to the highest since August 2015. Meanwhile, Leveraged Funds, i.e. hedge funds, decreased short by $10.2bn to -$16.4bn; net position the least short since December 2014.

Additionally, institutions bought $1.2bn S&P 500 and $0.2bn EM futures last week, but sold other equity indices: -$1.1bn NASDAQ 100, -$0.7bn Russell 2000 and -$0.4bn EAFE. HFs bought $10.2bn S&P 500, but sold other equity indices: -$0.9bn Nasdaq 100, -$0.7bn each of Russell 2000 and EM.

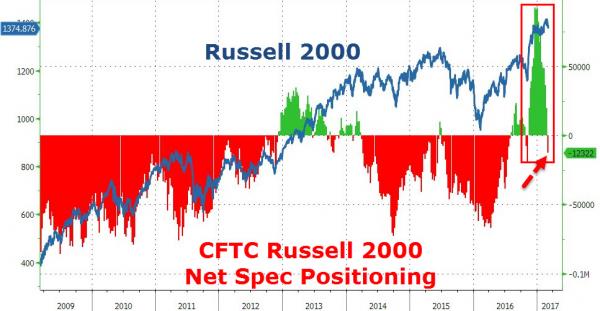

Also of note, as we reported yesterday, despite the exuberant money flow (and short covering) from the FOMO-followers into the broader S&P, not everyone’s buying it as speculators have entirely erased their massive record net long position in the small-cap Russell 2000 index, swinging the net position to its first net short since the election.

* * *

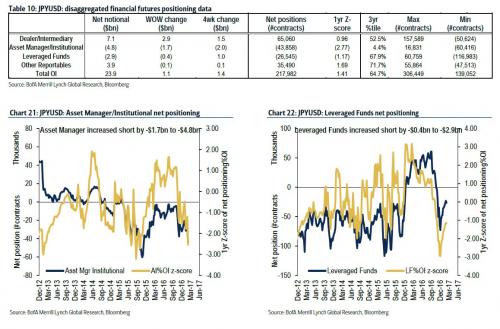

The second notable observation in last week’s CFTC report according to BofA’s Jue Xiong, is that institutions sold the most JPYUSD futures since February 2013. Asset Managers increased their JPY short by -$1.7bn to -$4.8bn; net position near 3-year low (4.4%tile), while leveraged funds increased short by -$0.4bn to -$2.9bn.

* * *

Finally, BofA notes that in light of the recent move wider in credit spreads, Hedge Funds may “get hurt” as they are increasing negatively correlated to the bond risk premium. Short Bias and Managed Futures are the only two strategies that provide positive correlation, i.e. benefit from higher credit spread. Macro strategy also offers better diversification in this aspect. The one-year correlation between diversified HF performance and S&P 500 price return has declined from the three-year and five-year relationship, suggesting that HFs are less relying on market exposure.

Leave A Comment