Image Source: PixabayStocks bounced back in a major way in 2023, a stark reversal from last year’s bear market. The former headwinds that exacerbated last year’s decline steadily evolved into bullish tailwinds. Decelerating inflation, better-than-expected corporate earnings, and falling treasury yields helped propel the S&P 500 back near record highs.Unique catalysts such as the artificial intelligence theme resulted in the more aggressive pockets of the market returning to the forefront. The three sectors responsible for the majority of the annual gains include information technology, communication services, and consumer discretionary. These are the sectors we’d expect to outperform in a bull market; defensive sectors utilities and consumer staples lagged in 2023, as did energy-related stocks.Other sectors that had been underperforming throughout the year (including real estate, industrials, and financials) have also come on strong in the past few months as the market rally broadened out and participation improved.The media-hyped concentration risk at the very top of the cap-weighted index would have us believe that investors are becoming increasingly reliant on a smaller number of companies to lead their portfolios. But only 1 of the top 5 S&P 500 constituents (by index weight) is included in the best 3 performers for 2023.Keep in mind we still have the remainder of this last trading session of the year, so theoretically these could change. But in all likelihood, these stocks will go down as the top 3 winners from the S&P 500 this year.S&P 500 MVP: NvidiaTechnology tends to underperform in bear markets and outperform in bull markets. That was undoubtedly the case between this year and last. Semiconductor stocks were the main beneficiaries of the tech resurgence and AI explosion in 2023, and Nvidia (NVDA) is the top dog of the semi world.Considered most preferred by datacenter operators, Nvidia’s GPUs are likely to help the company grab a larger market space. Companies like Amazon, Microsoft and Alphabet are expanding their global operations, driving demand for NVDA chips. By applying its GPUs in AI models, Nvidia is expanding its base in untapped markets like automotive, healthcare, and manufacturing.Nvidia torched earnings estimates this year, surpassing even the most optimistic projections. A Zacks Rank #2 (Buy) stock, NVDA continues to witness rising estimates as we look ahead to next year. Analysts covering NVDA have increased their full-year EPS estimates by 21.48% in the past 60 days. The Zacks Consensus Estimate now stands at $19.85/share, reflecting a 61.5% potential growth rate versus this year. Revenues are anticipated to climb 53.1% to $90.22 billion.

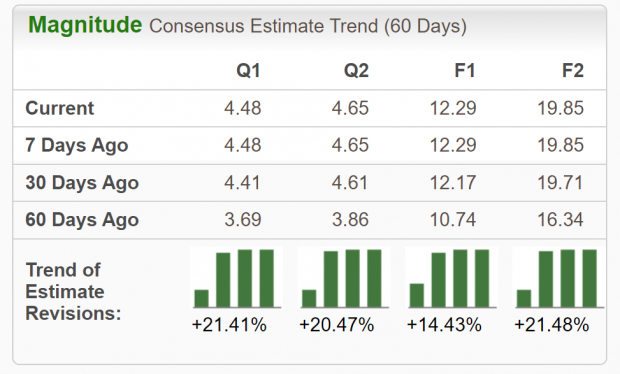

Image Source: PixabayStocks bounced back in a major way in 2023, a stark reversal from last year’s bear market. The former headwinds that exacerbated last year’s decline steadily evolved into bullish tailwinds. Decelerating inflation, better-than-expected corporate earnings, and falling treasury yields helped propel the S&P 500 back near record highs.Unique catalysts such as the artificial intelligence theme resulted in the more aggressive pockets of the market returning to the forefront. The three sectors responsible for the majority of the annual gains include information technology, communication services, and consumer discretionary. These are the sectors we’d expect to outperform in a bull market; defensive sectors utilities and consumer staples lagged in 2023, as did energy-related stocks.Other sectors that had been underperforming throughout the year (including real estate, industrials, and financials) have also come on strong in the past few months as the market rally broadened out and participation improved.The media-hyped concentration risk at the very top of the cap-weighted index would have us believe that investors are becoming increasingly reliant on a smaller number of companies to lead their portfolios. But only 1 of the top 5 S&P 500 constituents (by index weight) is included in the best 3 performers for 2023.Keep in mind we still have the remainder of this last trading session of the year, so theoretically these could change. But in all likelihood, these stocks will go down as the top 3 winners from the S&P 500 this year.S&P 500 MVP: NvidiaTechnology tends to underperform in bear markets and outperform in bull markets. That was undoubtedly the case between this year and last. Semiconductor stocks were the main beneficiaries of the tech resurgence and AI explosion in 2023, and Nvidia (NVDA) is the top dog of the semi world.Considered most preferred by datacenter operators, Nvidia’s GPUs are likely to help the company grab a larger market space. Companies like Amazon, Microsoft and Alphabet are expanding their global operations, driving demand for NVDA chips. By applying its GPUs in AI models, Nvidia is expanding its base in untapped markets like automotive, healthcare, and manufacturing.Nvidia torched earnings estimates this year, surpassing even the most optimistic projections. A Zacks Rank #2 (Buy) stock, NVDA continues to witness rising estimates as we look ahead to next year. Analysts covering NVDA have increased their full-year EPS estimates by 21.48% in the past 60 days. The Zacks Consensus Estimate now stands at $19.85/share, reflecting a 61.5% potential growth rate versus this year. Revenues are anticipated to climb 53.1% to $90.22 billion.  Image Source: Zacks Investment ResearchThese are phenomenal growth rates for a company of this size, and it’s no wonder NVDA rewarded investors this year with an astounding 236% return.

Image Source: Zacks Investment ResearchThese are phenomenal growth rates for a company of this size, and it’s no wonder NVDA rewarded investors this year with an astounding 236% return. Image Source: StockChartsS&P 500 Silver: Meta PlatformsLate last year, talks of the Facebook-parent’s diminished role were prevalent amid a costly Reality Labs division that was bleeding money. And while Zuckerberg’s metaverse vision has yet to materialize, increased engagement across popular apps like Instagram, Facebook, WhatsApp, and Messenger have been a major growth driver for the company.Meta Platforms (META) is leveraging AI to recommend Reels content, leading to increased traffic and advertising revenues. The latest data showed that plays from Reels now exceed 200 billion per day across Facebook and Instagram. Meta is using AI to endorse roughly 40% of the content that users see in Instagram.Considered to be the pioneer of social networking, Meta exceeded earnings estimates in each quarter this year. A Zacks Rank #2 (Buy) stock, META has delivered a trailing four-quarter average earnings surprise of 27.5%. Earnings estimates for next year are on the rise, with current expectations showing 22.7% EPS growth to $17.57/share on 13.4% higher revenues ($151.37 billion).META stock clocks in at second place, providing investors with a remarkable 193% annual return.

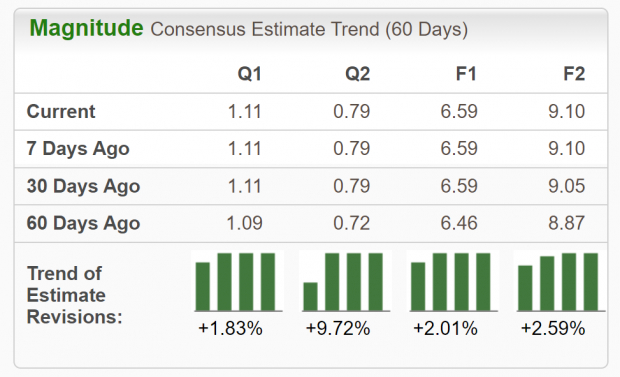

Image Source: StockChartsS&P 500 Silver: Meta PlatformsLate last year, talks of the Facebook-parent’s diminished role were prevalent amid a costly Reality Labs division that was bleeding money. And while Zuckerberg’s metaverse vision has yet to materialize, increased engagement across popular apps like Instagram, Facebook, WhatsApp, and Messenger have been a major growth driver for the company.Meta Platforms (META) is leveraging AI to recommend Reels content, leading to increased traffic and advertising revenues. The latest data showed that plays from Reels now exceed 200 billion per day across Facebook and Instagram. Meta is using AI to endorse roughly 40% of the content that users see in Instagram.Considered to be the pioneer of social networking, Meta exceeded earnings estimates in each quarter this year. A Zacks Rank #2 (Buy) stock, META has delivered a trailing four-quarter average earnings surprise of 27.5%. Earnings estimates for next year are on the rise, with current expectations showing 22.7% EPS growth to $17.57/share on 13.4% higher revenues ($151.37 billion).META stock clocks in at second place, providing investors with a remarkable 193% annual return. Image Source: StockChartsS&P 500 Bronze: Royal Caribbean CruisesRounding out the top 3 leading S&P 500 stocks this year is none other than cruise liner Royal Caribbean Cruises (RCL). The company has benefitted from solid demand for cruising and an acceleration in booking volumes. A full fleet resumption and an emphasis on higher pricing bode well for RCL heading into 2024.Royal Caribbean intends to focus on new advanced ships and onboard experiences to boost its offerings. Technological innovations such as revamped websites and new vacation packaging capabilities have boosted pre-cruise purchases and consumer onboard spending. New cruise experiences are helping Royal Caribbean differentiate its product offering and deliver superior yields and margins.Looking ahead, EPS estimates for 2024 are on the rise, with analysts bumping up expectations by 2.59% in the past 60 days. The Zacks Consensus Estimate stands at $9.10/share, translating to a very respectable 38.1% growth rate compared to this year. Revenues are projected to climb 13.7% to $15.86 billion.

Image Source: StockChartsS&P 500 Bronze: Royal Caribbean CruisesRounding out the top 3 leading S&P 500 stocks this year is none other than cruise liner Royal Caribbean Cruises (RCL). The company has benefitted from solid demand for cruising and an acceleration in booking volumes. A full fleet resumption and an emphasis on higher pricing bode well for RCL heading into 2024.Royal Caribbean intends to focus on new advanced ships and onboard experiences to boost its offerings. Technological innovations such as revamped websites and new vacation packaging capabilities have boosted pre-cruise purchases and consumer onboard spending. New cruise experiences are helping Royal Caribbean differentiate its product offering and deliver superior yields and margins.Looking ahead, EPS estimates for 2024 are on the rise, with analysts bumping up expectations by 2.59% in the past 60 days. The Zacks Consensus Estimate stands at $9.10/share, translating to a very respectable 38.1% growth rate compared to this year. Revenues are projected to climb 13.7% to $15.86 billion. Image Source: Zacks Investment ResearchRCL shares are ranked favorably by our Zacks Style Scores, with a top ‘A’ mark in our Growth category. This indicates that RCL is likely to move higher based on favorable earnings and sales growth metrics. The stock has risen more than 162% this year and is a Zacks Rank #2 (Buy).

Image Source: Zacks Investment ResearchRCL shares are ranked favorably by our Zacks Style Scores, with a top ‘A’ mark in our Growth category. This indicates that RCL is likely to move higher based on favorable earnings and sales growth metrics. The stock has risen more than 162% this year and is a Zacks Rank #2 (Buy). Image Source: StockChartsFinal ThoughtsWhile technology companies led the way in 2023, other sectors such as consumer discretionary also played a large part in the S&P 500’s annual performance. The bulls are hoping that this banner year will be followed by more strength ahead in 2024.The end of the year is a great time to take a step back and analyze what we did right, and more importantly, what we could have done better. Studying the top performers is a great way to prepare for the following year.From all of us here at Zacks, we wish you a Happy New Year. Cheers to making 2024 your most successful investing year yet!More By This Author:3 Great Utility Stocks To Buy For A Steady Stream Of Income 3 Tech Stocks Suited Nicely For Income Investors 2 Energy Stocks To Buy With Robust Bottom Lines Going Into 2024

Image Source: StockChartsFinal ThoughtsWhile technology companies led the way in 2023, other sectors such as consumer discretionary also played a large part in the S&P 500’s annual performance. The bulls are hoping that this banner year will be followed by more strength ahead in 2024.The end of the year is a great time to take a step back and analyze what we did right, and more importantly, what we could have done better. Studying the top performers is a great way to prepare for the following year.From all of us here at Zacks, we wish you a Happy New Year. Cheers to making 2024 your most successful investing year yet!More By This Author:3 Great Utility Stocks To Buy For A Steady Stream Of Income 3 Tech Stocks Suited Nicely For Income Investors 2 Energy Stocks To Buy With Robust Bottom Lines Going Into 2024

Leave A Comment