You can say this for the swamp creatures: Their gall knows no limits.

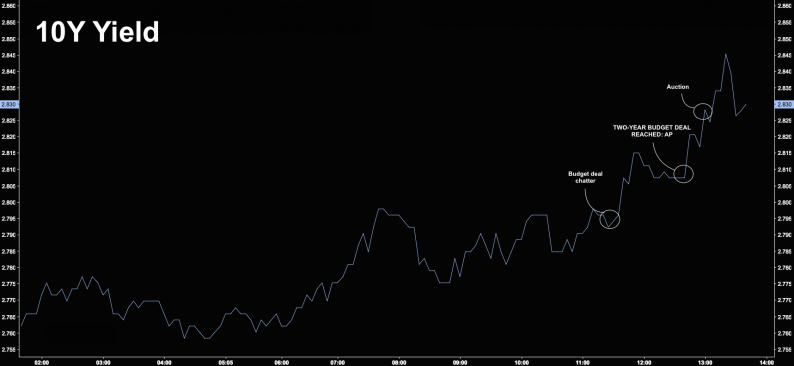

Apparently, the two government lifers running the US Senate—-Mitch McConnell and Chuck Schumer (hereafter “Mitchels & Chuckles”)—-have reached a deal to bust the already red-ink soaked budget by $400 billion over the next two years and by upwards of $3.5 trillion over a decade. Consequently, bond yields have continued their upward march.

The above yield surge is surely not surprising, but here’s the galling part. Mitchels & Chuckles christened their baleful deal: “The Government Shutdown Prevention Act”.

That’s right. The taxpayers and future generations be damned. Apparently, it doesn’t matter how many small businesses, farmers and entrepreneurs get elbowed out of the capital markets by Uncle Sam’s $1 trillion per year borrowing spree: Mitchels & Chuckles intend to keep the Washington Monument open and the Imperial City’s 3.7 million employees paid in full come hell or high water.

This is just another way of saying that the swamp creatures have become so inured to big deficit numbers that they have literally gone berserk on the borrowing front. For instance, before they passed their utterly asinine tax bill, the GOP was told by CBO that the baseline deficit over the next decade was $10 trillion, meaning that the already baked-in-the-cake public debt would reach $30 trillion by 2027.

No matter. They passed a temporary tax cut for individuals and a permanent $1.4 trillion inducement for more stock buybacks, dividends, M&A deals and other corporate engineering ploys as a Christmas Eve present to the K-street lobbies.

Soon thereafter, of course, the CBO was out with an update. They computed that the post-tax bill baseline deficit would now cumulate to nearly $12 trillion over the decade.

That produced no alarm bells, either. As shown below, the most recent handiwork of Mitchels & Chuckles will balloon the 10-year deficit to $15 trillion and thereby guarantee that the public debt will top $35 trillion by 2027—-a level that we estimate would amount to about 135% of GDP.

Yes, that’s the fiscal math from piling on top of the massive deficits that were already there nearly$150 billion annually from busting the sequester caps on appropriated defense and domestic spending (see below); $90 billion for disaster aid that is not offset with cuts elsewhere; $20 billion for infrastructure and $6 billion to fight another “crisis” (the opioid one); funding for the $2.5 trillion per year entitlement sector on an automatic pilot basis; and straining out the rest of the Kentucky windage embedded in the CBO baseline. That is, “expiring” tax breaks that always get “extended” at the last minute and future year spending “cuts” that always get deferred before they happen.

In short, our friends at the Committee for a Responsible Budget (CFRB) calculate that Mitchels & Chuckles have now outdone even Barry’s bottom of the recession eruption of red ink. Their plan will have Washington on track to hit a $2.1 trillion annual deficit by 2027.

But here’s the thing. The CFRB projection below is based on Rosy Scenario!

To wit, it assumes that the US goes 219 months (thru FY 2027) without a recession. That’s nearly double the longest one in history during the far more propitious circumstances of the 1990s; it’s 3.6X the average post-1950 recovery (61 months); and its just plain nuts when you look at the storm clouds gathering everywhere—-not the least of which is rapidly rising bond yields that have now nearly touched 2.90% on the benchmark 10-year treasury note.

The chart below, therefore, should be enough to scare the living bejesus out of the denizens who function on both ends of the Acela Corridor. We will get back to the beltway pols in a moment, but it is important to note that the drastic, sustained falsification of interest rates and financial assets prices by the Fed and other central banks has basically destroyed the signaling system that used to keep both Washington and Wall Street reasonably honest.

Leave A Comment