If the US consumers and attendant “demand” had been relatively weak entering 2015 producing even at that point questionable conditions that are now admitted as a manufacturing recession, it is increasingly clear that “something” changed around the middle of the year. Obviously, market turmoil that had been largely focused overseas suddenly swung internally to capture US markets once though invulnerable, but even in the economic accounts the mid-year inflection stands out – industrial production being perhaps the most important indication (so far).

Whether or not this leads the NBER to consider a recession dating is beside the point right now; what is relevant is what IP renders in especially the wider historical context about past recession and how that relates to our current circumstances. It suggests, with very little room for argument, that the US economy is already in truly dire condition and increasingly so at the same time as market indications suggest and price the very same.

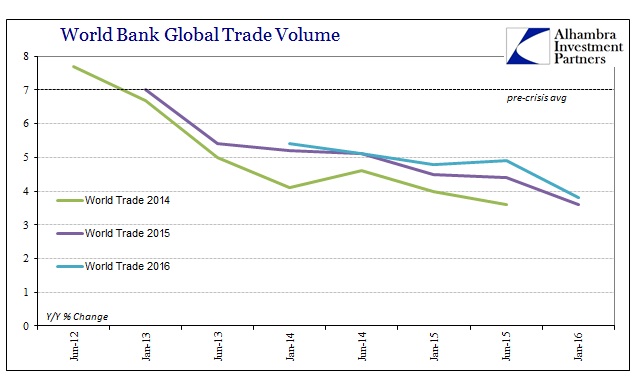

After it has become clear about these kinds of dangers, now the economists are adding their lagging analysis. The World Bank, as per usual, reduced its growth estimates in January for everything from global GDP to US GDP to world trade. In January 2013, with all the secondary “stimulus” (QE3 & 4 in the US, Mario Draghi’s promise and what would be the last of China’s bubble-ism) still rather fresh in the economic models, the World Bank predicted global trade would expand by a healthy 6.7% in 2014 and then 7.0% in 2015. While 2014 never lived up to those expectations, finishing at 3.6%, last year’s final estimate did not either also estimated 3.6%. These are contractionary numbers not appreciably different than the trade levels of 2012 and 2013, nor 2008.

Most concerning was the scale of the downgrade from the World Bank’s last estimates in June. Since mid-year, the expectation for trade growth (2015) fell from 4.4% to again 3.6% as of January; 2016 trade estimates were slashed from 4.9% at mid-year to now just 3.8% and already back within the same challenging range as all prior years. This is a major problem but as far as the World Bank is concerned (despite the stark changes in behavior) it is largely limited to EM’s or “developing” economies.

Leave A Comment