Sherwin-Williams (SHW) is the leader in the North American coatings (paint) industry. The company is the 3rd largest coatings corporation globally.

Source: Source: Sherwin-Williams Credit Suisse Presentation, slide 5

The company is not an overnight success. Sherwin-Williams was founded in 1866.

Sherwin-Williams’ management has a long history of rewarding shareholders with rising dividend payments. The company has paid increasing dividends for 37 consecutive years. This makes Sherwin-Williams 1 of only 50 Dividend Aristocrats.

The company’s stock currently has a 1.2% dividend yield. Despite its long corporate history Sherwin-Williams is still in growth mode.

This growth is reflected in the rise of Sherwin-Williams stock price over the last several years:

Source: Finviz

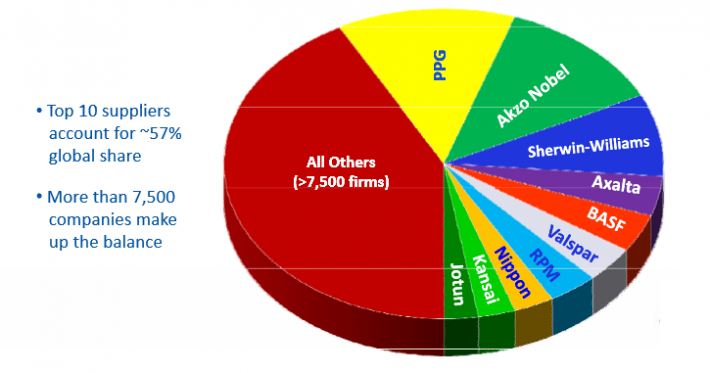

The company is realizing growth by consolidating the fragmented coatings industry.

Sherwin-Williams took a big step forward in consolidating the industry with its latest announcement…

Sherwin-Williams is Acquiring Valspar

Sherwin-Williams announced it will acquire Valspar (VAL) on March 20th. Sherwin-Williams will acquire Valspar for $11.3 billion (including Valspar’s debt).

The image below compares the size (using enterprise value) of Valspar and Sherwin-Williams. Enterprise value for both businesses is post acquisition announcement. This shows the impact the acquisition will have on Sherwin-Williams’ business.

The acquisition of Valspar by Sherwin-Williams is more than a small ‘bolt on’ deal. The acquisition will significantly bolster Sherwin-Williams international operations and boost the company to become the largest coatings business in the world.

Valspar Overview

Valspar had a market cap of ~$5.3 billion before the acquisition. Valspar has a long history of dividend increases (like Sherwin-Williams). The company has increased its dividend payments every year since 1992.

Leave A Comment