A few weeks ago, the IMF said something that, although it should have been obvious, seemed to surprise quite a few people. Here’s the quote from a recently released study:

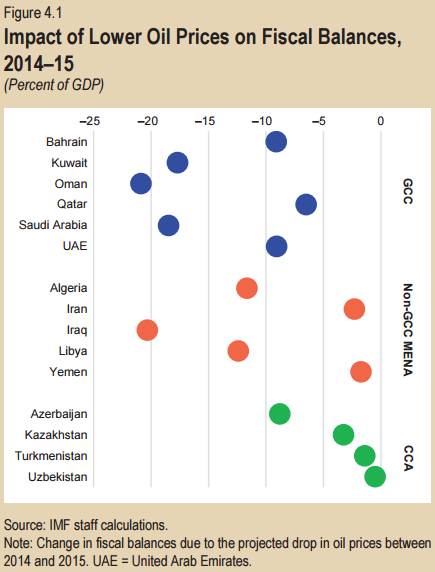

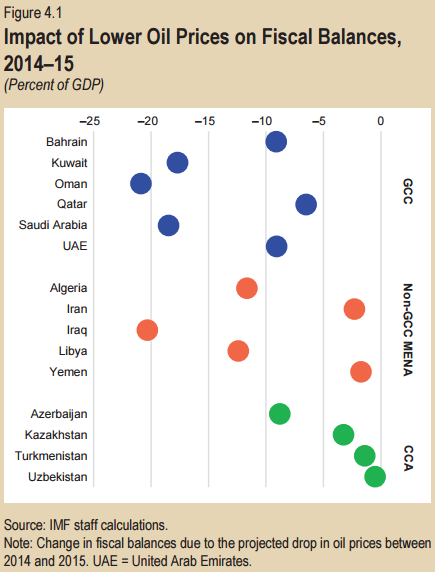

Bahrain, Oman, and Saudi Arabia have medium-term fiscal gaps of some 15–25 percentage points of non-oil GDP, while conflict-torn Libya has a gap of more than 50 percent of non-oil GDP.

In, contrast, CCA oil exporters have at least 15 years’ worth of available financial savings,1 while GCC countries are split evenly between countries with relatively large buffers (Kuwait, Qatar, and the United Arab Emirates—more than 20 years remaining) and countries with relatively smaller buffers (Bahrain, Oman, and Saudi Arabia—less than five years).

In other words, the Saudis, Oman, and Bahrain are going to go broke in “less than five years” if something doesn’t give in terms of either oil prices, budgeting, or both.

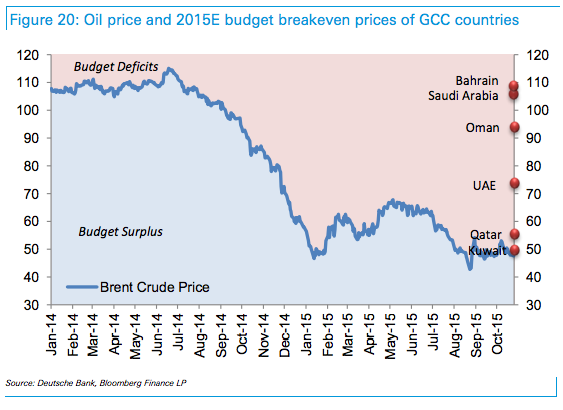

Because this represents nothing short of a seismic shift in the way we think about ME crude exporters, and because it’s helpful to know just where producers need prices to go in order to avoiding racking up double-digit budget deficits, we present the following visual from Deutsche Bank which depicts break-even prices and also summarizes where the various Mid-East producers stand (fiscally speaking) in the wake of crude’s remarkable decline:

As you can see, there’s a long way to go for the Saudis and the UAE to get back into the black and indeed,even Qatar is now set to post red ink.

We’re sure invading Syria would help. After all, things have gone so well in Yemen…

Leave A Comment