Tax cuts and hope for accelerating economic growth, inflation and interest rates in 2018, have rendered an even wider than usual consensus that treasury prices can only go down from here.

January did see a further sell-off in government bonds and gap higher in yields. And this did increase the cost of borrowing for consumers, business and governments alike, and there in lies a rub. With the world more indebted than ever before, and much worse than in 2008, rising rates crimp already tight cash flows.

It’s also the reason that bond prices typically fall first at the top of each credit cycle as monetary conditions tighten, and are then soon followed by deflating stock and commodity prices. (See The valuation cycle strikes back for more).

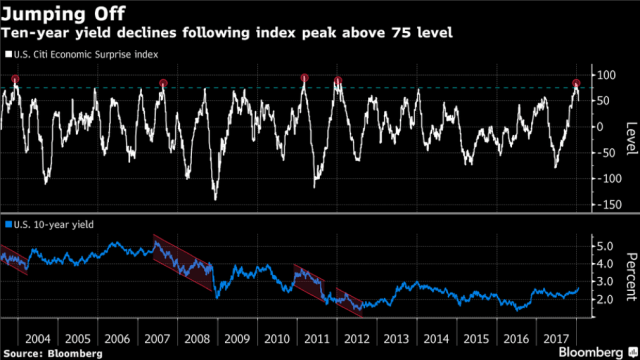

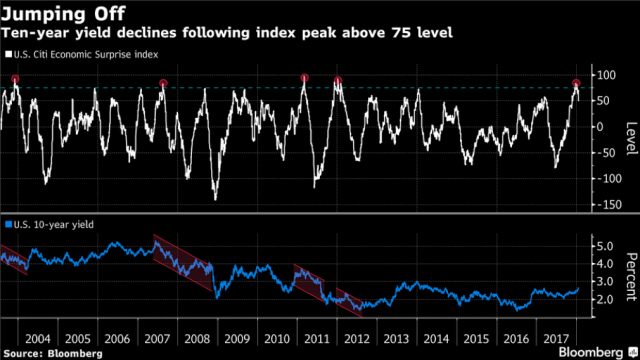

When credit cannot get any looser, employment, income and ‘upside surprise’ any better, then spending retreats, the economy weakens, everyone looks to central banks for more slack and ‘safe-haven’ treasuries are bid once more. The below chart of the US economic surprise index (in white) and the US 10 year Treasury yield (in blue) since 2003, shows the pattern.When the upside surprise index tops 75, good news has been over-priced and disappointment and falling treasury yields are due.See: Markets are about to get ugly according to these charts.

December was only the fifth time since 2003 the economic-surprise index peaked above 75. From each peak to the corresponding trough, 10-year yields on average dropped 1.11 percentage points over the next seven months, according to data compiled by Canaccord. Bonds have yet to respond to recent disappointing data, as the 10-year approaches the 2.66 percent high watermark set in 2014.

If disappointing economic activity now prompts central banks to hike rates less than they have planned (hoped), and 10-year treasury yields begin to fall (bond prices rise) over the next several months, then, as charted below by my partner Cory Venable, we may also be at the end of the equity market expansion cycle as in 2000 and 2007. Then as now, of course, hardly anyone is prepared for that.

Leave A Comment