High dividend stocks appeal to many investors because their high yields provide generous income.

Many of the highest paying dividend stocks offer a high yield in excess of 4%, and some even yield 10% or more.

However, not all high yield dividend stocks are safe. Let’s review what high dividend stocks are, where stocks with high dividends can be found in the market, and how to identify which high dividends are risky.

At the end of the article, we will take a look at 33 of the best high dividend stocks, providing analysis on each company. Almost all of these high yield stocks offer a dividend yield greater than 4%, have increased their dividends for at least five consecutive years, and maintain healthy Dividend Safety Scores.

The market’s strength has reduced the number of safe dividend stocks with high yields, but there are still several dozen worth reviewing.

What are High Dividend Stocks?

I generally classify any stock with a dividend yield in excess of 4% as being a “high dividend stock.”

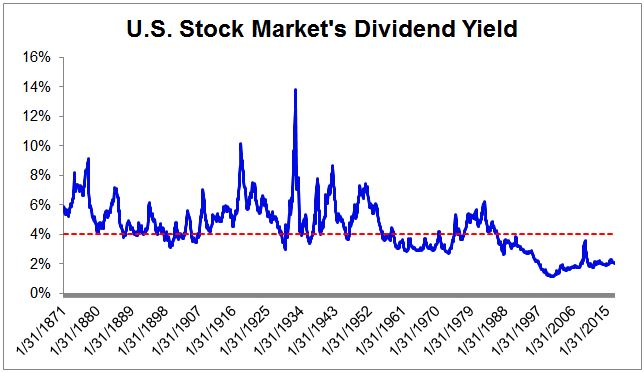

Why 4%? Well, the chart below shows the U.S. stock market’s dividend yield since 1871.

You can see that the stock market’s dividend yield has remained well below 4% for most of the last 25 years.

In today’s era of record-low interest rates, a 4% dividend yield is relatively high. In fact, it is about twice as high as the market’s dividend yield today.

Source: Simply Safe Dividends

A 4% dividend yield is also a sensible cutoff to use for investors who are funding their retirements primarily with dividend stocks rather than the traditional 4% withdrawal rule.

Regardless, why do some dividend-paying stocks offer much higher yields than others?

As you might have guessed, there are many different possible answers.

In some cases, a high yield reflects a company’s mature status. Since the business has relatively few profitable growth investments it can pursue, it returns most of its cash flow to shareholders in the form of dividends.

Utilities and telecom companies would be good examples.

Other high dividend stocks have unique business structures that require them to distribute most of their cash flow to investors for tax purposes.

Some stocks with high dividends are able to offer generous payouts because they use financial leverage to magnify their profits.

And then there are high yield stocks that have landed on hard times. Unfavorable business conditions have reduced their cash flow to the point where investors no longer believe their dividends are sustainable.

In these instances, the high yield is a mirage.

Let’s take a closer look at where yield-hungry investors can hunt for high dividend stocks.

Where to Find High Yield Stocks

Many different types of high dividend stocks exist in the market, and each type possesses unique benefits and risks.

Here are some of the best places to find higher-yielding dividend stocks:

Master Limited Partnerships (MLPs): MLPs were created by the government in the 1980s to encourage investment in certain capital-intensive industries. Most MLPs operate in the energy sector and own expensive, long-lived assets such as pipelines, terminals, and storage tanks. Many of these assets help move different types of energy and fuel from one location to another for oil & gas companies.

MLPs can pay high dividends because they do not pay any income taxes (you pay taxes on your share of the MLP’s income instead), pay out almost all of their cash flow in the form of cash distributions (the MLP equivalent of corporate dividends), and generate fairly predictable earnings in many cases.

Real Estate Investment Trusts (REITs): REITs were created in the 1960s as a tax-efficient way to help America fund the growth of its real estate. Like MLPs, REITs are pass-through entities that pay no federal income tax as long as they pay out at least 90% of their taxable income as dividends.

There are over a dozen different types of REITs (e.g. apartments, offices, hotels, nursing homes, storage, etc.), and they make money by leasing out their properties to tenants. Their high payout ratios and generally stable rent cash flow make them a very popular group of higher dividend stocks.

Business Development Companies (BDCs): BDCs were created in 1980 and are regulated investment companies. They are basically closed-end investment funds that are structured similarly to a REIT, meaning they avoid paying corporate taxes if they distribute at least 90% of their taxable income in the form of dividends.

There are many different types of BDCs, but they ultimately exist to raise funds from investors and provide loans to middle market companies, which are smaller businesses with generally non-investment grade credit. Roughly 200,000 of these businesses exist, and large banks are less likely to lend them growth capital, which is why BDCs are needed.

Closed-end Funds (CEFs): closed-end funds are a rather complex type of mutual fund whose shares are traded on a stock exchange. Its assets are actively managed by the fund’s portfolio managers and may be invested in stocks, bonds, and other securities. The majority of CEFs use leverage to increase the amount of income they generate, and CEFs often trade at premiums or discounts to their net asset value, depending largely on investor sentiment.

Monthly Dividend Stocks: monthly dividend stocks are popular holdings in retirement portfolios because of their convenient payout schedules, which make budgeting easier. There are hundreds of monthly dividend stocks, but most of them are closed-end funds or REITs, which offer high yields in most cases.

YieldCos: a relatively new class of high dividend stocks, YieldCos are pass-through entitles that purchase and operate completed renewable power plants (e.g. wind, solar, hydroelectric power), selling the clean energy they generate to utility companies under long-term, fixed-fee power purchase agreements.

Warren Buffett’s High Dividend Portfolio: the majority of publicly-traded stocks held by Warren Buffett’s Berkshire Hathaway pay dividends, and several of them offer high yields that are appealing for retirement portfolios. Each of Buffett’s dividend stocks is analyzed in the link above, starting with his highest-yielding positions.

Bill Gates’ High Dividend Portfolio: similar to Warren Buffett, Bill Gates’ investment manager holds mostly dividend-paying stocks. Each of Gates’ dividend stocks is analyzed in the link above, starting with his highest-yielding positions.

Exchange-traded funds (ETFs): thousands of ETFs exist in the stock market today, and some of them pay high dividends. You can learn about my 10 favorite ETFs for high dividend income in the link above.

Utilities & Telecoms: utility and telecom companies are generally mature businesses with low growth rates. As a result, many of them return the majority of their cash flow to shareholders in the form of dividends, resulting in attractive yields.

The Highest Dividend Stocks Can Be Risky

After reading through the different lists above, you might have noticed that most high dividend stocks are not your basic blue chip corporations like Coca-Cola (KO) and Johnson & Johnson (JNJ).

Instead, many of them have unique business structures and risks to consider.

Take REITs and MLPs, for example. Since these high yield stocks distribute almost all of their cash flow to investors to maintain their favorable tax treatments, they must constantly raise external capital (i.e. debt and equity) to grow.

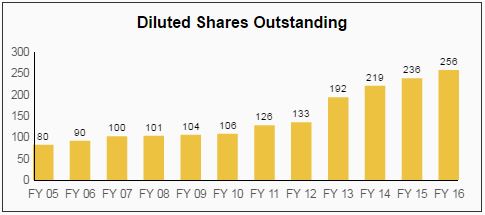

Realty Income (O), one of the best monthly dividend stocks, has more than tripled its shares outstanding since 2005, for example:

Source: Simply Safe Dividends

On the other hand, a business like Johnson & Johnson can use the free cash flow it generates to pay dividends while still retaining plenty of funds to reinvest in new projects, growing earnings and dividends along the way (without needing to issue equity or new debt).

Since REITs and MLPs need to issue debt and sell additional shares to raise the money they need to keep growing their capital-intensive businesses (buying real estate and constructing pipelines isn’t cheap), they face additional risks compared to basic corporations.

If access to capital markets becomes restricted or more expensive (e.g. rising interest rates; a slumping share price), such as what happened during the financial crisis, these types of high dividend stocks can suddenly be very vulnerable.

Kinder Morgan (KMI), the largest pipeline operator in the country, is perhaps the most notorious example in recent years.

The company slashed its dividend by 75% in late 2015 as outside financing became too costly, forcing the company to pick between investing for growth and maintaining its dividend.

Ferrellgas Partners (FGP), a major retail distributor of propane, is another example of the risks certain high dividend stocks can pose.

While the MLP had been in business for more than 75 years and paid uninterrupted dividends since 1994, it stunned investors by slashing its distribution by more than 80%.

Ferrellgas Partners took on too much debt to diversify its business in recent years, and mild winter temperatures drove down propane sales, causing a cash crunch.

Simply put, high payout ratios and high financial leverage elevate the risk profile of many high dividend stocks.

A seemingly stable company can become dangerous in a hurry if unexpected hiccups surface.

In addition to their dependence on healthy capital markets, certain high dividend stocks such as REITs and MLPs also face regulatory risks.

For example, if Congress decided to change the tax treatment for MLPs, those businesses might not be able to avoid double taxation.

BDCs and CEFs contain their own unique risks, too. By employing meaningful amounts of financial leverage to boost income, any mistakes made by these high dividend stocks will be magnified, potentially jeopardizing their payouts.

If something appears too good to be true, it often is (eventually). Not surprisingly, many of the highest paying dividend stocks can also be value traps.

GameStop (GME) is one example. The company has been in business since 1994 and operates thousands of retail stores that primarily sell new and used video game hardware and accessories.

GameStop is a basic corporation, not a REIT or MLP, but its stock still yields more than 6%. However, the company appears to be more of a value trap than a high yield bargain.

GameStop’s same store sales declined by 11% in 2016, and the company’s profitability is steadily deteriorating.

Management has taken on increasing amounts of debt in an effort to diversify the company into more attractive markets, but the clock is ticking on its turnaround.

If results aren’t delivered over the coming years, the dividend will likely be at risk, and the value of the overall company (and your stock) could be significantly diminished.

At the end of the day, high yield investors need to do their homework and make sure they understand the unique risks of each high dividend stock they are considering – especially the financial leverage element.

Maintaining a well-diversified dividend portfolio is an essential risk management practice. Before piling into REITs, for example, consider that the Real Estate sector only accounts for roughly 3% of the S&P 500’s total value.

There are some very good REITs out there, but most things are better in moderation. You just never know what could happen, especially as we potentially begin exiting this period of record-low interest rates.

Safe High Dividend Stocks: What to Look For

While the risks of owning certain high yield dividend stocks are hopefully clear, there are a number of steps investors can take to pick out the safest ones.

First, it goes without saying that you should never buy any investment that you don’t understand.

Warren Buffett refers to this concept as staying within one’s circle of competence, and it’s one of his best pieces of investment advice.

Many high yield stocks are unfortunately just too complicated for me to own them in my dividend portfolio.

Once you have identified a stock that you understand fairly well, you need to evaluate its riskiness.

Some of the biggest risk factors to be aware of for a stock are: (1) the industry it operates in; (2) the amount of operating leverage in its business model; (3) the amount of financial leverage on the balance sheet; (4) the size of the company; and (5) the current valuation multiple.

I wrote an article that explores the five safety tips above in greater detail, and you can check it out here.

Collecting the information needed to gauge how risky a high yield dividend stock is can be a time-consuming process.

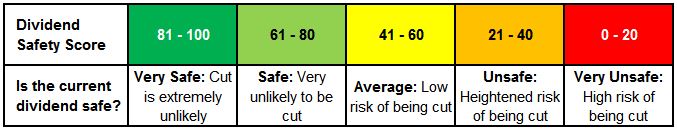

That’s one reason why we created Dividend Safety Scores, which scrub through a company’s financial statements to evaluate the safety of its dividend payment.

Dividend Safety Scores can serve as a good starting to point in the research process to steer clear of high yield traps.

Investors can learn more about how Dividend Safety Scores work and view their real-time track record here.

We used our Dividend Safety Scores to help identify over 30 high dividend stocks that are reviewed in detail below.

Top High Dividend Stocks Analyzed

In this list, we analyzed 34 of the highest paying dividend stocks in the market.

Almost all of these companies offer a high dividend yield close to 4% or higher, have increased their dividends for at least five consecutive years, and score average or better for Dividend Safety.

The list is sorted by dividend yield from low to high, and our analysis is updated monthly.

You will notice that each high dividend stock has a Dividend Safety Score and Dividend Growth Score. We analyze 25+ years of dividend data and 10+ years of fundamental data to understand the safety and growth prospects of a dividend.

Our Dividend Safety Score answers the question, “Is the current dividend payment safe?” We look at some of the most important financial factors such as current and historical EPS and FCF payout ratios, debt levels, free cash flow generation, industry cyclicality, ROIC trends, and more.

Dividend Safety Scores range from 0 to 100, and conservative dividend investors should stick with firms that score at least 60. Since tracking the data, companies cutting their dividends had an average Dividend Safety Score below 20 at the time of their dividend reduction announcements.

Our Dividend Growth Score answers the question, “How fast is the dividend likely to grow?” It considers many of the same fundamental factors as the Safety Score but places more weight on growth-centric metrics like sales and earnings growth and payout ratios. Scores of 50 are average, 75 or higher is very fast, and 25 or lower is very slow.

Here are 33 of the most interesting high dividend stocks as of 2/9/18:

33) General Mills (GIS)

Dividend Yield: 3.6% Forward P/E Ratio: 17.0(as of 2/9/18)

Dividend Safety Score: 85 Dividend Growth Score: 45

Sector: Consumer Staples Industry: Food Processing

Dividend Growth Streak: 14 years

General Mills maintains a diversified sales mix of packaged meals, cereal, snacks, baking products, yogurt, and more. The company’s key brands include Cheerios, Yoplait, Pillsbury, Totino’s, Nature Valley, FiberOne, and Annie’s.

By product category, snacks accounted for 21% of sales last year, cereal 17%, convenient meals 17%, yogurt 15%, dough 11%, baking mixes 11%, super-premium ice cream 5%, and vegetables and other products contributed 3%.

General Mills primarily sells its products to large retailers such as Wal-Mart (20% of sales), and close to 75% of its sales are made in the U.S. The company has over 500 SKUs per store and has been expanding its product categories organically and via acquisition.

General Mills and its predecessors have been around for well over 100 years. Compared to newer companies, General Mills benefits from its scale, long-standing distribution relationships, entrenched brands, and decades’ worth of marketing spend.

As long as General Mills is able to continue adapting to changing consumer preferences by introducing relevant new products and pursuing appropriate marketing campaigns, the company will likely maintain its strong staying power.

General Mills and its predecessors have paid dividends without interruption or reduction for more than 115 years, an amazing accomplishment. While the packaged food industry faces a number of headwinds today, the company’s dividend remains on solid ground.

Thanks to its recession-resistant business, solid cash flow generation, and reasonable payout ratio near 65%, General Mills should have no trouble maintaining its streak of uninterrupted dividends.

Jeff Harmening, a company insider for more than two decades, took over as CEO in June 2017. His top priority is improving sales growth by addressing issues such as product innovation and pricing. If successful, his actions will further strengthen the long-term safety of the company’s dividend.

Read More: General Mills High Dividend Stock Analysis

32) Valero (VLO)

Dividend Yield: 3.6% Forward P/E Ratio: 12.5(as of 2/9/18)

Dividend Safety Score: 67 Dividend Growth Score: 84

Sector: Energy Industry: Oil Refining & Marketing

Dividend Growth Streak: 8 years

Valero was incorporated in 1981 and is the world’s largest stand-alone refiner with more than a dozen petroleum refineries located across North America and the United Kingdom. The company’s refineries purchase crude oil and process it into a number of different products, including gasoline, diesel, jet fuel, petrochemicals, lubricants, and asphalt.

Valero sells its branded and unbranded products on a wholesale basis through a bulk marketing network and more than 7,000 outlets that carry its brand names. The company is also owns 11 ethanol plants and is the majority owner of Valero Energy Partners (VLP), a fee-based MLP that operates pipelines and logistics assets.

The refinery business is extremely expensive. A single refinery can cost several billion dollars, and they require permits and compliance with a variety of regulations. Refineries also need access to transportation systems, pipelines, and feedstock supply agreements. These factors have caused the industry to consolidate over time, and until 2012 no new refineries had been built in the U.S. in 30 years.

Despite the barriers to entry, refiners experience major swings in profitability and typically earn low margins thanks to their lack of pricing power and capital-intensive operations. Valero has somewhat of an advantage because of its size and ability to process more complex crudes compared to its competitors. However, its profitability will ultimately remain driven by the crack spread, which measures the difference between the purchase price of crude oil and the selling price of finished products such as gasoline. Many uncontrollable factors impact the crack spread, making this a rather complicated investment to study.

Turing to the dividend, investors should be aware that Valero did cut its payout in 2010. Despite the dividend cut, Valero’s payout has still managed to grow by 23.1% per year over the last decade, and its quarterly dividend has more than tripled since 2014.

Valero last raised its payout by 14% in early 2018, and the company’s dividend growth potential remains strong thanks to its healthy cash flow generation and balance sheet. However, Valero is still a cyclical stock that can fluctuate significantly over short periods of time, depending on where refining margins head. Investors seeking less volatility might want to consider some of the other stocks on this list instead.

Read More: Valero High Dividend Stock Analysis

31) Kimberly-Clark (KMB)

Dividend Yield: 3.6% Forward P/E Ratio: 15.9(as of 2/9/18)

Dividend Safety Score: 88 Dividend Growth Score: 54

Sector: Consumer Staples Industry: Sanitary Products

Dividend Growth Streak: 46 years

Kimberly-Clark has been in business since 1928 and has grown into one of the largest global manufacturers of various tissue and hygiene products, including disposable diapers, training pants, baby wipes, incontinence care products, tissues, toilet paper, paper towels, napkins, and more.

Kimberly-Clark’s major brands include Huggies, Pull-Ups, Kleenex, Cottonelle, Kotex, Scott, and Depend. Products are primarily sold to supermarkets, mass merchandisers, drugstores, and other retail outlets.

The company is very global as well, with close to half of total revenue coming from outside North America (Asia and Latin America generate over 35% of total sales).

Kimberly-Clark gains advantages from its size, strong brands, and product innovation. As one of the largest players in most of its markets, the company’s manufacturing scale allows it to produce products at a lower cost than most of its rivals.

These extra profits can be invested in advertising, which Kimberly Clark spends more than $600 million on each year to defend its shelf space and keep its products popular with consumers. Breaking the company’s distribution channels would be very difficult for new entrants, and Kimberly-Clark has the financial resources necessary to invest in R&D or marketing if a new product trend emerges.

The company’s strong exposure to emerging and developing markets is worth highlighting. Demand for many of Kimberly Clark’s products tracks population growth, so the company is reasonably well positioned to combat potentially stagnant growth in developed markets.

Kimberly-Clark’s excellent free cash flow generation, recession-resistant products (sales were down just 2% in fiscal year 2009), investment grade credit rating, and reasonable payout ratio near 60% make its dividend payment highly secure.

This dividend aristocrat seems very likely to continue its 46-year dividend growth streak to become a dividend king in four years.

Read More: Kimberly-Clark High Dividend Stock Analysis

30) Pfizer, Inc. (PFE)

Dividend Yield: 4.0% Forward P/E Ratio: 11.6(as of 2/9/18)

Dividend Safety Score: 83 Dividend Growth Score: 47

Sector: Medical Industry: Pharma

Dividend Growth Streak: 7 years

Pfizer is one of the biggest global pharmaceuticals companies with revenues in excess of $50 billion. The company was incorporated in 1942 and currently produces a wide variety of biopharmaceutical and biotechnology products for the healthcare sector.

The company operates through two business segments:

Pfizer operates in the relatively recession-proof pharmaceuticals industry, which is immune from the vagaries of economic cycles.

The huge R&D expense and expertise required to develop new medicines is a big entry barrier, and patent laws allow pharmaceuticals companies to make monopolistic profits on a new product for long periods of times.

The healthcare sector has a bright future both in developed as well as developing countries. Faster population aging in Japan, the U.S., and Europe is the major demand driver in developed nations, while rising healthcare spending in developing nations like India should increase demand for Pfizer’s products over time.

Though Pfizer cut its dividend in 2009, the company has rewarded investors with a 9.4% annual dividend growth rate over the last 20 years. It has continuously paid and increased dividends for more than 30 years with a decline in 2009 being the only blemish.

Leave A Comment