It seems like it was just last week, that I discussed the risk of a bigger corrective action in the market.

Because it was.

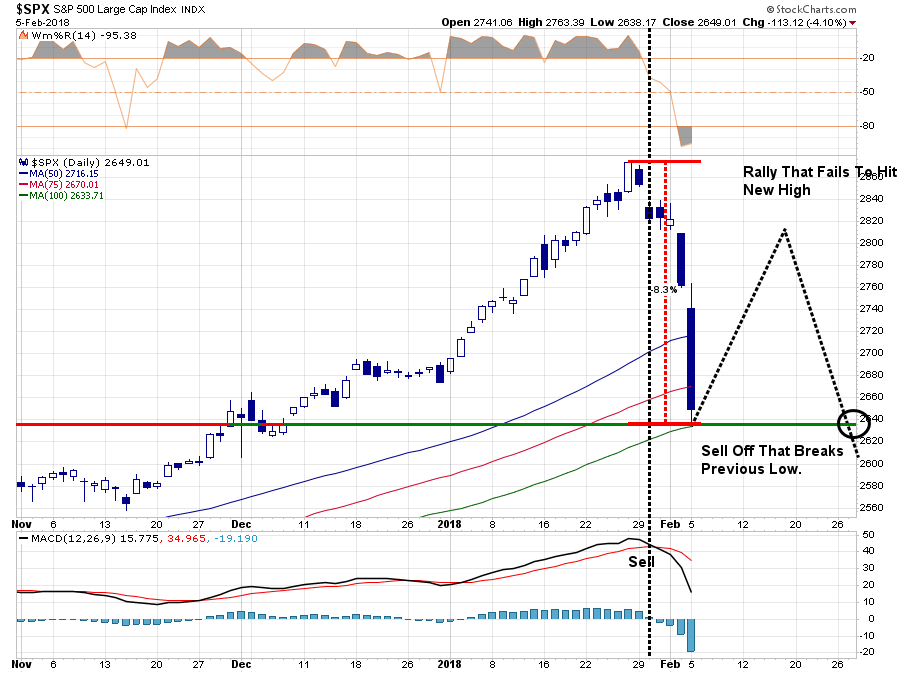

“This past week, the market tripped ‘over its own feet’ after prices had created a massive extension above the 50-dma as shown below. As I have previously warned, since that extension was so large, a correction just back to the moving average at this point will require nearly a -6% decline.”

“But more importantly, as I have repeatedly written over the last year:

‘The problem is that it has been so long since investors have even seen a 2-3% correction, a correction of 5%, or more, will ‘feel’ much worse than it actually is which will lead to ’emotionally driven’ mistakes.’

The question now, of course, is do you ‘buy the dip’ or ‘run for the hills?’

Don’t do either one, yet.”

I know, it “feels” like we should be doing something…anything. Right?

Here is the issue.

The markets have not done anything WRONG…just yet.

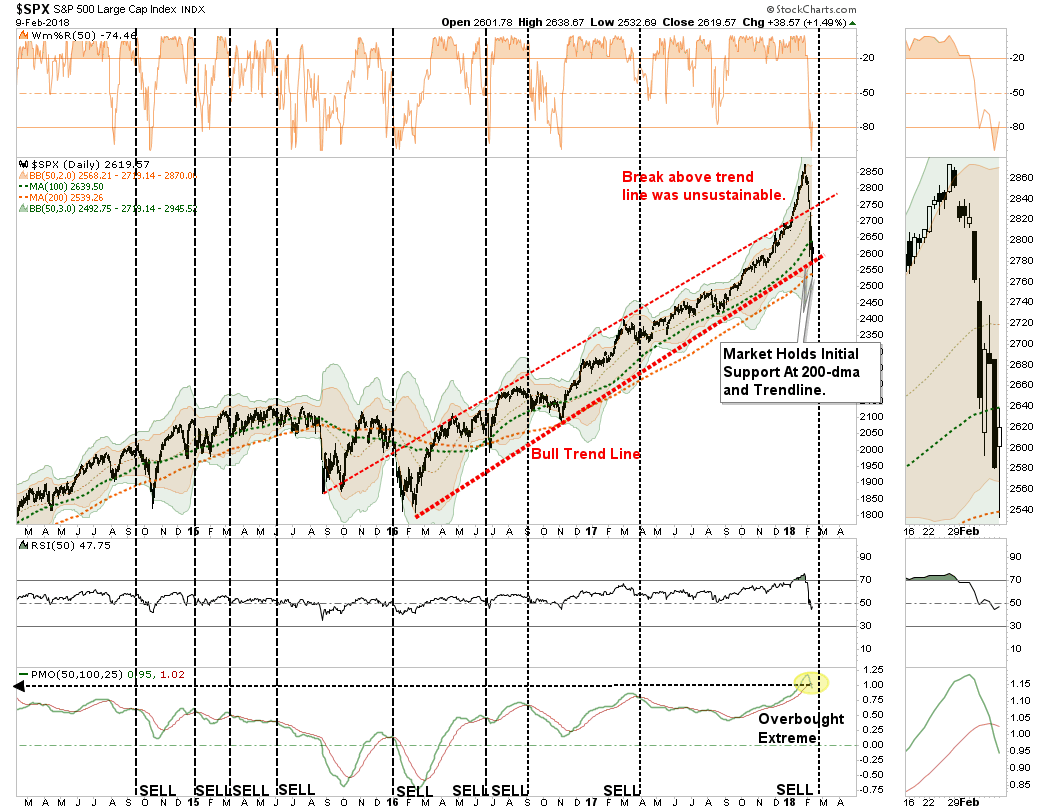

Yes, corrections do not “feel” good. But they are part of a “healthy” market cycle. In more normal, healthy, correction to bullish trends should be used as buying opportunities to increase exposure to equity risk in portfolios. As shown in the chart below, that may be what is occurring now.

Currently, we do not know whether the current corrective action is JUST a normal, healthy correction, or the beginning of something bigger.

BUT – this is the expected correction we have been discussing over the last several weeks. It is also something we had planned for by reducing overweight positions and adding a short-hedge to portfolios.

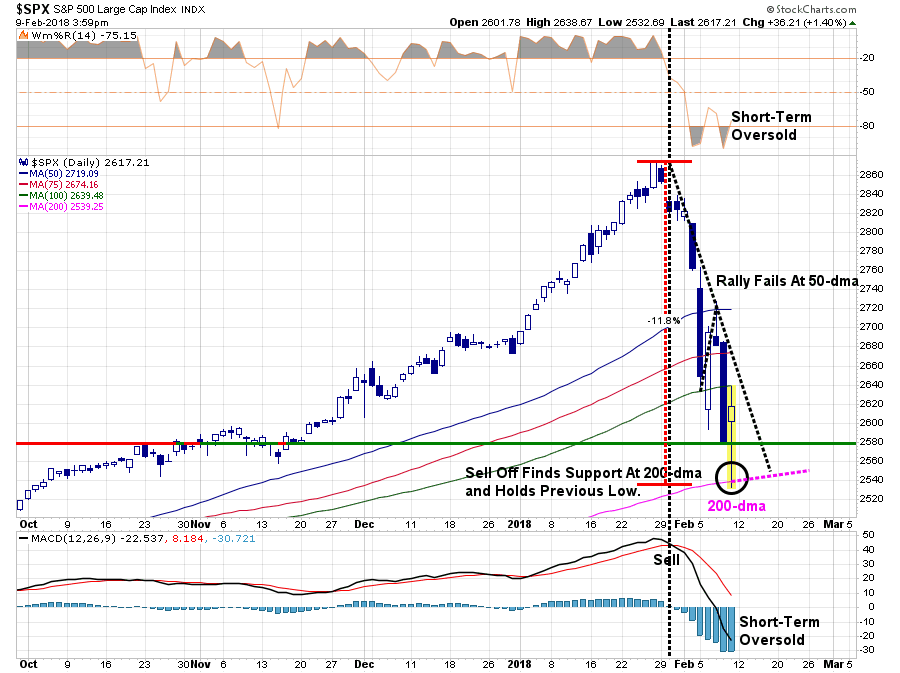

With the markets on a short-term sell signal (noted by black vertical dashed lines in the chart above,) the current correctional process is underway. But, with the market now oversold on a VERY short-term basis a counter-trend rally over the next week, or two, should be expected.

Furthermore, as noted above, and below, the market held support at the 200-dma and the bullish trend line which goes back to the beginning of 2016.

In other words, the market has not violated any important trend lines that would suggest the current sell-off is anything more than just an ordinary “garden variety”correction.

It is what happens NEXT that will be most important.

The larger concern currently, is the “sell signal” which has been triggered at abnormally high levels and remains in extremely overbought territory. Such suggests there remains “fuel” for either a “deeper correction” or a “consolidation” of the markets in the weeks ahead to “work off” that “overbought” condition. Historically, markets don’t resolve such conditions by trading “sideways.”

That is the longer-term risk at the moment and something we will discuss more in a moment.

In the VERY short-term the market did attempt to rally mid-week and failed at the 50-dma where we added to our existing short-hedge. The breakdown on Friday led to a successful test of the 200-dma, where we reduced some of our short-hedge, as the market rebounded above the previous lows.

Technically speaking, this is not a good sign and suggests the market could be in for more selling to test the 200-dma as stated.

As stated, with the market very oversold on a short-term basis, the most probable outcome following a test of the 200-dma is a fairly strong counter-trend rally. But should you buy it?

It depends.

Leave A Comment