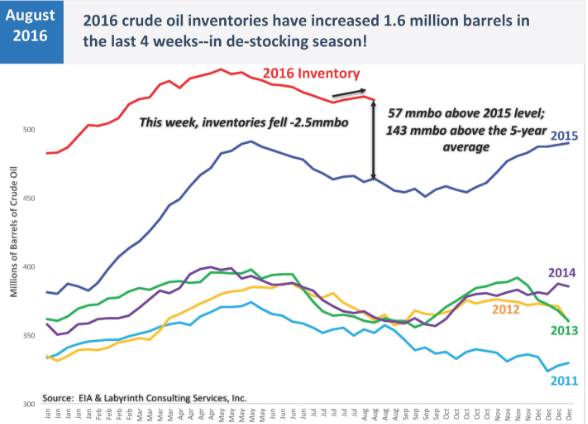

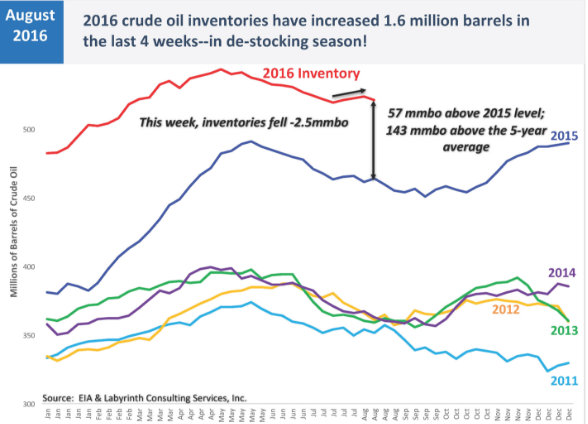

Crude oil prices spiked above $50/bbl in early June and have fallen back to $47/bbl as of Friday’s close. The high $47 level remains above the early August low of $39.52. Further weakness in oil prices is likely as a result of stubbornly high crude oil inventories (excl. the Strategic Petroleum Reserve.) On Wednesday last week, the Energy Information Administration (EIA) reported weekly inventories increased 2.5 million barrels and is a reversal of the 2.5 million barrel decline in the prior weekly report. Not that one or two weekly reports tell the entire story, but, as the below chart shows, inventories remain at very elevated levels and prices are not likely to move higher until this elevated inventory is reduced.

Source: Art Berman

With inventories at significantly high levels, then demand is necessary to draw down this higher inventory. As this Source: Art Berman also shows, the supply/demand balance has improved, but not to the extent necessary to reduce inventories. Historical current ‘supply/consumption’ levels would have equated to oil prices in the $80-$100 range.

Berman notes though, “As long as oil prices are are range-bound between about $40 and $50 per barrel, it makes more sense to store oil than to sell it. The carrying cost of storage is less than what can be made by rolling futures contracts over each month. Inventories will stay high until prices break out of their current range but outsized inventories make that impossible. Catch-22.”

Other factors potentially placing downward pressure on oil prices:

Increasing rig count

Mid-May of this year represented the low point in drilling rigs totaling 404 in the U.S. The Baker Hughes rig count report on Friday noted U.S. rigs totaled 489. Most of this increase is associated with the Permian Basin located in Texas and New Mexico. These two states have seen rig counts increase by 75. The increased drilling activity in some of the shale regions will certainly add to supply and keep downward pressure on oil prices.

Leave A Comment