The portfolio finished August much in the same fashion as in the previous four months, stumbling to a monthly loss of about 0.7%. The dip extended the decline since May to a total of 1.1%—a far cry from the punchy +6.4% in the first four months of the year—and paltry compared with the MSCI World’s +3.7% return in the same period. The numbers get even worse by adding currency effects.

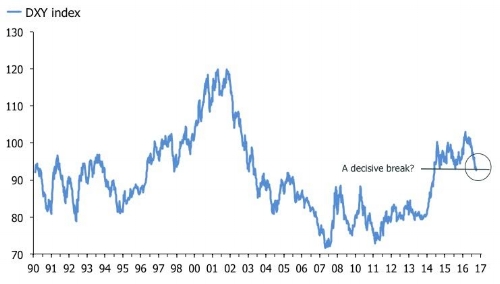

In a nutshell, your humble scribe has found himself on the wrong side of the contrarian trade of the year; the greenback’s fall from grace. Accounts denominated in DKK and GBP with a lot of USD denominated investments have not been particularly friendly for returns so far in 2017. Speaking of which, traders’ arguments about the dollar is reaching a crescendo and I have a decision to make. A few weeks ago I mused that if DXY broke 93 to the downside, punters would need to rethink their views. The DXY slipped to 92.5 towards the end of August, and I imagine many FX geeks are doing just that. The chart below shows that the dollar hasn’t exactly crashed through support, so it still has time to step back from the brink, but it’s getting sporty.

EURUSD has been fighting to punch through 1.20, and it has taken all kinds of convoluted trial balloons from ECB “sources” to keep it in check. GBPUSD and AUDUSD are grinding higher, making the classic “higher lows” formations and USDCAD is flirting with a renewed break lower into the abyss after a home run Canadian GDP report. Even the once so mighty USDCNY has completely lost the ghost. I don’t punt FX, but I am tempted to fade it. That said, I wonder whether the pain trade isn’t in fact for further dollar weakness. Judging by my indirect long-exposure via dollar denominated equities and bonds, that would seem to be the case.

I was pleased to see a number of my single names regain their mojo at the end of August and on the first trading day of September. Many of them have been severely beaten recently, so I am confident that there are a couple of positive surprises coming my way. Unfortunately, for the market as a whole, I am not convinced that the rebound since the middle of August is durable. Trailing six-month and year-over-year returns have rolled over, and a many leading indicators suggest that they will weaken further. Last week, I showed that momentum in global M1 growth signals falling returns in the next six months—even if underlying support from central banks remain firm—and the first chart below shows my updated valuation score for the MSCI World. Six-month returns peaked in May, and the model suggests that weakness will persist. Even worse, the market’s resilience in the past few weeks has not been accompanied by improving breadth. A market that rallies on thin legs is a market that warrants skepticism.

Leave A Comment