Everyone’s just waiting on Santa.

Stocks are still “pricing in” tax cuts at the sector level apparently, but the broader market has seemingly entered a pre-holiday drift.

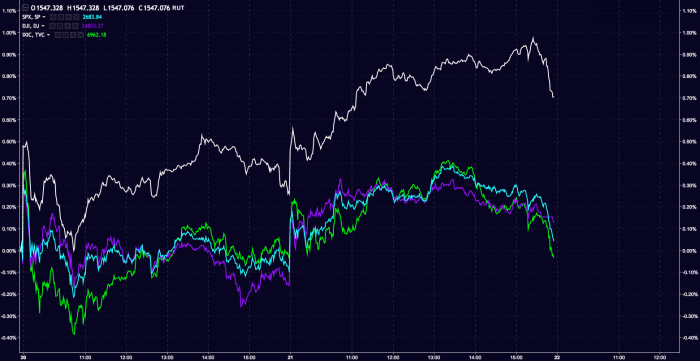

The benchmarks were basically flat on Wall Street although it’s worth noting that small-caps have outperformed over the past two sessions:

As a reminder, this year has been lake placid:

From worst to first in December for Telecom and Energy which have lagged all year long but are now outperforming:

Treasurys were mixed on Thursday following a slight disappointment on the Q3 GDP revision. 30Y yields halted a their march higher…

…leading to renewed flattening in the 5s30s.

As a reminder, headed into Thursday this was the biggest weekly steepening since the election (“bigly”) for the 2s30s:

Even the bears are long according to the NAAIM’s weekly active money manager survey:

Things were poppin’ north of the border today and I know just the man to tell you about it:

BOOM! Canadian retail sales crush it

— Luke Kawa (@LJKawa) December 21, 2017

“BOOM!” Chewbacca socks.

Between that and a hotter-than-expected CPI print, the loonie rose:

Bottom line:

BoC January hike odds now >50% for the first time since late October.

— Luke Kawa (@LJKawa) December 21, 2017

The yen hit a one-week low overnight after Kuroda reiterated his penchant for insanity:

There’s trouble in crazy town:

Which means it’s time to break out the credit cards and get it on the “cheap”:

Finally, take a second to appreciate the extent to which no one is talking about Christmas anymore…

Leave A Comment