from CoreLogic

— this post authored by Andrew LePage

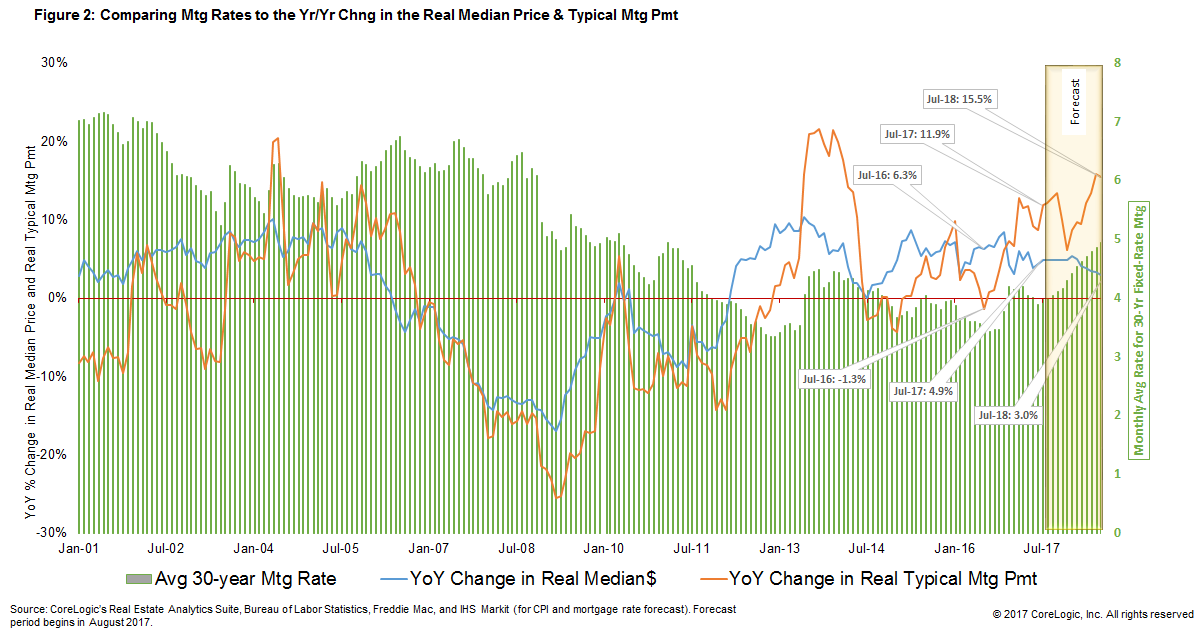

Low mortgage interest rates helped soften the blow of rising prices for homebuyers over the past six years. But with prices still rising and mortgage rates running about half a percentage point higher than last summer the mortgage payments that many homebuyers face have increased at roughly double the rate of home prices over the past year.

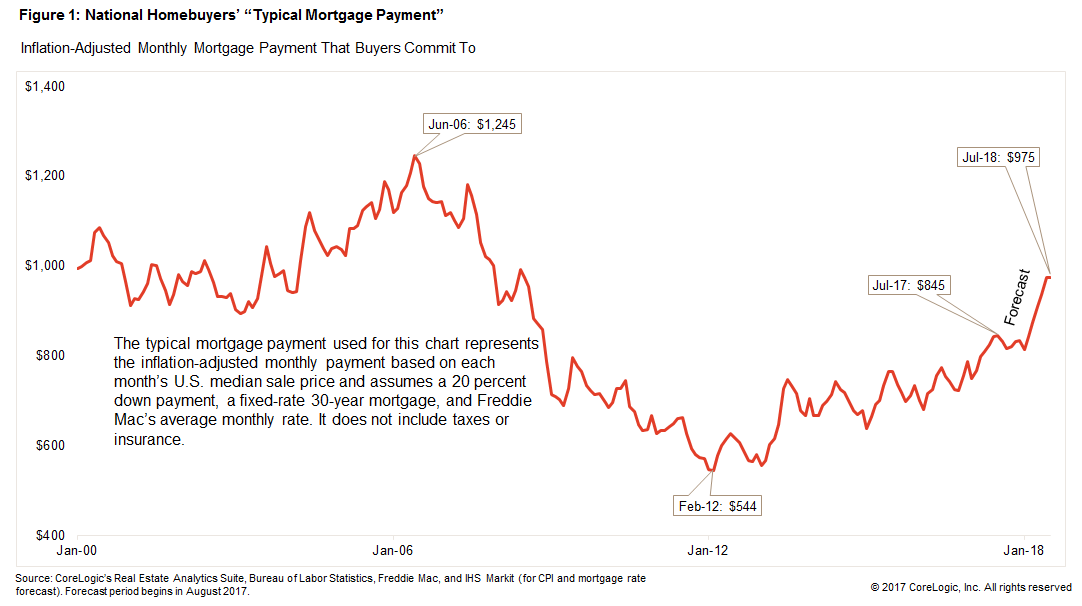

One way to measure the impact of inflation, interest rates and home prices on affordability over time is to use something we call the “typical mortgage payment.” It’s an interest rate-adjusted monthly payment based on each month’s U.S. median home sale price. It is calculated using Freddie Mac’s average interest rate on a 30-year fixed-rate mortgage with a 20 percent down payment. It does not include taxes or insurance. The typical mortgage payment is a good proxy for affordability because it shows the monthly amount that a borrower would have to qualify for in order to get a mortgage to buy the median-priced U.S. home. When adjusted for inflation, the typical mortgage payment also puts current payments in the proper historical context.

The change in the typical mortgage payment over the past year illustrates how it can be misleading to simply focus on the rise in home prices when assessing affordability. For example, in July this year the median sale price was up 6.7 percent from a year earlier in nominal terms, but the typical mortgage payment was up 13.9 percent because mortgage rates had increased 0.5 percentage points over that 12-month period.

Figure 1 shows that while the inflation-adjusted typical mortgage payment has trended higher in recent years, in July 2017 it remained 32.2 percent below the all-time high payment of $1,245 in June 2006. That’s because the average interest rate back in June 2006 was about 6.7 percent, compared with just under 4 percent this July, and the median sale price in June 2006 was $199,900 (or $241,750 in 2017 dollars), compared with $221,936 this July.

Leave A Comment