I am not a particularly big fan of the idea that markets are efficient. In fact I think people who believe this have never spent any time working in investment management. Everyone in the industry has seen how investment fads wash over the industry from time to time, only to wash out again as returns begin to disappoint.

– Russell Clark, CIO of Horseman Global

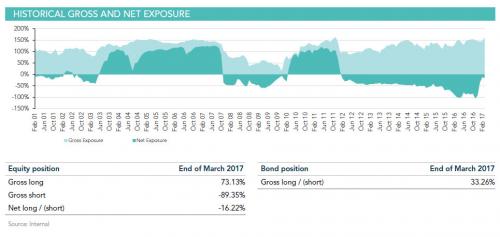

Well, the redemption-driven capitulation is over, and what until recently was the world’s most bearish hedge fund (which was down 24% in 2016 and another 7% to start 2017), with a net exposure in the negative triple digits is now effectively neutral, as the following breakdown of Horseman Global’s latest portfolio demonstrates.

Indeed, with a net exposure of only -16%, the highest since 2011, his book must feel like a raging bull for Horseman and its CIO, Russell Clark.

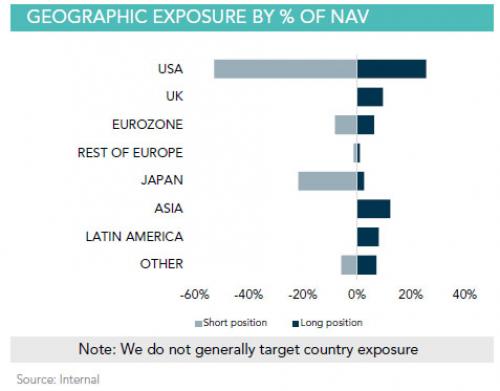

And yet, not matter what, Horseman’s desire to remain bearish, or perhaps contrarian, persists as his latest monthly note to investors reveals. In it, Clark not only provides an update on the fund’s March P&L (down another 1.1% for a YTD of -7.7%), and breaks down the fund geographic distribution…

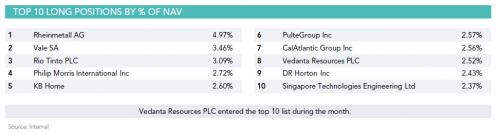

…. and top holdings…

…. but reveals a fascinating framework for how to approach shorting in a “new normal” world in which passive “investors” do the bulk of the capital allocation decisions.

But first, recall that earlier today, One River CIO Eric Peters had some very topical observations on the fate of capital markets in a world dominated by passive investing. The key excerpts:

It is this theoretical framework for the next crash that Clark posits as the thesis for his next round of shorts.

Citing the transition from active to passive as a catalyst that makes markets even more inefficient, something Peters noted in his own weekly note, Clark repeats a lament made by many short sellers, stating that there “are complaints from some quarters about it being harder to short sell as flows of money push up stocks.”

Leave A Comment