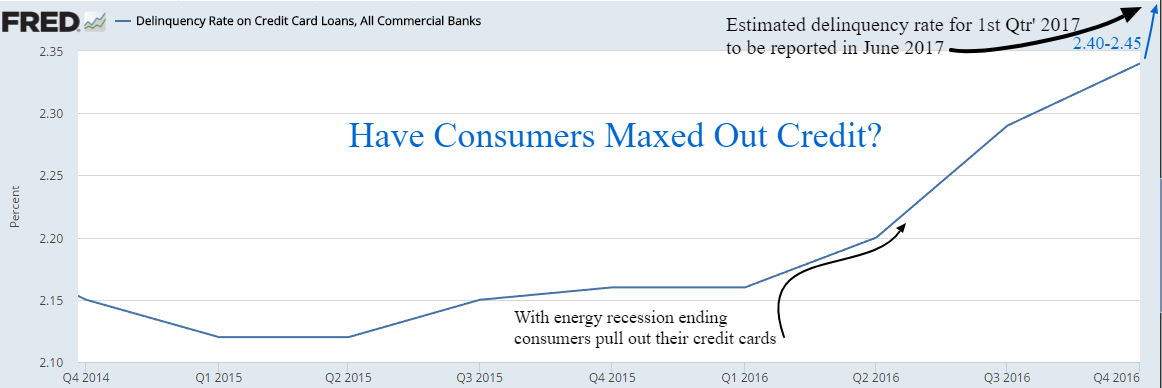

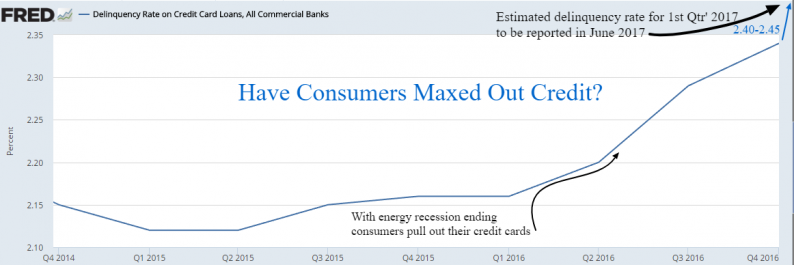

Consumer Credit Card default rates have “surged” to 4 year highs. Capital One reported its largest write off since 2011 due to credit card delinquencies. Discover Card loan loss provisions in the 1st quarter 2017 rose a whopping 38% to $586 Million. Sounds like the alarm bells have rung! Myth or Reality?

Alarming headlines are not always tethered to reality, seeking to grab your attention and “go viral”. The next chart is identical to the chart above with a broader time perspective. Wake us up when default rates rise into the 4 to 5% neighborhood! If the economy improves we would expect default rates to rise as consumers take on more risk and banks tighten credit ahead of excess speculation and potential inflation. In spite of the sensationalist “the sky is falling” stories, Credit Card delinquencies are still historically low with considerable room to rise before banks tighten credit enough to choke off this slow growth economy.

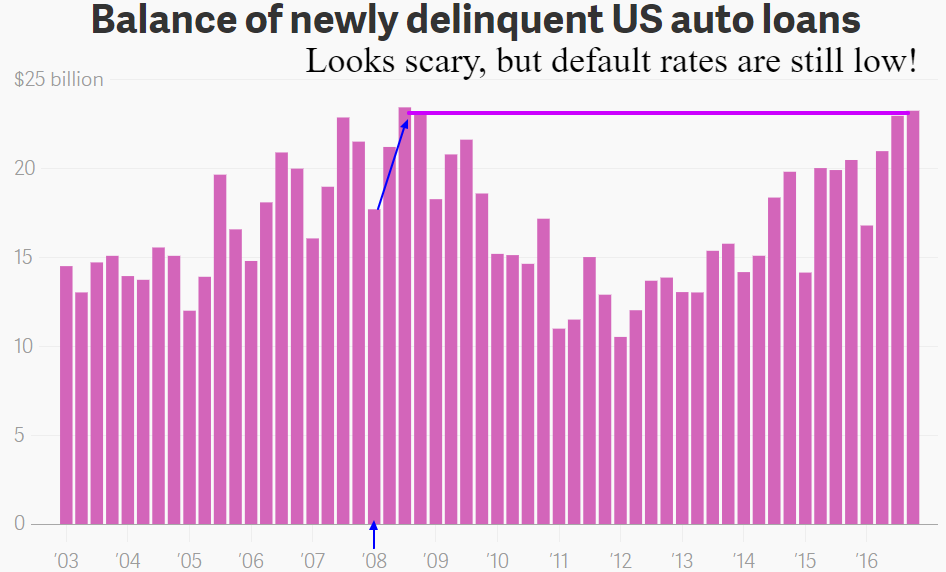

Auto loans have risen back to the scary levels of 2007 and 2008 when the economy was overheating and the real estate bubble was bursting. Car inventories by US brands have risen back to 2009 levels requiring manufacturers to slow production to 17.3 Million autos from 17.5 Million average the previous 2 years.

Increased loan defaults should be expected during a “strong” growth surge in auto loans in an economic recovery. Car and light truck purchases in 2016 returned to their average peak levels of the record pace in the early 2000’s although well below their population adjusted peak. Auto loan demand correlates with delinquencies. Yet, Experian’s Auto loan default rate is very tame, which again relegates the alarming headlines as trumped up news.

However, Real Estate is the big fish in the sea of debt, as we learned during the global sub-prime meltdown of 2008. Mortgages make up 67% of all household debt and will be the area of focus if interest rates finally have the rise that has been prematurely expected for years (currently rates are “falling”). Typically home purchases rise enough during an economic recovery to cause mortgage rate overheating with debt service costs exceeding 12% of a households disposable income before credit trouble arrives. Thus far the recent historically low rates and a paucity of millennial home buying have created record low debt service burdens. This excess leverage available to consumers is normally witnessed in the “early” innings of an economic recovery, not the late innings as many economists assume.

Leave A Comment