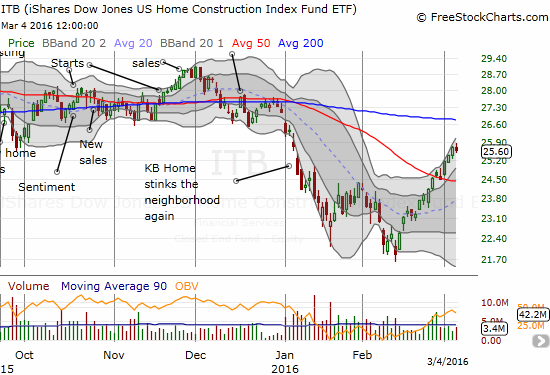

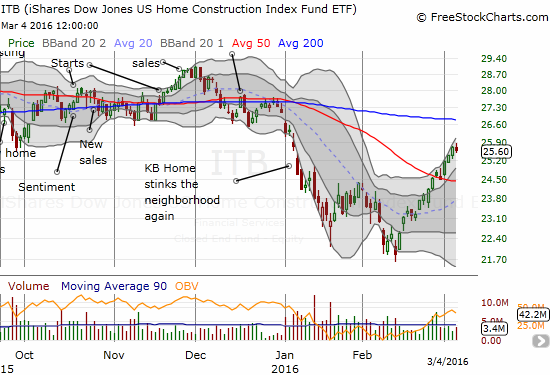

The last Housing Market Review covered data released in January, 2016. At the time, I warily looked at a nervous market and insisted that the steep decline in the iShares US Home Construction ETF (ITB) and individual home builder stocks presented a great buying opportunity. I was conservative in my expectations including looking out to 2017 for realizing the bulk of the potential upside. Fortunately, my positions have already experienced siginficant upside well ahead of schedule largely thanks to a very strong push from February’s lows and the last oversold period. I will cover some individual names in the “parting thoughts” section at the end of this review.

The iShares US Home Construction (ITB) is making a well-deserved comeback.

Source: FreeStockCharts.com

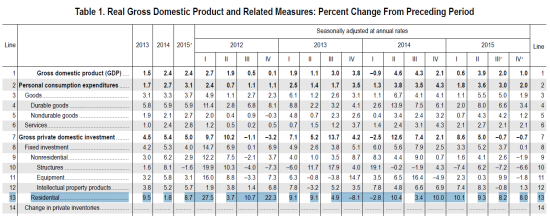

GDP

On Friday, February 26th, the U.S. Department of Commerce’s Bureau of Economic Analysis reported revised GDP results for Q4 2015. Q4 GDP includes a continuing strong performance for domestic private residential investment. Since Q4 of 2014, the quarterly percentage changes have ranged from 8 to 10% – very healthy numbers. These numbers are not surprising given the other strong results for 2015.

Strong growth in residential gross private domestic investment for the last five quarters

Source: revised GDP results for Q4 2015

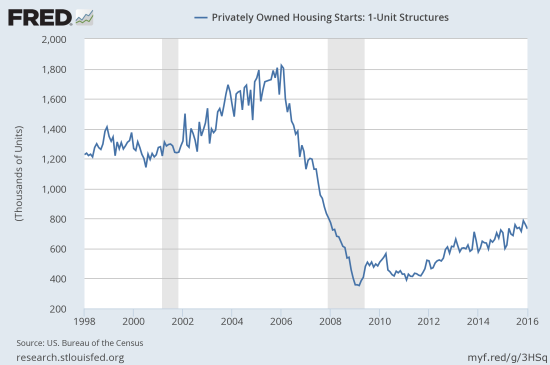

New Residential Construction (Housing Starts) – January, 2016

Privately owned housing starts for 1-unit structures came in at 731,000. The December 1-unit starts were revised slightly downward to 761,000. These numbers are well within the on-going uptrend in housing starts.

Housing starts for 1-unit structures continue a volatile upward trend that restarted in late 2014.

Source: US. Bureau of the Census, Privately Owned Housing Starts: 1-Unit Structures [HOUST1F], retrieved from FRED, Federal Reserve Bank of St. Louis, March 6, 2016.

The 3.5% year-over-year gain and 3.9% month-over-month drop are consistent with another mixed picture from the confidence of home builders (see below). The South led the regions with the only positive year-over-year gain at 10.7%. The South region includes Texas and thus continues to show remarkable resilience in the face of the collapse of the oil patch. The West led decliners with a 6.7% drop.

The overall trend and momentum for housing starts continue to encourage me.

Leave A Comment