Housing starts disappointed today, down 3.8%. This was the second consecutive negative month , and just below the low end of Econoday economist’s range of estimates. Economists on average expected a 2.3% rise.

Housing starts and permits proved softer-than-expected in January, down 3.8 percent to an annual rate of 1.099 million for starts with permits down 0.2 percent to 1.202 million. Starts show roughly equal weakness between single-family homes, down 3.9 percent to a 731,000 rate, and multi-family homes, down 3.7 percent to 368,000. Permits for single-family homes fell 1.6 percent to 720,000 while multi-family permits, in the strongest reading of the report, rose 2.1 percent to 482,000.

Multi-family homes remain the center of strength for the housing sector with year-on-year permits up 19.9 percent, surpassing a very solid 9.6 percent gain for single-family homes. Starts are lagging far behind, at a year-on-year plus 1.8 percent overall and reflecting supply constraints in the construction sector, including for labor, as well as January’s heavy weather that hit the East Coast at mid-month.

The housing sector isn’t on fire but trends in permits do point to strength. Watch for existing home sales on Tuesday next week followed by new home sales on Wednesday.

Permits Point to Expectations

Permits don’t point to strength. Rather, permits point to builder expectations of strength, a completely different thing.

Recent History

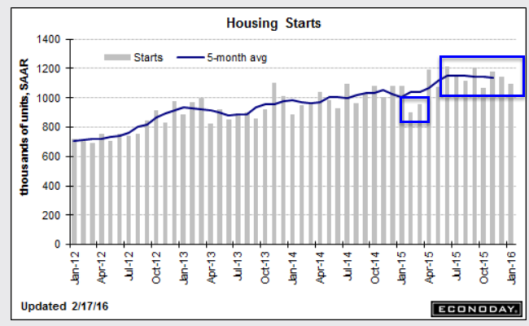

Econoday recent history comments are amusing vs. reality. Econoday says “Housing starts & permits have been volatile month-to-month but have been trending higher with accelerating strength.”

How Bloomberg Econoday translates that chart into “accelerating strength” is a mystery.

As noted by the smaller box in the above chart, the next two year-over-year comparisons will be exceptionally easy to beat.

Since the Econoday writer trumps up every bit of strength, real or imagined, expect the horns to sound about impressive year-over-year gains even if starts decline again next month.

Leave A Comment