Hurricane Harvey To Have A Major Economic Impact

The flood in Houston is going to be catastrophic to the city’s economy. Houston is the 4th largest city in America, so this will show up in the August and September economic data. Don’t get fooled by the theory that this will create more demand, making it a net benefit for the economy. While new demand will come, it comes at the expense of people’s savings. Some businesses will never recover. It will take months and possibly years to rebuild the city. This could be a turning point for the entire American economy. I’m not saying a long recession is coming, but when you have a major city shut down for weeks, it puts a major dent in economic activity. We’ll start getting the details of how bad it will hurt the economy in a few weeks. The nightmare isn’t over for the city just yet.

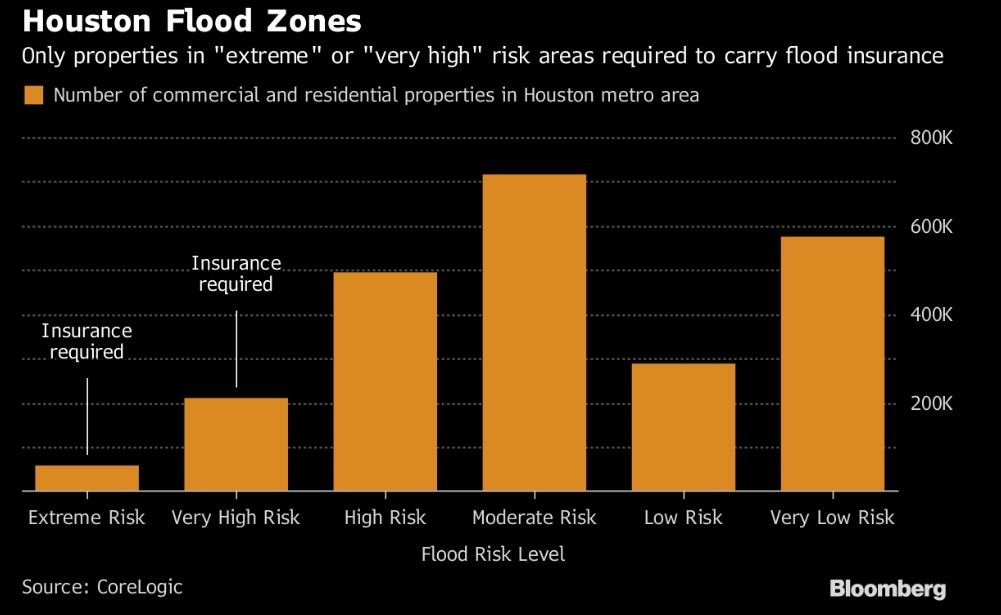

The chart below shows the flood zones in Houston compared to the risk level. As you can see, only those who live in the very high risk and extremely risky areas are required to buy flood insurance. 52% of Houston homes and commercial properties that now have moderate to high risk of flooding are outside of what FEMA calls Special Flood Hazard Areas. This means many of the areas affected won’t get money from insurance companies to pay for the damage to their houses and their cars being totaled. There will be donations to help the victims, but it won’t make up for the spending power lost.

North Korea Fires Missile

Just when we thought the North Korean issue might be de-escalating, the country fired a ballistic missile over Japan. It split into three pieces and fell into the ocean. This led the Japanese prime minister to ask the U.N. to further pressure North Korea. This opens up Pandora’s box again as President Trump will need to issue another statement which North Korea will respond to. North Korea won’t be happy with the new pressure the U.N. puts on it. The biggest risk now is that North Korea fires a missile which is aimed to threaten Japan, but ends up killing people. That would escalate the situation quickly. Every time there is action like this missile being shot over Japan, the stock market should fall 2%-3%. It’s tough to decide whether to hedge against this risk because there’s no way of knowing the capabilities of the North Korean missile program and what is going through Kim Jong-un’s mind. I wouldn’t change my positioning based on this risk, but there’s clearly a chance the market has a large correction on a major news event related to these tensions. As you can see from the chart below, the number of North Korean provocations have increased in the past two years. Usually violent threats escalate situations; let’s hope that doesn’t happen and the situation cools down.

Leave A Comment