On Friday, we noted that at least some local businesses in Texas are sympathetic to the pitiable plight of the state’s beleaguered oil patch workers.

Houston-based Gramercy Cleaners on Richmond avenue, we observed, is demonstrating their compassion for the imploding energy sector by offering service discounts.

Much like Calgary and many other oil boom towns north of the border, many a Texas city is feeling the squeeze of rock bottom crude prices. As we documented in “The Next Chicago? Houston Faces Pension Crisis In Latest Example Of Local Government Fiscal Folly,” Houston is staring down a $3.2 billion funding gap and reduced revenue from oil and gas operations isn’t doing anything to help.

“Home sellers are slashing prices and offering incentives to keep buyers from walking away from contracts as an 18-month oil slump buffets this city’s once-booming housing market,” WSJ wrote last week, underscoring the impact “lower for longer” is having on the city. “Home-construction permits in the area plunged 26% from a year earlier in the third quarter, while December sales of existing single-family houses fell nearly 10% from the same month of 2014.”

In short, a year of crude carnage has wreaked havoc upon what, until last year anyway, was the engine driving the “robust” US labor market.

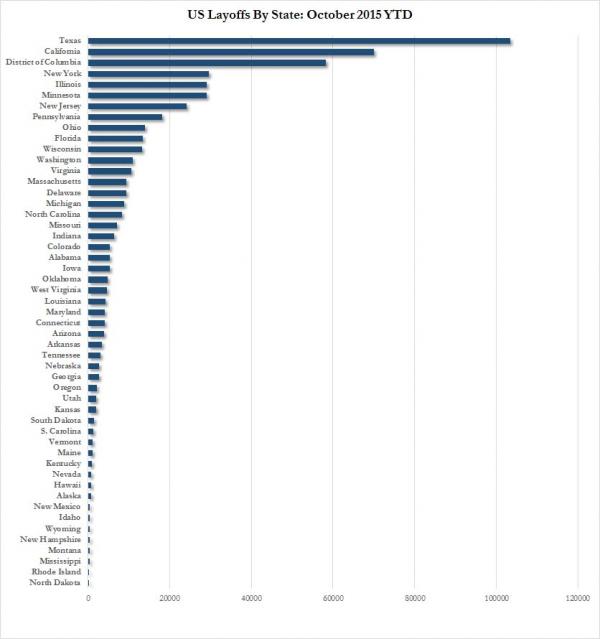

As we showed in November, layoffs in Lone Star land far outrun job losses in any other state:

“The Texas recession is only in its early innings,” we said on Friday, because we are just now beginning to witness the bankruptcies and shut-ins that will soon become endemic and sweep across the entire US oil patch as revolvers are reigned in and Wall Street suddenly refuses to finance uneconomic producers’ funding gaps.

So what happens when the pain really begins to hit home in Texas, you ask? And what are the implications for the broader economy considering the state has for years served as a kind of counterbalance to a job market that increasingly resembles a feudal system as opposed to the manufacturing-led middle class utopia American enjoyed five decades ago?

Leave A Comment