With the specter of a “yes” outcome to the Swiss gold referendum finally being priced in by the market, and the frontrunning of the SNB’s potential 1,500 tons of gold purchases starting to move the price of gold higher, a question has emerged: Is there enough physical gold to satisfy Swiss gold demand in case of a favorable outcome to the referendum? Well, as Deutsche Bank reports, that may not even be an issue. Because as the following step by step explanation demonstrates, the SNB may simply “window dress” its balance sheet with gold swaps.

So for anyone curious how banks “represent and warrant” that they have thousands of tons of physical gold when in reality they have far less if not zero physical in storage and all in “synthetic” form, here is the blow by blow.

From Robin Winkler of Deutsche Bank

An early suggestion of the ‘gold initiative’ was to transfer Swiss gold reserves to a sovereign wealth fund to protect them from perceived mismanagement by the SNB. This idea was soon dropped. The concern behind the referendum is not the SNB’s management competence but the perceived shortage of gold reserves. Transferring the SNB’s FX reserves to a fund to avoid gold purchases would therefore be a blatant disregard of the political will and probably involve another referendum.

Gold swaps a more realistic option

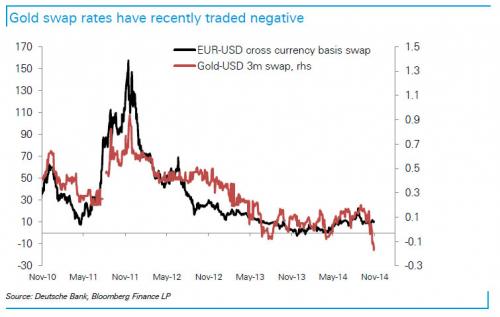

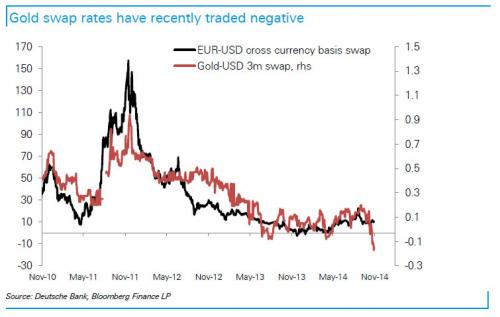

Another option for the SNB would be using gold swaps to ‘window dress’ its balance sheet rather than holding physical gold or futures contracts. The SNB could borrow gold from counterparties prior to monthly balance sheet reporting dates, re-exchanging it for currency the following day.

There would be two advantages to such an approach. First, by borrowing gold to meet reserve holdings disclosure requirements for one day of the month, the SNB would be free to invest in other, higher yielding assets during the rest of it. Second, if the SNB chose to meet its gold requirements through physical or paper gold, it could still use swaps to smooth out purchases beyond the initial 5 year implementation period thereby minimizing its market footprint.

Leave A Comment