U.S. gasoline prices averaged $3.31 a gallon over December 2013 to February 2014 but only $2.31 a gallon over December 2014 to February 2015. How did consumers respond to this windfall in their spending power? A new study by the JP Morgan Chase Institute has come up with some interesting answers.

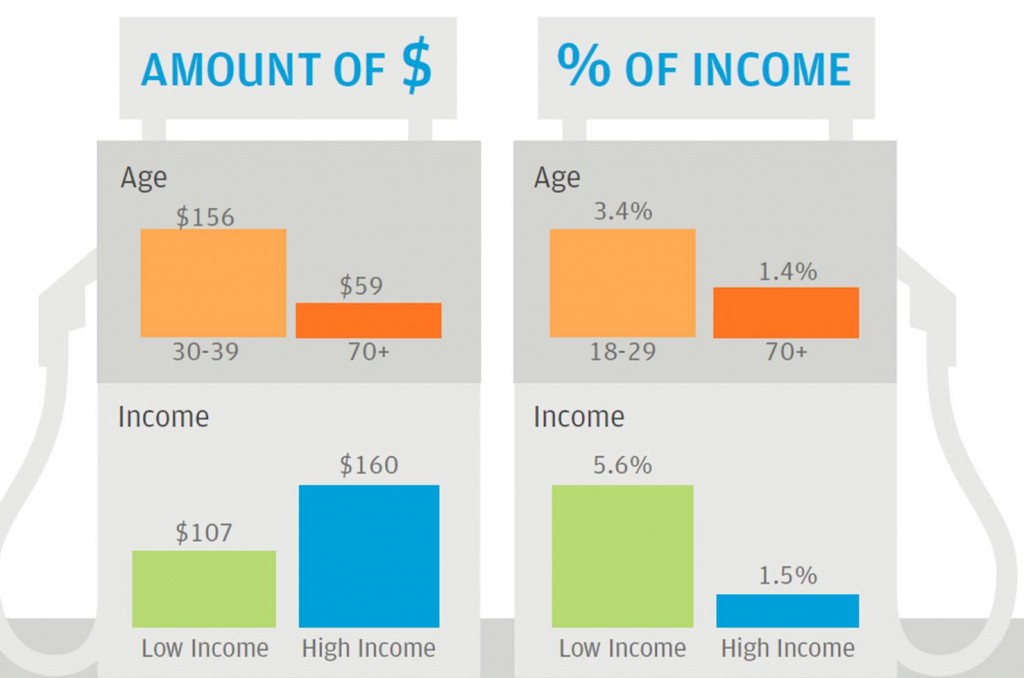

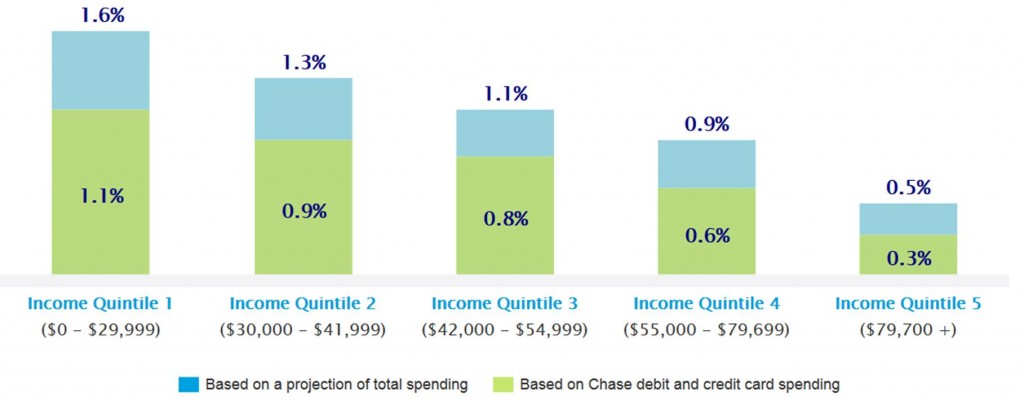

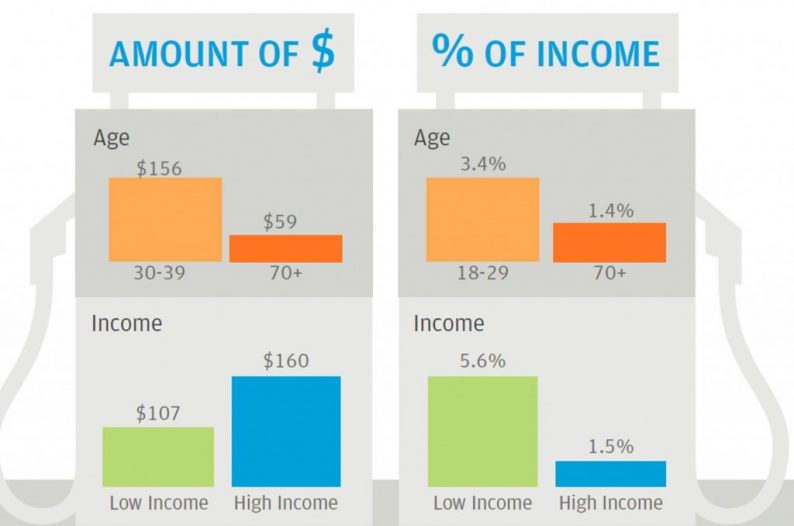

Rather than trying to draw conclusions from imperfect aggregate or survey data, the study by the JP Morgan Chase Institute is based on the anonymized credit or debit card transactions of 25 million individuals over these two periods of high versus low gasoline prices. They found huge differences across individuals in terms of how important gasoline is for their budget. A typical household was spending $101 a month on gasoline back when gas prices were high. For the highest-spending quintile, that number was $359/month, whereas for the lowest quintile it was only $2/month. And spending on gasoline is a much bigger fraction of the budget for lower income households.

Spending on gasoline by different income quintiles and age groups (total dollars and as a percent of percent of income). Source: JP Morgan Chase Institute.

Increase in purchasing power from gasoline saving for different income groups. Source: JP Morgan Chase Institute.

I and others have tried to infer the effects of lower gasoline prices on consumer spending by looking at aggregate consumption spending. But using their detailed data set the Chase researchers were able to come up with a more satisfying answer. The basic idea is to compare how much spending on other items changed between the high gas price and low gas price periods for those who had been spending a large amount on gasoline with those who had been spending a low amount on gasoline. Economists refer to this as inference based on difference in differences. The Chase researchers found 73 cents in extra spending on other items for every dollar saved at the gasoline pump. Restaurants and groceries were the two biggest areas where spending was observed to increase.

Leave A Comment