Many in the financial service industry are now using ETFs to build portfolios. Some love the tax-efficiency of ETFs relative to mutual funds, while others use ETFs as trading vehicles. Either way, ETF assets continue to grow at a steady pace, with total ETF assets now over $3 trillion. The question we often get is how ETF trading works? The paper we discuss sheds some light on this question.

An important piece of the ETF landscape is the ETF market-making business. Each day ETF market makers are “making a market” in ETFs, many of which have much lower volumes than the well known ETFs (SPY, EFA, AGG, etc.). When a market maker sells shares in an ETF to an individual in the secondary market, most of the time the market maker is now short the ETF they just sold (assuming the market maker does not keep inventory of an ETF, which can be costly).

So what happens when a market maker is short the ETF?

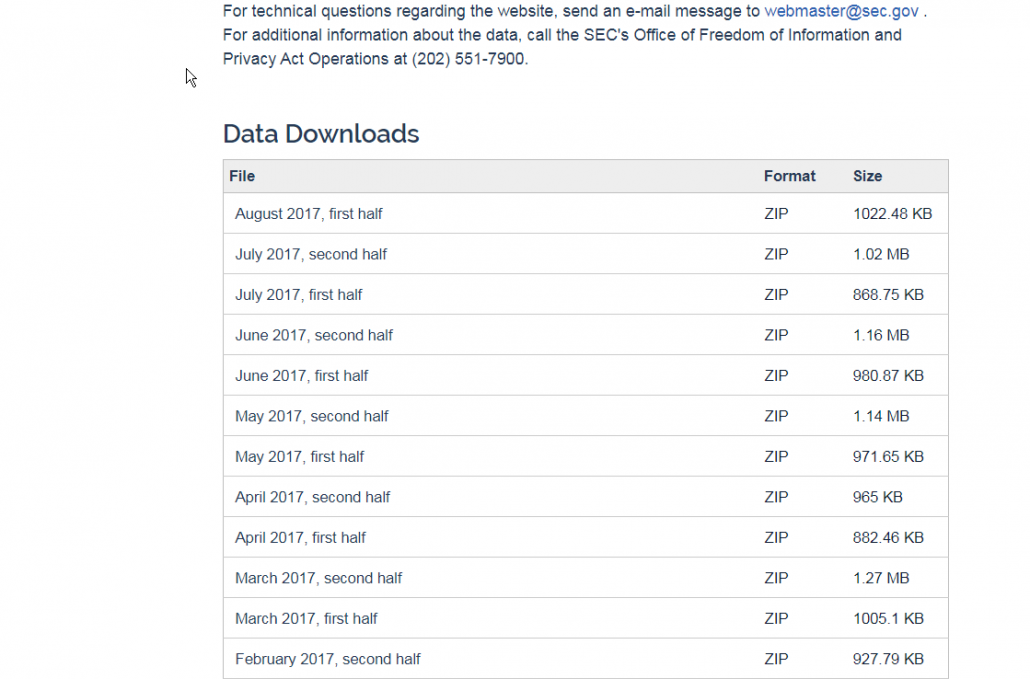

At some point in the future, they will need to create new ETF shares, or locate/purchase shares to give to the end buyer. However, creating new shares on a daily basis may not be the most efficient use of capital from an operational perspective. As a result, market makers from time to time will fail-to-deliver (FTD). The SEC posts the FTD data on their website here.

Source: here

Understanding How ETF Trading Works

As ETFs continue to grow, it is important to better understand the following:

A new research paper, titled “ETF Short Interest and Failures-to-Deliver: Naked Short-selling or Operational Shorting?” written by Rich Evans, Rabih Moussawi, Mike Pagano, and John Sedunov investigates this ETF market making activity. We were privy to early tables from the paper (seen around a year ago), and we think it adds to the literature by shedding light on the ETF market making activity, where many in the financial service industry do not really know what is happening.(1).

I was able to sit down with Mike Pagano, a Villanova Professor and friend of the firm (ETF Board Member), and ask a few questions about the paper.

Below are my questions and Mike’s responses:

—

Mike, we’re trying to help our audience get a better understanding of how ETF trading works. You seem like the perfect candidate to address this question.

1) What is a Failure to Deliver? Why is this important?

A failure-to-deliver (FTD) occurs when the seller of a security does not deliver the security on or before the settlement date (typically T+3 days for most investors but ‘bona fide’ market makers get up to T+6 days).

Leave A Comment