We’re in the “sweet spot” – it’s “Goldilocks”- it’s “have your synchronized global growth cake and eat your ongoing central bank accommodation too.”

[Feel free to create your own fun description of the prevailing risk-friendly environment.]

The idea that a synchronous upturn in global growth accompanied by still-subdued DM inflation justifies “rational exuberance” in markets has become so ubiquitous that it found its way into the Friday installment of Jim Cramer’s Mad Money. This is the narrative that everyone has adopted to explain why it makes sense to stay long risk despite stretched valuations in bonds, credit, and equities and despite the fact that at least in the U.S., we are almost unquestionably late cycle (protestations and tortured attempts to characterize the situation as more “mid-cycle” notwithstanding).

As Barclays notes in the latest installment of their Global Macro Survey, “the US business cycle is now the third-longest on record since the Second World War, European economies have broken out of the tepid range that prevailed during the 2010-12 crisis, [and] Emerging economies have also rebounded, helped by the rise in commodity prices.”

The question is: how much longer? The real answer is complicated and a nuanced take requires adopting innovative frameworks for analyzing how central bank gradualism (i.e. the management of the risk that accompanies the unwind of accommodation) interacts with investor psychology and modern market structure to shrink horizons and optimize around the prevailing low vol. regime.

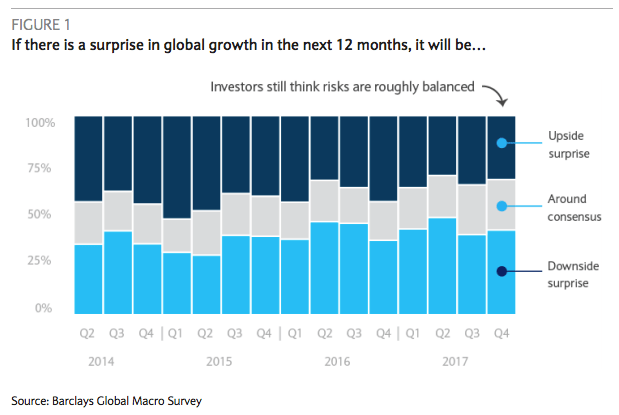

But a simple answer to the “how much longer” question is this: “a bit longer.” Or at least according to the 700 institutional clients who participated in the 33rd installment of Barclays’ survey.

On the growth front, investors still see the risks as balanced:

And investors are still reasonably constructive on EM although the proportion expressing skepticism via an Underweight allocation is rising:

Leave A Comment