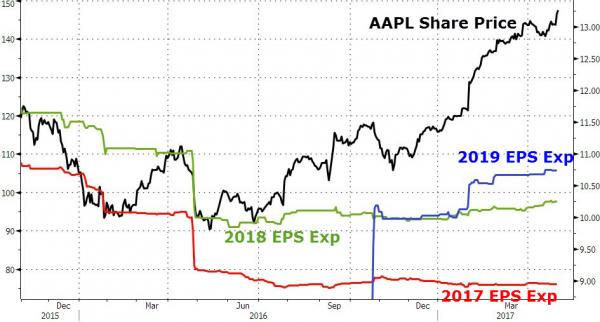

Apple (AAPL) has dominated price action in the Dow in 2017 (accounting for almost 20% of the index’s 1100 point move) as the tech behemoth has powered ahead almost 30% this year (all while 2017 earnings expectations have limped lower). So while expectations are for low iPhone sales (pent up iPhone 8 demand) and lower-than-average reaction priced into options, the question is – just how low is the bar for AAPL to get a pass here?

Apple is scheduled to report earnings after the bell on Tuesday with expectations for earnings of USD 2.02 per share on revenue of approximately USD 53bn. It would appear that the bar for 2017, 2018, and even 2019 earnings expectations are pretty low…

A lot of focus will also be on Apple’s cash pile which is now almost USD 250bn. It is expected that they will conduct another share buyback and increase their dividends. A week ago, US President Trump announced his tax plans, which included a “one time tax on trillions of dollars held overseas”. This repatriation tax may make it easier for Apple to move cash held overseas back to the US and so they might hint at plans for the cash if the tax plans come to fruition.

ESTIMATES & FORECASTS:

iPHONE:

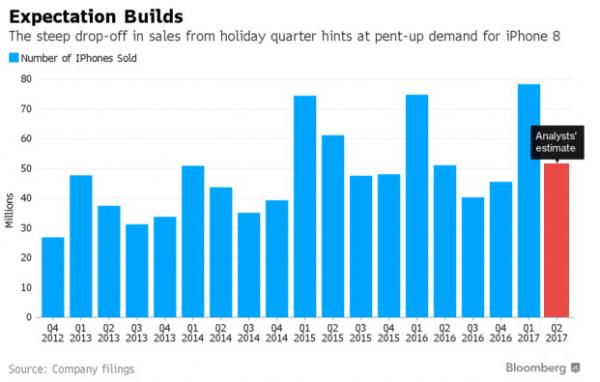

As has become customary, investors will be focused on iPhone sales. Analysts project 52 million units were sold in the quarter, a marked drop from the record 78.3 million in the Christmas quarter, which is when sales of the smartphone usually peak.

The decline would slightly exceed the trends of recent years, which indicates growing expectations for the latest release of the company’s flagship product this year, marking the 10th anniversary of the iPhone’s launch.

Leave A Comment